Guide to LLC for Non-US Residents: Forming an LLC from Abroad

- Read & Associates

- Jan 13

- 16 min read

Let's get straight to the point: Yes, you absolutely can form and own a Limited Liability Company (LLC) in the United States as a non-resident. There's no requirement to be a citizen, have a green card, or even set foot in the country. This opens up direct access to the world's largest consumer market, letting you run your U.S. business from anywhere on the planet.

Our goal with this guide is to provide a clear, step-by-step roadmap for international founders. We'll walk you through the entire process, from choosing the right state to understanding your tax obligations, so you can make informed decisions and build a strong foundation for your U.S. venture.

Why Launching a US LLC Is Your Global Business Advantage

For international entrepreneurs, setting up a U.S. LLC is much more than just a legal checkbox. It’s a powerful strategic move that unlocks opportunities often completely out of reach for businesses based abroad. By creating a domestic entity, you gain instant credibility and operational power that can make or break your success in America.

Think about it from a practical standpoint. If you're an e-commerce seller based in Asia, forming a Wyoming LLC allows you to seamlessly integrate with essential U.S. financial tools like Stripe or tap into Amazon FBA, both of which can be difficult for international companies to access. That one simple step can completely change your operational game overnight.

Or, imagine you’re a SaaS founder in Europe trying to raise funds. Having a Delaware LLC makes you far more attractive to American venture capitalists. Investors are comfortable with the familiar, robust legal framework of a U.S. company, which dramatically improves your chances of securing that crucial funding.

For a clearer picture, here’s a breakdown of what a U.S. LLC really brings to the table for an international founder.

Key Advantages of a US LLC for International Founders

Benefit | Why It Matters for Non-Residents |

|---|---|

Access to US Financial Systems | Easily open U.S. bank accounts and integrate with payment processors like Stripe and PayPal, which are often restrictive for foreign entities. |

Enhanced Credibility | A U.S. address and entity signals legitimacy to American customers, suppliers, and partners, removing a major barrier to trust. |

Personal Asset Protection | The LLC structure shields your personal assets (home, savings) from business debts and lawsuits—a critical layer of security. |

Attract US Investment | American VCs and angel investors overwhelmingly prefer to invest in U.S.-based companies due to legal simplicity and familiarity. |

Simplified Business Operations | Contracting with other U.S. companies becomes much easier, as many prefer—or even require—dealing with domestic entities. |

These advantages work together to place your business on a level playing field, removing the friction that so often holds back international businesses.

Building Trust and Unlocking Growth

At its core, a U.S. LLC changes how American partners and customers see your business. Many U.S. companies have policies that make it difficult to contract with or pay foreign entities. Having a U.S. business address and bank account simply makes everything smoother and builds instant trust.

This structure also provides powerful personal liability protection. By creating a legal separation between your business and personal finances, the LLC ensures your personal assets are protected if the business ever faces debts or legal challenges. It's a fundamental safeguard for any serious entrepreneur.

A Growing Trend for Global Founders

The secret is out. By 2025, it's expected that non-U.S. residents will account for 10-15% of all new LLC filings in business-friendly states like Wyoming and Delaware. That translates to over 300,000 new companies every year, highlighting a massive shift toward using the U.S. as a launchpad for global ventures. You can find more insights about foreign-owned LLC trends and their growing impact on the small business landscape.

The core benefit is simple: a US LLC Americanizes your business. It provides the legal and financial foundation to operate on a level playing field with domestic competitors, all while you manage operations from your home country.

Ultimately, forming a U.S. LLC is your entry ticket. It's the key to accessing U.S. banking, payment systems, and investment capital while immediately boosting your brand's credibility. The process is more straightforward than most people think, and with the right guidance, you can establish your U.S. presence efficiently and correctly from day one.

Where Should I Form My International LLC? Picking the Right State

Figuring out where to form your LLC is easily one of the most critical decisions you'll make as an international founder. You could technically form your company in any of the 50 states, but for non-residents, a few have become the go-to choices for a reason.

