How to register company in usa: A UK Founder's Guide

- Read & Associates

- 12 hours ago

- 18 min read

So, you're a UK founder ready to take on the American market. It's a massive move, and the first step is actually registering your company in the US. This involves a few key decisions: picking the right business structure (usually an LLC or a C-Corp), choosing a business-friendly state like Delaware or Wyoming, and then getting the official paperwork filed. You'll also need a couple of things to be fully operational, like a Registered Agent and an Employer Identification Number (EIN) from the IRS.

Your Roadmap to US Business Registration

Jumping into the US market is a huge step, but the company formation process itself doesn't have to be a headache. I've designed this guide to be your step-by-step roadmap, looking at the process specifically from a UK founder's perspective. We'll kick things off with the big, foundational choices that will really shape your company’s future and set you up for success down the line.

Think of this first section as our high-level strategy session. We’ll map out the entire journey, from the initial paperwork right through to opening a US bank account, so you always know what’s coming next. This is more than just a legal checklist; it’s about making smart, strategic decisions right from the start.

Understanding the Opportunity

The sheer size of the American market is a massive draw, and you're certainly not the only one to notice. In the first 11 months of a recent year, the US saw a staggering 5.13 million new business applications. That's an 8.13% jump from the previous year. This boom is part of a bigger picture—monthly new business formations are now averaging around 478,800, a wild 435% increase from 2004. For a UK founder, this means you're entering a competitive but incredibly vibrant market. It's worth a look at the latest US new business trends just to get a feel for the landscape.

My goal here is to give you a clear, straightforward path for registering a company in the USA, breaking down what can feel like a complex process into simple, manageable actions.

From what I've seen helping countless UK founders, the ones who succeed in the US are those who plan their entry methodically. They don't just "register a company." They build a strategic foundation from day one that considers US banking, tax compliance, and the practical realities of operating across the pond.

The Core Components of US Company Formation

Before we dive into the nitty-gritty, it helps to see the whole process from a bird's-eye view. These are the key milestones you'll hit on your journey:

Choosing Your Entity and State: This is your first big decision. Will you be a Limited Liability Company (LLC) or a C-Corporation? And where will you register? We'll look at popular choices like Delaware, Wyoming, and Florida.

Preparing Formation Documents: This is the actual paperwork—filing the necessary articles with your chosen state to make your company official.

Appointing a Registered Agent: Every US company needs a physical point of contact in its state of formation. This is a legal requirement you can't skip.

Obtaining a Federal EIN: Think of this as your company's tax ID number from the IRS. You absolutely need it for banking, payroll, and filing taxes.

Opening a US Bank Account: Getting your financial infrastructure in place is crucial for taking payments from US customers and managing your operations.

Addressing Initial Compliance: We'll touch on the basics of what you need to do to keep your company in good standing, from taxes to annual reports.

Each of these steps builds on the one before it, creating a solid foundation for your American venture. By tackling them with a clear plan, you can sidestep the common mistakes and set your business up to grow in one of the world's most dynamic markets.

1. Choosing Your US Business Structure and State

This is it—the foundational decision that shapes your entire US venture. Let's get straight to what matters for a UK founder: choosing between an LLC and a C-Corporation isn't just a box-ticking exercise. This choice directly influences your taxes, how you’re protected from liability, and, most importantly, your ability to attract American investment down the road.

Think of it this way. If you're building a tech startup with eyes on venture capital, the Delaware C-Corp is the unofficial uniform. US investors know it, the legal framework is solid, and it’s built to handle stock options and funding rounds.

But what if you're a Manchester-based e-commerce seller who just wants to crack the US market? Simplicity and low overheads are your priority. In that case, a Wyoming LLC is a brilliant move, offering fantastic privacy and asset protection without the stuffy corporate paperwork.

