A Founder's Guide on How to Apply for an EIN Number

- Read & Associates

- Jan 6

- 17 min read

Launching your business in the U.S. is an exciting venture, but the first critical step is securing an Employer Identification Number (EIN) from the IRS. This nine-digit number is the key that unlocks banking, hiring, and tax compliance.

For founders based in the U.S. with a Social Security Number (SSN), the online application is a game-changer—you can get your EIN instantly. However, for international founders, the path is different, typically involving a fax or mail-in application. Navigating this process correctly from the start is crucial to avoid delays and set your business up for success.

Your First Step in U.S. Business: An EIN Primer

Before you can open a U.S. bank account, hire your first employee, or file American taxes, your business needs an Employer Identification Number. Think of this nine-digit number as the Social Security Number for your company. It's the single most important identifier the IRS will use, making it absolutely non-negotiable for U.S. operations.

Obtaining this number is a foundational milestone for any business owner, but it's especially vital for international founders. Without an EIN, you're effectively locked out of the U.S. business ecosystem. The process might seem simple, but for non-residents, small mistakes can easily turn into frustrating, weeks-long delays that stall your progress.

Why Every Founder Needs to Prioritize Their EIN

The sheer volume of EIN applications shows just how many entrepreneurs are making this their top priority. The startup landscape is buzzing. In just one recent month, the IRS received a staggering 535,041 business applications for EINs, which was a 7.1% increase from the month before. You can dig into more of these business formation statistics directly from the U.S. Census Bureau.

This isn't just a bureaucratic formality; it's a foundational asset. Your EIN is what allows you to:

Open a U.S. business bank account.

Legally hire W-2 employees and set up payroll.

File your federal and state tax returns correctly.

Apply for necessary business licenses and permits.

Start building business credit separate from your personal finances.

For a deeper dive, our guide on what an EIN number is and why you need one covers all the essential details.

Navigating the EIN application is often the first real test for international founders entering the U.S. market. Getting it right from the start saves weeks of potential delays and frustration, allowing you to focus on growth instead of paperwork.

Choosing Your Application Path

The best way to apply for an EIN really comes down to your specific situation—mainly, whether you have a U.S. SSN or ITIN. Each path has its own timeline and set of requirements. Picking the right one can mean the difference between getting your number in minutes versus waiting for weeks.

Which EIN Application Method Is Right For You?

This table gives a quick overview to help you decide which route is the best fit for your business.

Application Method | Eligibility | Typical Processing Time | Best For |

|---|---|---|---|

Online Application | U.S.-based applicant with a valid SSN/ITIN | Immediate | U.S. residents needing an EIN quickly for a new domestic business. |

Application by Fax | U.S. and International Applicants | 4-7 Business Days | International founders without an SSN/ITIN who need the fastest non-online option. |

Application by Mail | U.S. and International Applicants | 4-6 Weeks | Applicants who aren't in a hurry and prefer having a physical paper trail for their records. |

Application by Phone | International Applicants Only | Immediate (Number Given Verbally) | Founders needing an EIN instantly who can immediately follow up by faxing Form SS-4. |

As you can see, the online route is the clear winner for speed if you qualify. For everyone else, fax is typically the fastest and most reliable method to get your number and start moving forward.

Getting Your Ducks in a Row Before You Apply

The quickest way to get an EIN application flagged or rejected is to submit it with missing or incorrect information. This preparation stage is your pre-flight checklist. Getting these details right the first time is the key to a smooth process and avoiding weeks of back-and-forth with the IRS.

Before you even look at Form SS-4, the official application, you need to pull together some key information. This isn't just about having papers ready; it's about understanding why the IRS asks for each specific detail. A tiny mismatch can bring the entire process to a screeching halt.

Who's the "Responsible Party"?

One of the biggest hurdles, especially for non-residents, is correctly identifying the Responsible Party. This is the individual—the human being—who ultimately owns or controls the company and has the authority to manage its finances. For most new LLCs or startups, this is straightforward: it's the owner or a managing member.