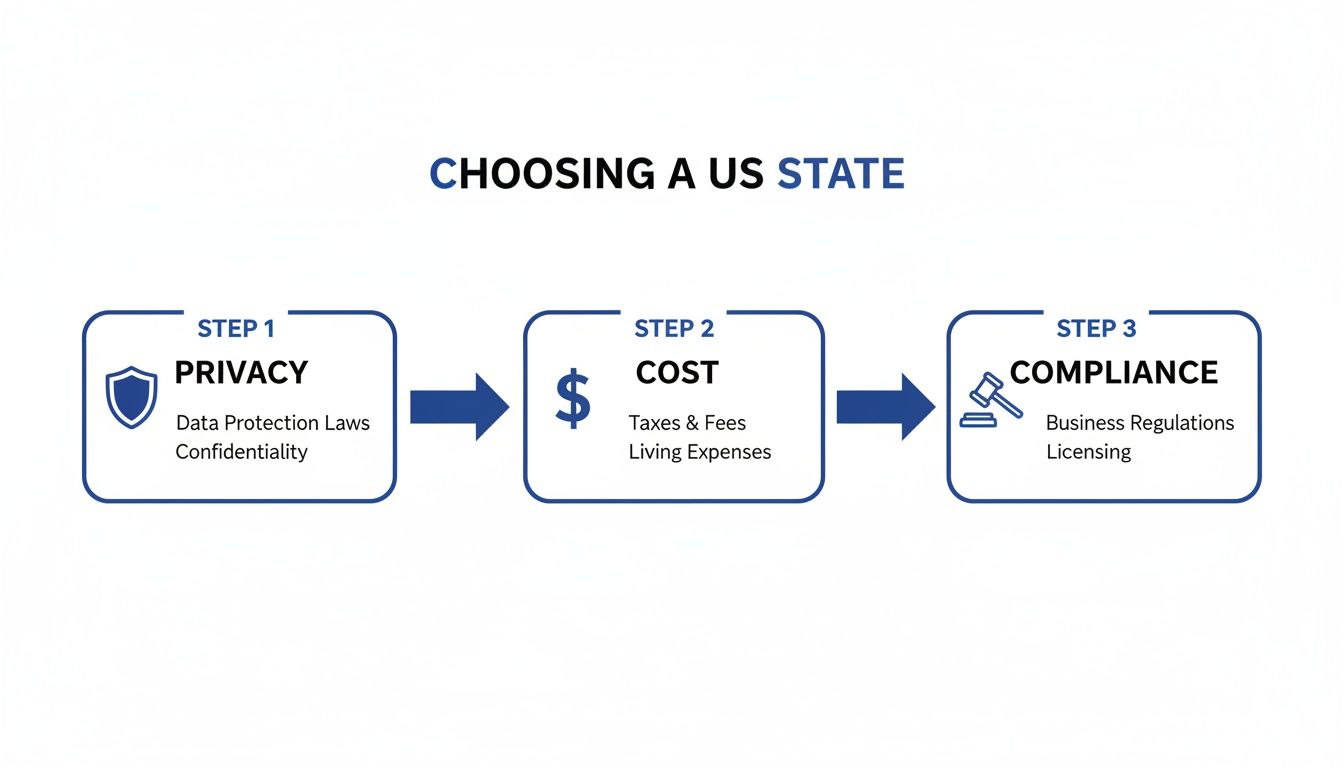

This isn't just about picking a spot on a map. It’s a strategic move that dictates your company's privacy, how much you'll pay in fees, and what your long-term compliance will look like.

Think about it this way: a digital nomad running a freelance business has completely different needs than a tech startup hoping to land venture capital. The nomad wants low costs and minimal paperwork. The startup founder needs a legal structure that investors know and trust. Your business model is the compass that should guide your choice.

The Top States for Non-Resident Founders

For international entrepreneurs, the conversation almost always narrows down to three states: Wyoming, Delaware, and New Mexico. Each has its own unique advantages and is structured for different types of businesses.

Wyoming: This is our top recommendation for most online businesses, consultants, and e-commerce sellers. It offers incredible privacy (your name isn’t on the public record), has no state income tax, and keeps both initial and ongoing fees refreshingly low.