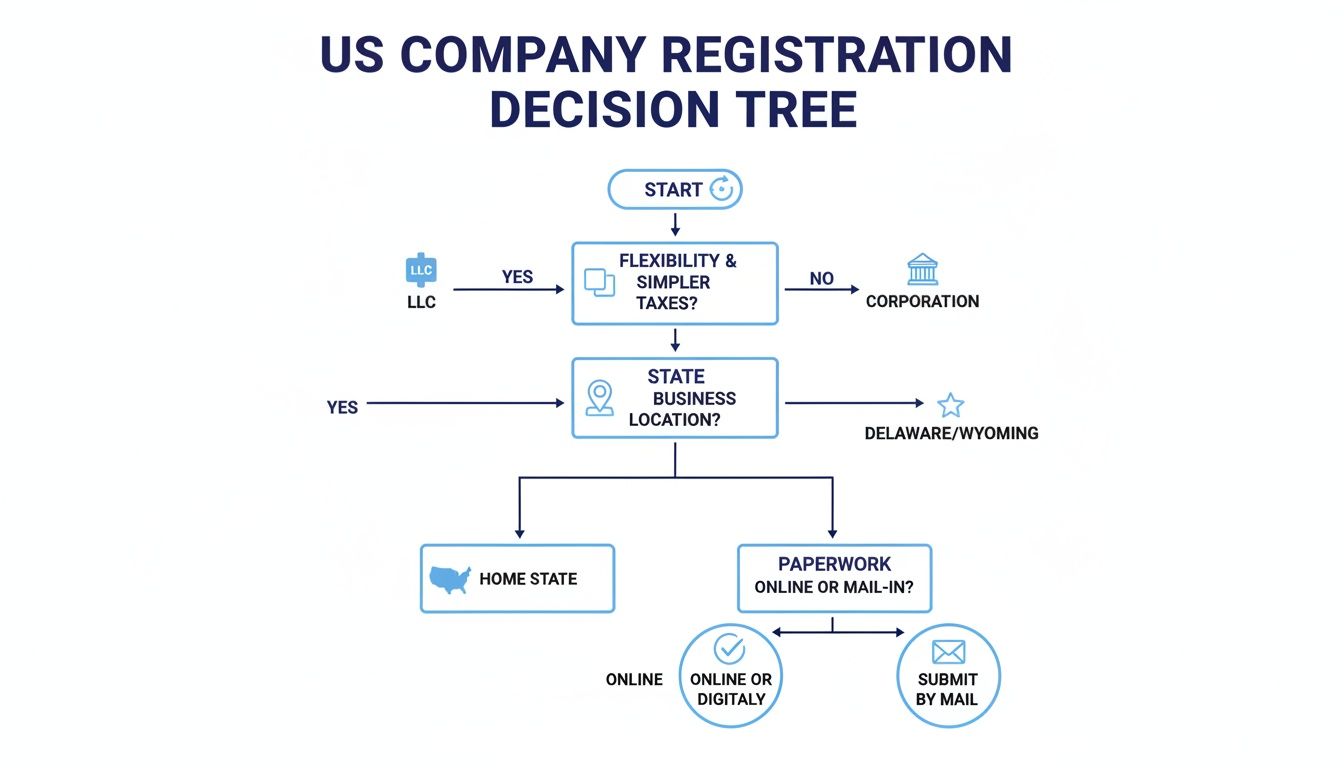

This decision tree gives you a quick visual on how your goals point you to the right structure.

As you can see, it all starts with your ambition. Let that guide you.

LLC vs C-Corporation A UK Founder's Quick Guide

The "LLC or C-Corp?" question is easily the one I hear most often. There’s no secret right answer—it all comes down to your business model and where you see it going in the next five years.

A Limited Liability Company (LLC) is the champion of flexibility. It shields your personal assets (like your house) from business debts, which is non-negotiable. By default, it's a "pass-through" entity for tax purposes. This means profits and losses flow through to you to report on your personal taxes, which can keep things simple. However, you absolutely must get your head around the US-UK tax treaty implications.

A C-Corporation (C-Corp) is a more formal, buttoned-up affair. It’s a completely separate entity from you, legally and for tax. The corporation pays its own taxes, and you pay taxes again on any dividends you take. Yes, that’s the infamous "double taxation." So why bother? Because C-Corps are the only game in town if you want to raise serious money from US investors, as they allow you to issue different classes of stock.

To make it clearer, here’s a quick breakdown of what matters most to a non-resident founder.