The IRS is incredibly specific here. The Responsible Party has to be an individual, not another company. This is a critical point. For instance, if your U.S. LLC is owned by your foreign corporation, you can't just list the corporation's name. You must name an individual director or owner from that parent company.

The IRS has a strict "one EIN per Responsible Party per day" rule. This isn't just red tape; it's an anti-fraud measure. But what it means for you is that if your application gets kicked back because of a mistake, you have to wait until the next business day to try again.

This rule alone makes getting it right on the first attempt a top priority. Double-check, then triple-check that you've correctly identified this person before you even think about how to apply for an EIN number.

The Big SSN vs. ITIN Question

For international founders, this is the main fork in the road. Does the person you've named as the Responsible Party have a U.S. Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN)?

Got an SSN or ITIN? Great! You can use the IRS's online application. It's by far the fastest route, and you'll get your EIN in minutes.

No SSN or ITIN? You can't use the online portal. Period. You'll have to apply the old-fashioned way: by fax, mail, or phone. This is the situation for the vast majority of our international clients.

There's absolutely no workaround for this. If you try to use the online system without a valid SSN or ITIN, you'll just get an error message. Knowing this upfront helps you pick the right application method and sets a realistic timeline.

Your Pre-Application Checklist

Once you've nailed down the Responsible Party, it's time to gather the rest of the essential details. Having all of this organized and ready will make the application process much less of a headache.

Exact Legal Business Name and Address: The name on your application must perfectly match the name on your official state registration documents (like the Articles of Organization for an LLC). A simple mistake like "Co" instead of "Company" can be enough for a rejection. Your business address needs to be a physical U.S. address, but this can be a virtual address or your registered agent's address.

Entity Type: Know exactly what you are. Are you a Limited Liability Company (LLC), a C Corporation, or something else? This choice has major tax implications, and picking the wrong one on your EIN application can create a compliance mess later.

Reason for Applying: You'll have to choose why you need the EIN. For most new businesses, the answer is simple: "Started a new business." Other common reasons include hiring employees or setting up a retirement plan.

Business Start Date: This isn't the date you came up with your idea. It's the official date your business was formed by the state, which can be found on your approved formation documents.

Getting these initial steps right is half the battle. If you're feeling uncertain about identifying your Responsible Party or want an expert to ensure your documents are flawless, getting professional help can save you significant time and stress. Our team helps international founders with this every day—reach out for a consultation to ensure your application is handled correctly.

A Practical Walkthrough of Each EIN Application Method

Alright, you've got your information gathered. Now it's time to actually get the EIN. This isn't just about picking a random application method; it’s about choosing the right strategy for your specific situation. We'll walk you through this based on our direct experience helping international founders navigate the IRS.

Every path—online, fax, phone, or mail—has its own quirks and potential pitfalls. Understanding these nuances is often the difference between getting your EIN in a few days and getting stuck in a bureaucratic loop for weeks.