Delaware: The undisputed heavyweight champion for startups and any company that plans to raise money from investors. Its famous Court of Chancery—a court that only handles business law—gives investors the predictability and legal sophistication they demand.

New Mexico: A fantastic choice for founders who are laser-focused on keeping costs and administrative tasks to an absolute minimum. It provides solid privacy and is one of the only states that doesn't require an annual report, which is one less thing to worry about each year.

The difference between them really matters. If you're building a software company and have your sights set on a Series A funding round, you should be in Delaware. But if you’re an Amazon FBA seller from Germany, Wyoming’s low-cost, high-privacy setup is a much better fit.

A Look at the Numbers

The cost difference between these states can be significant. While Wyoming, Delaware, and New Mexico are the dominant choices for non-residents, Wyoming leads the pack with its combination of rock-bottom costs and ironclad privacy.

Filing fees in Wyoming can be as low as $100, and the annual report is just $60. Compare that to Delaware’s unavoidable $300 annual franchise tax. New Mexico is also attractive with $0 in ongoing state fees, but its filing system isn't as modern, which can sometimes make the initial setup a bit less straightforward.

For more on how these states stack up, you can find some great comparisons and data points in this breakdown of the best states for non-resident LLCs.

Key Takeaway: Don't just follow a trend. Take a hard look at your specific business—what are your privacy needs, your budget, and your growth plans? Pick the state that gives you a genuine strategic advantage.

States to Generally Avoid

Just as some states roll out the welcome mat, others can create a minefield of compliance issues for international owners. California is a perfect example of a state to avoid. It slaps every LLC with a minimum $800 annual franchise tax, even if you make zero income and have no physical operations there. That’s a painful surprise for any new business.

Likewise, forming an LLC in a state where you have no actual business connection usually just adds unnecessary red tape. The smartest move is to stick with one of the business-friendly states unless you have a very specific, compelling reason to plant your flag elsewhere.

Regardless of which state you choose, every LLC is legally required to have a physical point of contact there. This brings us to another non-negotiable step in the process.

You must appoint a Registered Agent. This is simply a person or a professional service that agrees to be your company's official point of contact for receiving legal documents and state mail. It’s a foundational requirement that ensures your business always has a physical presence in its state of formation.

If you want to get a better handle on this, we've put together a simple guide on what a Registered Agent is and why your U.S. business needs one.

Making the right choice from the start saves you from a world of headaches down the road and sets your U.S. venture up for success. If you're feeling stuck on which state best fits your vision, our team can help you find clarity. We're here to help you build a solid foundation for your American business—schedule a consultation to discuss your specific needs.

How to Form Your LLC and Get an EIN from Abroad

Once you've zeroed in on the right state, the next logical question is: how do you actually get your U.S. company off the ground from potentially thousands of miles away? Many international founders think this involves flying to the U.S. or navigating a legal minefield, but that's not the case. The whole thing can be handled remotely and quite smoothly if you know the steps.

It all boils down to two main milestones: officially registering your LLC with the state and then getting your federal tax ID number from the IRS.

The decision-making process for choosing a state often comes down to balancing privacy, cost, and ongoing compliance.

As you can see, the state you pick sets the stage for everything that follows, influencing both the cost and complexity of the formation process itself.

Filing Your Formation Documents

The first real move is to file the Articles of Organization. This is the document that officially creates your LLC, and you'll submit it to the Secretary of State in your chosen jurisdiction. Think of it as your company's birth certificate—it lays out the essential details.

You'll need to provide some basic information, including:

The exact name you've chosen for your LLC

The name and physical street address of your Registered Agent

Your business address (a virtual address is perfectly fine here)

It sounds simple, but getting every detail right is crucial. A single mistake, even a small typo, can get your application rejected. This means delays and more paperwork, which is the last thing you want. This is a big reason why many founders work with a formation service—to get it filed correctly the first time.

The Critical Role of Your Registered Agent

You absolutely cannot form a U.S. LLC without a Registered Agent. This is a non-negotiable legal requirement in all 50 states. This agent is simply a person or company with a physical address in your formation state who is designated to receive official legal mail and state notices on your behalf.