Feature | Limited Liability Company (LLC) | C-Corporation (C-Corp) |

|---|---|---|

Best For | E-commerce, consultants, service businesses, and solo founders prioritising simplicity. | Tech startups, businesses planning to raise VC funding, or companies aiming for an IPO. |

Taxation | "Pass-through" by default. Profits/losses are reported on the owner's personal tax return. | Taxed at the corporate level. Shareholders are taxed again on dividends ("double taxation"). |

Investor Friendliness | Less attractive to US VCs due to complex ownership and tax pass-through structure. | The gold standard for US investors. Easily allows for issuing different classes of stock. |

Ownership & Management | Highly flexible. Can be managed by members (owners) or appointed managers. | Formal structure with shareholders, a board of directors, and officers. |

Formalities | Fewer ongoing compliance requirements (e.g., fewer formal meetings and records). | Stricter requirements for annual meetings, board resolutions, and record-keeping. |

For many UK founders, the choice really boils down to this: an LLC is about operational simplicity, perfect for lifestyle businesses or e-commerce stores. A C-Corp is the structural key that unlocks the door to venture capital and stock options, making it the default choice for high-growth tech ambitions.

Picking the Right State for Your US Company

Once you've settled on the entity type, the next question is where in the US to register. You don't have to register in the state where you sell your products or services. Instead, you can pick a state that offers the best legal and tax environment for a non-resident like you.

The big three are almost always Delaware, Wyoming, and Florida.

Delaware: The undisputed champion for C-Corporations. Its specialised business court, the Court of Chancery, has built a mountain of predictable, founder-friendly corporate law. If you want US investment, your VCs will just assume you’re a Delaware C-Corp.

Wyoming: A powerhouse for LLCs and the new favourite for privacy-conscious founders. It was the first state to even create the LLC, and it offers incredible privacy (no public listing of owners) and iron-clad asset protection. Plus, there's no state corporate or individual income tax.

Florida: Another fantastic, business-friendly option. It also has no state income tax and a red-hot economy, making it a pragmatic and affordable choice, especially if you think you might want a physical presence there one day.

These states have become incorporation hubs for good reason. They're locked in a friendly competition to be the most attractive for entrepreneurs. For UK founders, understanding these subtle differences is what turns a good decision into a great one.

This isn’t just a logistical hoop to jump through; it's a strategic play that sets the entire legal and financial tone for your company's future. Take a moment to really align your choice with your ultimate goals.

If you’re leaning towards an LLC but want to dig deeper, our team put together a resource just for you. Check out our complete guide on forming an LLC as a non-US resident for a more detailed analysis.

Getting the Core Registration Paperwork Sorted

Alright, you’ve picked your business structure and settled on a state. Now comes the part where it all becomes real: the paperwork. This is where you translate your big plans into official, legally recognised documents. It might feel like just filling out forms, but getting these details spot-on from the start is absolutely crucial for a hassle-free launch.

Your first major move is to file a formation document with the Secretary of State's office in your chosen state. This is the document that officially gives birth to your company. If you went with an LLC, this is called the Articles of Organization. For a C-Corp, it's the Articles of Incorporation.

Think of this document as your company's birth certificate. It’s a public record that announces your business exists and outlines the most basic, vital information about it.

Filing Your Formation Documents

Whether you’re setting up an LLC or a C-Corp, the information needed is pretty much the same, just with slightly different labels. This isn't a time for creative writing; it's all about precision and meeting the state’s exact requirements.

Typically, your filing will need to include:

Company Name: Your official business name, which must follow state rules (like including "LLC" or "Inc.").

Business Purpose: A general statement usually does the trick. Something like "to engage in any lawful act or activity" is often all you need.

Registered Agent Details: The name and address of the Registered Agent you've appointed in that state.

Principal Office Address: Your company’s main business address, which can be a virtual address.

Organizer's Name: The person or service submitting the documents on your behalf.

This part of the journey is a flurry of key decisions. You're choosing your entity (where 85% of small businesses go for an LLC), filing the articles of organization (with an average cost around $100), and appointing that all-important registered agent. Be prepared for varying costs, as state filing fees can be as low as $50 in a place like Wyoming or jump to $500 in California. Processing times usually land between one and seven business days.

The Non-Negotiable Registered Agent

For any UK founder, appointing a Registered Agent is a legal must-have. You simply can't form a US company without one. A Registered Agent is a person or, more commonly, a service with a physical street address in your state of formation. Their job is to receive official legal and government mail for you.

This isn't junk mail. We’re talking about crucial documents like:

Annual report reminders from the state

Official tax notices

Service of process (the formal notice of a lawsuit)

Since you’re based in the UK, you don’t have a physical presence in Delaware or Wyoming. A commercial Registered Agent service bridges that gap perfectly, ensuring you never miss a critical piece of mail that could put your company's good standing at risk.