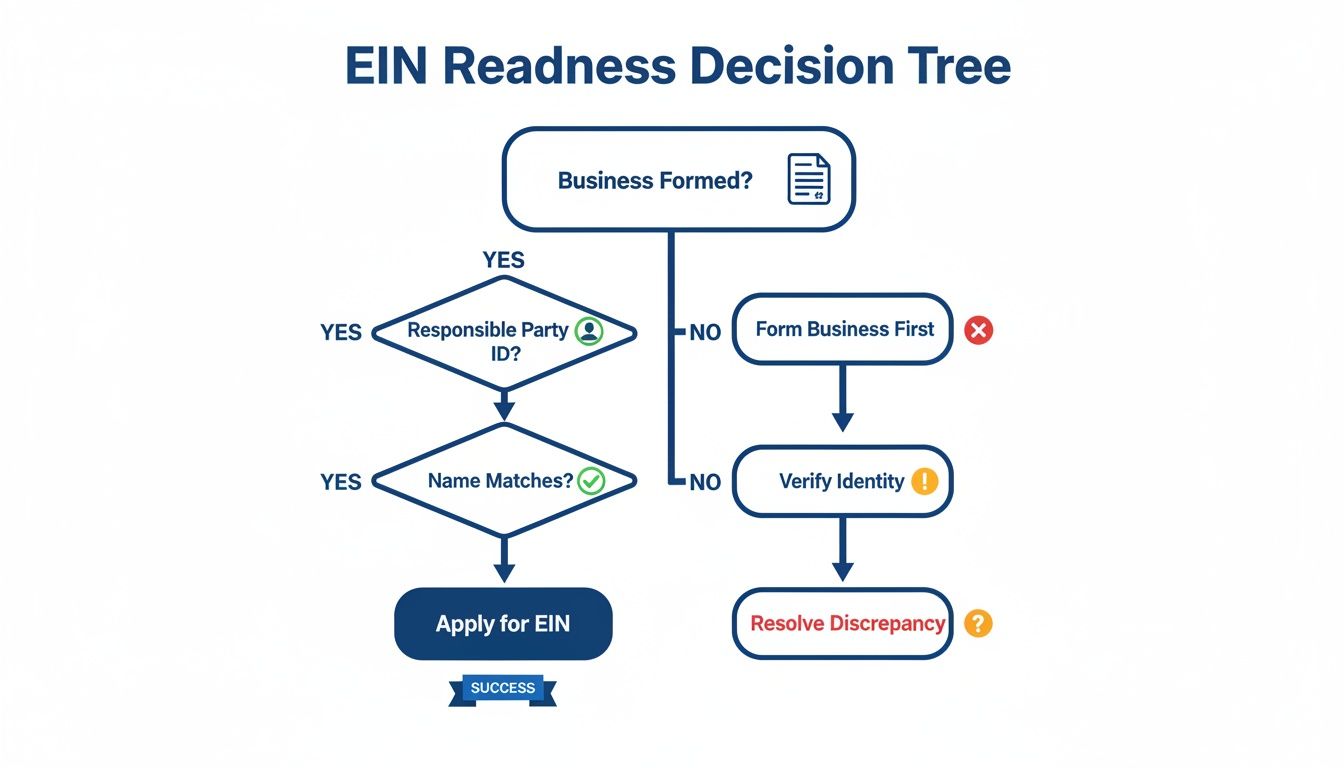

Before you fill out a form, it helps to quickly visualize where you stand. This simple decision tree shows the key checkpoints you absolutely have to clear first.

As you can see, getting your business officially formed and knowing exactly who your "responsible party" is are non-negotiable first steps. That final check—making sure the name on your application perfectly matches your state documents—is what saves you from the most common and frustrating rejections.

Breaking Down Form SS-4 for Non-Residents

For almost every international founder, Form SS-4 is the key document. Whether you apply by fax or mail, this is the form the IRS uses to understand your business. It can look intimidating, but only a few lines are mission-critical for non-residents.

Let's cut through the noise and focus on what matters:

Line 1 (Legal Name): This needs to be the exact legal name of your LLC or C-Corp, just as it appears on your state-approved formation documents. No nicknames, no abbreviations.

Lines 7a & 7b (Responsible Party): This is where you put the full name of the individual you identified earlier. Crucially, for line 7b, if that person doesn't have a U.S. SSN or ITIN, you must write "Foreign." This tiny detail is what tells the IRS system how to process your application correctly.

Line 9a (Type of Entity): Check the right box here. For a typical LLC owned by non-residents, you'll check "Limited liability company" and write in the number of members.

Line 10 (Reason for Applying): In nearly every case, you're going to check "Started a new business" and briefly describe what you do (e.g., "e-commerce," "consulting services").

Getting these fields right is everything. We've seen applications automatically rejected simply because someone forgot to write "Foreign" on line 7b, which caused the system to mistakenly flag it for a missing SSN.

The Fastest Path: The Online Application

If your company’s responsible party has a U.S. Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN), the online application is your golden ticket. It's the only way to get an EIN instantly.

This IRS online tool is incredibly efficient—it delivers an EIN in minutes, completely free. But its strict requirements lock out most international founders. The IRS also enforces a one-EIN-per-day limit for each responsible party to manage volume. You can read more about their internal controls in the Treasury Inspector General's report.

Just a heads-up: the online session times out after 15 minutes of inactivity, so have all your information laid out and ready to go before you start.