For anyone living outside the U.S., using a professional Registered Agent service is the only realistic way to go. They give you the required physical address, scan and email you important documents, and help you keep track of key compliance deadlines, like filing annual reports.

Think of your Registered Agent as your company's physical anchor in the U.S. They ensure you never miss a critical legal notice or tax document, providing peace of mind and keeping your business in good standing.

Securing Your EIN Without an SSN

Once the state gives your LLC the green light, the next vital step is getting your Employer Identification Number (EIN). This is a unique nine-digit number assigned by the IRS that functions as your business's tax ID. You'll need it for just about everything, from opening a U.S. bank account to hiring staff and filing tax returns.

Here's the catch for international founders: you don't have a Social Security Number (SSN), which is required for the quick online EIN application. Instead, you'll have to apply the old-fashioned way by submitting Form SS-4 to the IRS via fax or mail. This form requires very specific details about your LLC and you as the foreign owner.

Here are a few insider tips to make the EIN application go smoothly:

Be Precise: Double-check that every single piece of information on Form SS-4 perfectly matches your LLC's formation documents. Any mismatch will cause delays.

Use Fax for Speed: Don't even think about mailing it. Faxing your application is dramatically faster. A faxed application typically takes 4-8 business days, while one sent by mail can take weeks, if not longer.

Appoint a Third-Party Designee: On the form, you can name a "Third-Party Designee"—like your accountant or formation service. This authorizes them to speak directly with the IRS on your behalf, which is a lifesaver if any issues pop up.

Navigating the SS-4 process can be one of the biggest hurdles for non-U.S. residents. If you need a deeper dive, our guide explains what an EIN is and the specifics of how to get one.

With your LLC officially formed and your EIN secured, you now have the legal and tax foundation for your U.S. business. The next piece of the puzzle is plugging this new company into the American financial system.

Opening a US Bank Account Remotely

Getting a U.S. bank account is often the biggest headache for an LLC for non-US residents, but it's a step you simply can't skip. Without one, you're locked out of essential U.S. financial infrastructure. Think about it: platforms like Stripe and PayPal, the engines of many online businesses, absolutely require a U.S. bank account to deposit your money.

Beyond just getting paid, a domestic bank account is your operational key. It lets you pay U.S. contractors, vendors, and for software subscriptions without the constant hassle and steep fees of international wires. For years, the only solution was to fly to the States and walk into a branch.

Thankfully, those days are largely over. The boom in financial technology has finally opened up the U.S. banking system to founders all over the world, no plane ticket required.

Modern Banking Solutions for Global Founders

Let's be blunt: traditional, big-name U.S. banks are not your friends here. Their old-school rules often demand in-person identity checks, and their staff usually gets confused by the paperwork for a foreign-owned LLC. It’s a recipe for frustration.

This is exactly where modern financial technology (fintech) platforms have stepped in.

Companies like Mercury and Wise have completely changed the game. They aren't technically banks themselves, but they partner with FDIC-insured banks to offer business accounts. Their biggest advantage? Their entire sign-up process is built for remote, international entrepreneurs.

You can get an account from your home office with just a few key documents:

Your LLC's formation documents (usually the Articles of Organization).

Your EIN confirmation letter from the IRS.

A clear copy of your foreign passport.

This digital-first approach means you can get your U.S. banking sorted in days, not weeks, saving you a small fortune in travel costs. For almost any online business, these platforms provide everything you need—debit cards, easy transfers, and clean integrations with accounting tools.

Expert Insight: For founders of an llc for non us residents, these fintech solutions aren't just a convenience; they're a competitive edge. They put you on a level playing field with domestic businesses, removing geography as a barrier to your financial operations.

Preparing for a Smooth Application

While these platforms are much more accommodating, they don't approve everyone automatically. A little preparation goes a long way. Before you even start an application, get your documents in order. Triple-check that every name, address, and detail is identical across your LLC formation papers, EIN letter, and passport. Mismatched information is the number one reason for getting delayed or rejected.

You also need to be ready to explain your business clearly and concisely. They’ll want to know what you sell, who your customers are, and how you make money. These companies have their own compliance hoops to jump through, so a professional, transparent description of your business helps them approve you quickly.