Securing Your Employer Identification Number (EIN)

Once the state gives your company the green light, your very next task is to get an Employer Identification Number (EIN) from the IRS. The simplest way to think about an EIN is as your company's national insurance number. It's a unique nine-digit code that the federal government uses to identify your business for all things tax-related.

You absolutely need an EIN to:

Open a US business bank account

Hire any employees in the US

File your federal tax returns

Get set up with payment processors like Stripe or PayPal

Here’s a common worry I hear from UK founders: the myth that you need a US Social Security Number (SSN) to get an EIN. Let me be clear: you do not. While US residents can hop online and get an EIN in minutes, non-residents without an SSN just have to follow a different, manual process by submitting Form SS-4 to the IRS. For a complete walkthrough, check out our founder's guide on how to apply for an EIN number.

Insider Tip: The IRS process for non-residents can be painstakingly slow and unforgiving. One tiny mistake on Form SS-4 can get your application rejected, setting you back weeks. This is one of those times where using a formation service to handle the filing for you is one of the smartest, time-saving investments you can make.

Crafting Your Internal Rulebook

The final piece of this paperwork puzzle isn't something you file with the state, but it’s arguably the most important document for the long-term health of your business. This is your internal governance document: the Operating Agreement for an LLC or the Bylaws for a C-Corp.

Think of this as the internal rulebook for your company. It sets out the ground rules on:

How ownership is divided

The rights and duties of members or shareholders

How profits and losses are distributed

The process for making big decisions

What happens if a founder wants to leave or sell their stake

While many states don’t technically require you to have one, trying to run a business without an Operating Agreement or Bylaws is like trying to sail a ship without a rudder. It clarifies all the "what if" scenarios that, if ignored, can blossom into massive disputes and legal headaches down the road. This document protects you, your partners, and the business itself.

Building Your US Financial Infrastructure

You've done the paperwork, your company is officially registered, and you have your EIN. Now for the crucial part: building the financial and operational plumbing that lets your new US entity actually do business. This is where you connect the dots to receive payments, manage finances, and establish a credible presence for American customers. For many UK founders, this is where theory meets reality, and the real challenges can pop up.

One of the biggest historical headaches has been opening a US business bank account. The old way involved booking a flight, showing up in person at a branch, and navigating a mountain of paperwork. Thankfully, that's no longer the case. The fintech world has stepped up in a big way for international entrepreneurs.

Modern Banking for International Founders

Today, you can get a fully functional US bank account from your desk in the UK. Platforms like Mercury and Wise were practically built for this exact scenario. They're designed for remote-first businesses and get the specific hurdles non-resident founders face. The entire application is online, and they’re built to work with the tools you're probably already using.

Mercury: A go-to for tech startups and e-commerce brands. It offers FDIC-insured accounts through its partner banks, provides virtual debit cards instantly, and connects beautifully with Stripe, Shopify, and your accounting software.

Wise: Fantastic if you’re juggling multiple currencies or sending money back and forth across the Atlantic. It gives you dedicated US account details (an ACH routing number and account number) that work just like a traditional bank account for getting paid by US clients.

These services completely sidestep the old requirement for a physical presence. They’re no longer just an alternative; they're the standard for anyone looking to register a company in the USA from overseas. For a more detailed comparison, check out our expert guide to opening a U.S. bank account online for non-residents.

Setting Up Your Accounting from Day One

With your bank account sorted, your very next task is to get your accounting system in place. I can't stress this enough: do not wait until you’ve made a few sales or until tax season is looming. Setting up a clean bookkeeping system from the start will save you from a world of pain later on.

Tools like Xero or QuickBooks Online are the undisputed champs here. They link directly to your new US bank account and pull in transactions automatically, which makes keeping your books in order so much easier. As a UK founder, having a crystal-clear, real-time view of your US finances isn’t just good housekeeping—it’s vital for making smart decisions and staying compliant.

From my experience, the single biggest mistake founders make is mixing personal and business funds or using spreadsheets for too long. A dedicated US business account linked to proper accounting software is a non-negotiable part of your financial infrastructure. It provides clarity and is the first thing a US-based accountant will ask for.

Your Professional US Business Address

Finally, let’s talk about where your business "lives." Your Registered Agent address is for official and legal mail only, not for your daily operations. For everything else—your website, invoices, and customer communications—you need a proper virtual business address.