Applying by Fax: The Non-Resident's Best Friend

For the vast majority of international founders without an SSN or ITIN, faxing is the most effective method. It hits the sweet spot between speed and reliability—far faster than postal mail without the strict requirements of the online portal.

When people ask, "how do I apply for an EIN number without an SSN," this is almost always the answer we provide.

Here’s the game plan:

Fill out Form SS-4, paying very close attention to those critical fields we just covered.

Sign and date it. This has to be a "wet" signature—no digital or electronic signatures allowed.

Fax the completed form to the correct IRS number, which depends on where your business is located.

Typically, you’ll get the confirmation letter with your new EIN faxed back to you within 4 to 7 business days. That speed is a game-changer when you have U.S. bank accounts to open and operations to launch.

Pro Tip: We have often found you can speed things up by calling the IRS Business & Specialty Tax Line about a week after faxing. If your application is in their system, an agent can sometimes provide the EIN over the phone while you wait for the official letter.

The Phone Application Method for Urgent Needs

A little-known option available to international applicants is applying by phone. This is the only other way to get your EIN immediately, often during the very first call. It can be a real lifesaver if you're up against a tight deadline.

The catch? It’s not a one-and-done deal. After the agent gives you the number verbally, you still have to sign and fax or mail the completed Form SS-4 to validate it. The agent on the line will walk you through what's required.

To make this work, you must be prepared. The IRS agent will essentially interview you using the Form SS-4 as their script. Be ready to answer questions like:

"What is the exact legal name of the business?"

"Who is the responsible party, and what is their role?"

"What is the physical address of the company?"

"What is the primary activity of your business?"

Your best bet is to call right when the phone lines open in the morning, U.S. Eastern Time. This is how you avoid the infamous hold times that can stretch for hours later in the day.

Navigating these options can be complex, and a simple mistake can set you back weeks. If you'd rather not deal with the hassle, our team handles this process day in and day out. Schedule a consultation with us, and we'll ensure your EIN application is done right from the start.

Common Application Mistakes and How to Fix Them

Getting an EIN from the IRS can feel like navigating a minefield. One wrong step, and your application gets stuck for weeks, putting a halt to critical next steps like opening a bank account. After guiding hundreds of international founders through this process, we've seen just about every mistake you can make. This isn't just a list; it's a field guide to avoiding the pitfalls we see every day.

These small errors have real consequences. A simple low-ink cartridge on a fax machine can render an application illegible, delaying a bank account opening by nearly a month. Accidentally selecting the wrong entity type can lead to serious compliance issues discovered by an accountant months later.

The Name Mismatch Nightmare

One of the most frequent and frustrating errors is a name mismatch. The legal name of your business on Line 1 of Form SS-4 has to be an exact, character-for-character match to the name on your state-approved formation documents.

This means:

"My Company LLC" is not the same as "My Company, LLC" (that comma matters).

"Global Ventures Inc" is not the same as "Global Ventures, Incorporated."

Even a tiny typo can get your application kicked back automatically.

How to get it right: Before you fill out anything, pull up your official state registration document. Copy and paste the legal business name directly onto the form. Don't paraphrase, don't abbreviate, and don't change it in any way. This one simple action will save you weeks of headaches.

Getting the Responsible Party Wrong

The IRS is incredibly particular about who you list as the "Responsible Party." This has to be an individual—a real person—not another company. It must be the person who ultimately owns or controls the business. A common slip-up is listing a parent company, which is an immediate red flag for the IRS.

For international founders, the real trap is on Line 7b. If the Responsible Party doesn't have a U.S. Social Security Number (SSN) or ITIN, you have to write the word "Foreign." If you leave this blank or write "N/A," the IRS system automatically flags the application for a missing SSN.

We’ve seen applications get stuck in limbo for this exact reason. The IRS system is automated to look for an SSN unless you explicitly tell it the applicant is foreign. Forgetting that one word leads to an unnecessary rejection because the system is applying a rule that doesn't fit your situation.

How to get it right: Clearly identify the individual who serves as the Responsible Party. On Form SS-4, Line 7b, physically write or type "Foreign" if they do not have an SSN or ITIN. This tells the IRS exactly how to process your application.