Setting Up Your Financial Foundation

Once your account is open and active, don't celebrate just yet. The very next thing you should do is connect it to an accounting system like QuickBooks or Xero. This isn't a "nice-to-have"; it's a must-do from day one.

Automating this link ensures every single dollar in and out is tracked and categorized. This discipline is the foundation of a well-run U.S. company. It keeps you compliant with U.S. tax laws and gives you a real-time pulse on the financial health of your business, empowering you to make smart decisions.

Navigating U.S. banking and accounting can feel complex, but you don't have to do it alone. If you need guidance on choosing the right banking partner or setting up your financial systems for success, our team is here to provide a clear path forward.

Navigating US Tax and Compliance for Non-Residents

This is where the rubber meets the road. Getting your company formed is the easy part; understanding and managing your U.S. tax and reporting obligations is what will make or break your business in the long run.

The U.S. tax system can look like a maze, especially from the outside. But for foreign-owned LLCs, it really boils down to a few key principles. Get these right, and you'll avoid the massive headaches and penalties that catch so many unprepared entrepreneurs. Let's walk through exactly what you need to know.

The Power of Pass-Through Taxation

One of the best things about an LLC is how it's taxed by default. The IRS considers a single-member LLC a "disregarded entity." That might sound strange, but it’s a huge advantage for non-residents.

Essentially, it means the LLC itself isn't a taxable entity. It doesn't pay its own U.S. income tax. Instead, any profits or losses "pass through" directly to you, the owner. You’re then responsible for reporting that income—but only if you actually have a U.S. tax liability.

This setup cleverly sidesteps the "double taxation" problem that hits corporations, where the business pays tax on profits, and then shareholders get taxed again on their dividends. For a non-resident, this pass-through system is incredibly efficient.

So, When Do You Actually Owe US Taxes?

Just because your LLC is making money doesn't automatically mean you owe a dime in U.S. income tax. The million-dollar question for non-residents is whether your income is considered Effectively Connected Income (ECI).

This is a technical IRS term, but the core idea is pretty straightforward. You generally have ECI if your income comes from a "U.S. trade or business" (USTB). This usually happens when you have what's called a "dependent agent" in the U.S.—think an employee or an exclusive contractor—who is actively working to generate business for you.

On the other hand, if you're selling digital downloads to a global audience or offering consulting services entirely from your home country, you might not have ECI. This distinction is everything, because non-residents are typically only taxed on their ECI. All other income is generally outside the U.S. tax net.

The Most Important Form You'll Ever File

Okay, this is critical. Even if you determine you have zero ECI and owe $0 in U.S. tax, you are absolutely not off the hook. This is the single biggest mistake international founders make, and it's a costly one.

Every single-member LLC owned by a non-resident must file Form 5472 with the IRS each year. It’s an informational return that discloses transactions between your LLC and you (the foreign owner). Failing to file it on time triggers an automatic, non-negotiable penalty that starts at $25,000.

I can't stress this enough. The penalty applies even if your LLC had no activity and you owe no tax. The IRS is dead serious about transparency, and they enforce this rule without mercy. You’ll file Form 5472 along with a pro-forma Form 1120, which basically acts as a cover letter for your filing.

Key US Tax and Reporting Forms for Non-Resident LLCs

To help you get familiar with the paperwork, here’s a quick-reference guide to the most common IRS forms you'll likely encounter as the owner of an LLC for non US residents.

Form Number | Purpose | Who Needs to File |

|---|---|---|

Form 5472 | An information return for foreign-owned U.S. entities, used to report transactions with their foreign owners. | Mandatory for all single-member LLCs owned by a non-resident. |

U.S. Corporation Income Tax Return. | Used as a "pro-forma" or cover sheet that you must attach your Form 5472 to. You file it even if you are not a C Corp. | |

Form 1040-NR | U.S. Nonresident Alien Income Tax Return. | Filed by the individual non-resident owner only if they have Effectively Connected Income (ECI) to report and pay tax on. |

W-8BEN | Certificate of Foreign Status of Beneficial Owner. | You provide this form to U.S. clients or payment processors like Stripe to certify you are a foreign person. |

This table covers the basics, but your specific filing requirements will depend on your business activities, your country's tax treaty with the U.S., and whether you have business partners.