This service provides a real street address in a US city, which immediately projects a more professional and trustworthy image than a P.O. Box or a foreign address. Any mail sent to you is scanned and uploaded to a secure online portal, so you can read it from anywhere. It's a simple, low-cost way to establish a legitimate US presence without the overhead of renting an office.

Getting your banking, accounting, and business address in order is the final step in making your new US company fully operational and ready to win business.

Staying Compliant: US Tax and Reporting for UK Founders

Getting your US company registered is a massive win, but it’s really just the starting line. Now comes the ongoing work of keeping your business healthy and on the right side of the law. This is where we dive into the essential tax and reporting duties you’ll need to manage as a UK founder.

My goal here isn't to make you a US tax expert overnight. Instead, I want to give you a solid foundation so you can stay on top of your key obligations and, just as importantly, know exactly when to bring in a professional who lives and breathes US-UK tax.

First Up: The Maze of US Sales Tax

For many UK founders, especially those in e-commerce or SaaS, sales tax is the first big compliance hurdle. It’s a consumption tax paid by your customer, which you are responsible for collecting and then sending to the correct state authority.

The tricky part? There’s no single, nationwide sales tax like the UK’s VAT. It's a patchwork quilt of rules managed at the state, and sometimes even city, level.

Understanding When You Need to Collect: The Concept of "Nexus"

Your duty to collect sales tax in a particular state all comes down to a concept called "nexus." In simple terms, nexus means you have a significant business connection to that state. Once you establish nexus, you have to register for a sales tax permit and start collecting.

You can trigger nexus in a couple of key ways:

Physical Nexus: This is the old-school trigger. Having an office, a warehouse, an employee, or even just inventory stored in a state (a classic example is using an Amazon FBA centre) creates a physical presence.

Economic Nexus: This is the more modern and often more relevant trigger for online businesses. If your sales into a state cross a certain threshold within a year, you’ve got economic nexus. For most states, that threshold is $100,000 in sales or 200 individual transactions.

As a UK founder selling online to US customers, economic nexus is the one you need to monitor like a hawk. You'll need a system to track your sales state-by-state so you know when you’re getting close to a threshold.

Don't Forget State Annual Reports and Franchise Taxes

Beyond sales tax, every single state requires an annual report filing to keep your company in good standing. It’s a simple check-in to confirm or update basic details like your Registered Agent or business address. It might seem like minor admin, but missing the deadline can lead to fines and, in a worst-case scenario, the state dissolving your company.

Some states, notably Delaware, also levy a franchise tax. This isn't a tax on your profit; it's more like a fee you pay for the privilege of being incorporated there. Delaware C-Corps face a mandatory annual franchise tax, whereas a state like Wyoming just has a small annual report fee. Think of these as non-negotiable costs of doing business in the US.

So many founders get tripped up by these small state filings. They're easy to overlook but can cause serious headaches. My advice is always the same: the moment you’re incorporated, get these deadlines in your calendar and treat them with the same importance as your federal tax return.

Tackling US Federal Income Tax

Alright, this is the big one. As a non-resident owner, you absolutely have to understand how the IRS (the US equivalent of HMRC) will tax your company's profits. The rulebook is completely different depending on whether you set up an LLC or a C-Corporation.

How a C-Corporation is Taxed

A C-Corp is treated as its own separate taxpayer. The corporation itself files a tax return (Form 1120) and pays federal corporate income tax on its profits. Right now, that’s a flat 21% rate.

If the C-Corp then pays out those post-tax profits to you in the UK as a dividend, that distribution might be subject to a US withholding tax (the US-UK tax treaty often reduces this) and will almost certainly be taxable income for you back in the UK.

How a Foreign-Owned LLC is Taxed

With an LLC, things get a bit more complex for non-residents. By default, a single-member LLC owned by a non-resident is a "disregarded entity." This is IRS-speak for saying they look straight through the LLC to you, the owner.

This means you’re personally responsible for filing two crucial forms:

Form 5472: This is purely an informational return that reports any transactions between your LLC and you (the foreign owner). The penalties for not filing this are steep, so don't miss it.

Form 1120 (Pro-forma): You'll file this to report the LLC's income and expenses to the IRS.