The Missing Signature Problem

It sounds obvious, but you'd be surprised how often it happens: an unsigned Form SS-4 is an invalid form. The IRS does not accept digital or typed signatures on faxed or mailed applications. It needs a physical, "wet ink" signature from the Responsible Party. We’ve had applications bounce because the signature was a scanned image that looked digital or was simply forgotten.

Submitting an incomplete application is another surefire way to get rejected. Every required field needs an answer. If you're unsure about a specific question related to how you should apply for an EIN number, guessing is the absolute worst strategy.

How to get it right: Print the completed Form SS-4. Have the designated Responsible Party sign it with a pen. Before you fax or mail it, do one final review to make sure every mandatory field is filled out and that the signature is clear and legible.

Avoiding these common slip-ups is the key to a smooth EIN application. If you’re feeling overwhelmed by the details or want the peace of mind that comes from getting it right the first time, our team is here to help. Schedule a consultation and let us handle the complexities for you.

You Have Your EIN—What Comes Next?

Getting that EIN confirmation letter from the IRS—usually the CP 575 Notice—is a huge milestone. It’s the official recognition that your business exists in the federal system. But let's be clear: this is the starting pistol, not the finish line.

What you do in the days and weeks that follow is what truly gets your U.S. business up and running. Think of your new EIN as a master key that unlocks banking, payroll, and state-level compliance. Now, it’s time to move from company formation to full-scale operation.

Opening Your U.S. Business Bank Account

Your first and most urgent priority is to open a U.S. business bank account. Without one, you can't manage U.S. revenue, pay American vendors, or keep your business finances separate from your personal funds—a non-negotiable step for protecting your liability.

This is often where international founders hit a wall. Many traditional U.S. banks demand an in-person visit, which is impractical for most. Thankfully, a new wave of fintech companies and modern banking solutions has emerged, catering specifically to foreign-owned U.S. businesses.

To get an account opened, you'll almost always need these three things:

Your EIN Confirmation Letter (CP 575): This is the non-negotiable proof the bank needs to verify your federal tax ID.

Your Company's Formation Documents: This means your Articles of Organization for an LLC or your Articles of Incorporation for a C Corp.

Your Personal Government-Issued ID: For the business owner or responsible party, a foreign passport is standard.

Once that account is open, you can connect to U.S. payment processors like Stripe and PayPal, which is essential for most e-commerce and SaaS companies.

Registering with State Tax Agencies

Here’s a common misconception: your federal EIN does not register you with any state tax authorities. That’s an entirely separate—and equally critical—process. Depending on what you sell and where you operate, you might need to register for several different state taxes.

For instance, if you plan to sell goods to customers in certain states, you’ll probably need a sales tax permit. If you hire U.S.-based employees, you must register for state payroll taxes to handle things like unemployment insurance.

Failing to register for the right state taxes is a fast track to penalties and a mountain of back taxes. Each state has its own unique rules for what creates "nexus"—the connection that legally requires you to collect and remit taxes—making this a minefield for non-residents.

Trying to navigate the tax laws of 50 different states is a massive undertaking. This is where having a clear compliance plan from the start becomes invaluable.

Setting Up Payroll and Accounting Systems

Even if hiring isn't on your immediate radar, it's smart to get a payroll provider picked out. When you do bring on your first U.S. team member, you'll need a system ready to go for handling withholdings, tax filings, and payments correctly from day one.

At the same time, get your accounting software set up. Platforms like QuickBooks or Xero are the industry standard here in the U.S. By linking your new bank account to your accounting software right away, you create a clean, organized financial record. Trust me, this will save you a world of headaches when it comes to bookkeeping and tax preparation later on.

Getting your EIN is a fantastic first step, but it's just one piece of the puzzle. Here’s a quick checklist to help you organize your next moves and ensure your new venture is built on a solid foundation.