Navigating this on your own is a huge risk. A single missed deadline or incorrect form can wipe out your profits. That's why working with a professional team that lives and breathes U.S. tax for international founders is so important. It’s about building a compliant, resilient business from day one.

Building Your US Business With an Expert Partner

You’ve made it this far, which means you now understand the major milestones involved in launching your LLC as a non-U.S. resident. We’ve covered selecting the right state, filing the essential documents, getting your EIN, opening a bank account, and even dipping our toes into the vast ocean of U.S. tax compliance.

Getting your U.S. entity off the ground is a huge accomplishment. But keeping it healthy, compliant, and poised for growth? That’s a whole different ballgame. The journey quickly shifts from a one-time setup checklist to a strategic, ongoing commitment. It’s about building a rock-solid foundation, not just filing paperwork.

Beyond Formation: A Strategic Partnership

This is where having an experienced partner can completely change the game. Instead of you losing sleep over IRS forms or obscure state deadlines, you get a dedicated team that lives and breathes the challenges non-resident founders face every single day.

This isn’t about just handing off tasks. It’s about gaining a trusted advisor who’s genuinely invested in your success. Our goal is to handle every piece of the puzzle, from day one and beyond.

Strategic State Selection: We go beyond the generic advice, helping you pick the state—whether that's Wyoming for its privacy shield or Delaware for its investor-friendly reputation—that truly fits your business model.

Flawless Formation & EIN: We manage all the filings with precision, making sure your company is structured correctly from the very beginning. No costly mistakes or redos.

Ongoing Financial Clarity: From setting up your bookkeeping system to managing your financial records, we give you the clear data you need to steer the ship.

Proactive Tax & Compliance: We take the lead on all federal and state reporting, including the critical Form 5472, to keep you compliant and penalty-free.

Your job is to grow your business—find customers, build amazing products, and expand your reach. It’s not to become an expert on the U.S. tax code. Let a dedicated partner handle the red tape so you can focus on what you do best.

We see ourselves as more than just a service provider. We're your long-term strategic ally in the U.S. market. By taking the administrative and compliance headaches off your plate, we give you the freedom and confidence to scale your operations.

Ready to turn your U.S. business dream into a concrete reality? Let's talk about your vision. We invite you to schedule a consultation with our team and discover how we can build a powerful foundation for your success in America.

Got Questions? We've Got Answers.

When you're setting up a U.S. business from overseas, a lot of questions pop up. It's completely normal. Let's tackle a few of the most common ones we hear from international founders just like you.

Do I Need a U.S. Visa to Own an LLC?

Absolutely not. This is a big one, and the answer often surprises people. You don't need a visa, and you don't even need to set foot in the United States to own a U.S. LLC. You can manage everything from your home country.

Just remember, owning the company doesn't automatically give you the right to work in the U.S. That’s a whole different process involving work visas. But for running your business from abroad? You're in the clear.

How Do I Pay Myself from My U.S. LLC?

As the owner of an LLC, you won’t be taking a typical salary. Instead, you'll take what are called owner's draws, which are just distributions of the company's profits.

For non-residents, these draws have a huge advantage: they aren't subject to U.S. self-employment tax. Your tax obligations are generally tied to income generated from U.S. sources, making this an incredibly tax-efficient way to operate for many international entrepreneurs.

That Form 5472 deadline is no joke. If you miss it, the IRS hits you with an immediate $25,000 penalty. This isn't a slap on the wrist—it's a serious fine that highlights why having an expert handle your compliance is so critical.

Can My Foreign Company Own the U.S. LLC?

Yes, it can. It's actually a pretty common strategy for established international businesses looking to break into the American market. Your existing foreign company can be the official member (owner) of the new U.S. LLC.

Keep in mind, all the same compliance rules apply. That means the mandatory Form 5472 filing is still required for this structure.

Figuring all this out is what we do best. At Read & Associates Inc., we handle the entire process, making sure your U.S. company is set up right and stays compliant from the very beginning. Start a conversation with our expert team today.