Here’s the critical part: as a non-resident, you are generally only taxed on income that is considered "Effectively Connected Income" (ECI) with a US trade or business. Figuring out exactly what counts as ECI is one of the most complex areas of US tax law, and it’s precisely where getting advice from a cross-border tax specialist is no longer a 'nice-to-have'—it's essential.

To help you get organised, here's a look at some of the most common compliance deadlines you'll need to have on your radar.

Key US Compliance Deadlines for UK-Owned Companies

Staying on top of deadlines is half the battle. This table breaks down some of the most common federal and state filings to help you map out your compliance calendar.

Compliance Task | Typical Deadline | Who It Applies To |

|---|---|---|

Federal Corporate Tax Return (Form 1120) | April 15th (or 15th day of the 4th month after fiscal year-end) | C-Corporations |

Foreign-Owned LLC Reporting (Forms 5472 & 1120) | April 15th | Single-member LLCs owned by non-residents |

Delaware Franchise Tax Report | March 1st | Delaware C-Corporations |

Wyoming Annual Report | First day of the anniversary month of formation | All Wyoming companies |

State Sales Tax Filings | Varies (Monthly, Quarterly, or Annually) | Businesses with sales tax nexus in a state |

Remember, these are just the most common ones. Your specific obligations will depend on your entity type, state of formation, and where you do business.

Keeping your US company compliant is an ongoing process, not something you can just set and forget. By understanding these core requirements from day one, you can build the right systems, get the right advice, and give your US venture the solid legal and financial footing it needs to succeed.

Burning Questions from UK Founders

Setting up shop in the US from the other side of the Atlantic always brings up some specific, nitty-gritty questions. I get these all the time from British founders taking that first leap. Let's get them answered so you can move forward with confidence.

Do I Need a US Visa Just to Own the Company?

This is the big one, and thankfully, the answer is simple. No, you don't need a US visa just to form and own an American company. You can run the entire show from your home office in the UK.

Company formation is a legal process, completely separate from your personal immigration status. The line in the sand is when you decide you want to physically move to the States to work for your company. At that point, you’ll absolutely need to look into getting the right work visa, like an E-2 Investor Visa or an L-1 for intracompany transfers.

Can I Get a US Tax ID (EIN) Without a Social Security Number?

Yes, you absolutely can. This is a huge point of confusion for many non-residents, but you don't need a US Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to get your Employer Identification Number (EIN).

The process is just a bit more old-school. While US residents can zip through an online form, you'll need to submit Form SS-4 to the IRS via fax or mail. It takes a bit longer, but it's the standard, well-trodden path for international founders. A good formation service can handle this for you to make sure it's done right the first time and avoid frustrating delays.

Key Takeaway: Lacking an SSN is not a roadblock. It just means you use a different, slightly slower application process for your federal tax ID. The only real difference is you need to build a bit more time into your setup plan.

Which US Bank Is Actually Friendly to UK Residents?

Trying to open a business account remotely with a big high-street bank like Chase or Bank of America is a non-starter. They almost always demand you show up in person at a branch, which isn't practical for most founders.

This is why nearly every UK founder I work with uses a modern financial platform built for international and digital-first businesses. These are your best bets:

Mercury: A fantastic all-rounder for startups and e-commerce brands. It gives you FDIC-insured accounts and plays nicely with other tech tools.

Wise (formerly TransferWise): Essential for managing different currencies. It provides you with real US account details, including ACH routing and account numbers, which is crucial for getting paid.

Brex: Tailored for high-growth, venture-backed startups, combining banking services with corporate cards and expense management.

These guys have a much saner onboarding process you can complete from your laptop.

What’s the Difference Between a Registered Agent and a Virtual Address?

It's easy to get these two confused, but they do completely different jobs. Think of it this way: one is a legal requirement, the other is an operational choice.

A Registered Agent is mandatory. It's a person or company at a physical address in your state of formation whose sole job is to receive official legal and government documents on behalf of your business—think tax notices or, heaven forbid, a lawsuit.

A virtual business address, on the other hand, is for everything else. It gives your company a professional mailing address for your website, customer correspondence, and regular business mail. It’s for your commercial mail, not for getting served legal papers.

Answering these questions is the first step in a much bigger journey. At Set Up Stateside, we live and breathe this stuff, helping UK founders get everything from their formation and banking to ongoing tax and compliance sorted out properly from day one. Let's build your US foundation the right way.

Comments