Your Post-EIN Action Checklist

Action Item | Why It's Important | Read & Associates Can Help With |

|---|---|---|

Open a U.S. Business Bank Account | Separates business/personal finances, enables payment processing, and establishes financial credibility. | Guidance on foreign-friendly banking solutions and document preparation. |

Register for State Taxes | Ensures compliance with state laws for sales tax, payroll tax, and franchise tax, avoiding penalties. | State-by-state tax nexus analysis and registration filings. |

Set Up Accounting Software | Creates a clean financial record from day one, simplifying bookkeeping, reporting, and tax filing. | Software setup, chart of accounts customization, and ongoing bookkeeping. |

Choose a Payroll Provider | Prepares you to legally hire U.S. employees and manage withholdings, filings, and compliance. | Payroll provider selection, setup, and state-specific compliance management. |

File Initial Corporate Reports | Many states require an initial report within months of formation to remain in good standing. | Tracking and filing all necessary state compliance reports on your behalf. |

Understand U.S. Tax Obligations | Knowing your federal and state tax filing deadlines and requirements prevents costly mistakes. | Comprehensive tax planning, preparation, and filing for U.S. entities. |

Putting these pieces in place correctly is the difference between a smooth launch and a compliance nightmare. The journey from formation to a fully operational U.S. company has many moving parts, but you don't have to navigate it alone. Our team specializes in creating that exact roadmap for international founders.

Schedule a consultation to ensure your new venture is set up for success from day one.

Your EIN Questions, Answered

Even with a step-by-step guide, you're bound to have some specific questions. These are the ones we hear all the time from founders navigating this process for the first time. We've compiled the most common queries and provided straight answers based on our hands-on experience.

How Long Will It Take to Get My EIN as a Non-Resident?

This really comes down to how you apply. For most non-residents without a U.S. tax ID, the timeline looks like this:

Fax: This is our go-to method for a reason. It's the sweet spot between speed and reliability. You can typically expect the IRS to process your Form SS-4 and fax back the confirmation within 4 to 7 business days.

Phone: You'll get the number on the spot during the call. However, it isn't officially "active" until the IRS receives and validates your signed Form SS-4, which you still have to fax or mail in.

Mail: We advise against this method unless you have no other choice. It's the slowest by a long shot. We've seen it take anywhere from 4 to 6 weeks for a mailed application to be processed.

Can I Apply for the EIN Before My Company Is Officially Formed?

No, you absolutely must have your approved formation documents from the state before you fill out Form SS-4.

This is a classic mistake. The IRS verifies your company's legal name against state records. If they can't find it, your application will be rejected immediately. Finish your state registration, get that confirmation, and then move on to the EIN.

We always advise our clients: think of state formation as laying the foundation of a house. Your business simply doesn't exist in the eyes of the law until the state says it does. The IRS can't give a tax ID to something that isn't legally there.

Help! I Lost My EIN Confirmation Letter. What Now?

First, don't panic. That original letter, the CP 575 notice, is a one-time document; the IRS won't send you a new one.

But you have options. Before you do anything else, check other official paperwork. Your EIN is often listed on bank account statements, old tax filings, or state tax registrations.

If you come up empty, your best bet is to call the IRS Business & Specialty Tax Line. Once you verify your identity as someone authorized to act for the company, an agent can give you the EIN over the phone. This is precisely why we urge our clients to save a secure digital copy of their CP 575 the second it arrives.

Is Getting an EIN from the IRS Really Free?

Yes, 100% free. The IRS never charges a fee to process a Form SS-4 or issue an EIN. It doesn't matter if you apply online, by fax, phone, or mail—the cost from the government is zero.

Be wary of websites that look official but are really just third-party services charging a hefty fee to do what you can do for free. While a professional firm like ours will charge for a comprehensive service package that includes handling the EIN application as part of a larger business formation and compliance strategy, just getting the number itself from the IRS costs nothing.

Getting your EIN and navigating the next steps is a huge milestone in your U.S. business journey. Doing it right from the start means you can open a bank account, hire your team, and focus on growth without hitting frustrating administrative walls. If you'd rather have a dedicated partner manage these details and build a solid foundation for your company, the team at Read & Associates Inc. is here to help.

Schedule your consultation with us today and let’s get your U.S. venture launched the right way.

Comments