What is form 8832? A Clear Guide for UK Founders on US LLC Tax Status

- Read & Associates

- 2 days ago

- 16 min read

Think of IRS Form 8832, the "Entity Classification Election," as a powerful switch on your company's financial control panel. It's a way for certain businesses to choose how they're treated for U.S. federal tax purposes, letting you move away from the default setting to one that actually matches your business goals.

Unlocking Your US Tax Strategy with Form 8832

When you set up a Limited Liability Company (LLC) in the States, the IRS doesn't just leave its tax status up in the air. It automatically gives it a "default" classification based on one simple factor: how many owners (or "members") it has.

Single-Member LLC: The IRS automatically sees this as a disregarded entity. This is a fancy way of saying the business isn't separate from its owner for tax purposes. All the income and losses flow directly onto the owner's personal tax return.

Multi-Member LLC: With two or more owners, the default is a partnership. The LLC itself doesn't pay income tax. Instead, the profits and losses are "passed through" to the members, who then report everything on their own tax returns.

For a lot of small domestic businesses, these defaults work just fine. But for UK founders aiming to make a real splash in the US market, they can be a serious handicap.

Why the Default Often Falls Short

The pass-through system of a default LLC can create real headaches for international founders. Say you plan on raising money from US venture capitalists. They almost always invest in C Corporations—it's the structure they know and trust, especially when it comes to things like stock options. An LLC structure can be an immediate red flag.

What if your plan is to reinvest your profits to grow the business? Maybe you need to buy more inventory, hire a US team, or launch a big marketing campaign. With the default pass-through status, you could end up paying personal income tax on profits you never actually withdrew from the company. That’s a major drag on your growth.

Form 8832 is your way to take back control. It's the official form you file to tell the IRS, "Thanks, but no thanks. I don't want the default. I elect for my LLC to be taxed as a corporation."

This isn't just about paperwork; it's a critical strategic move. Making the election to be taxed as a C Corporation can make your business far more attractive to investors, streamline how you reinvest earnings, and create a solid financial wall between your personal and business affairs. Knowing what Form 8832 is gives you the power to shape your company's tax destiny in the U.S.

To make this clearer, here’s a quick overview of what Form 8832 does.

Form 8832 At a Glance

Aspect | Description |

|---|---|

Official Name | Entity Classification Election |

Purpose | Allows eligible entities (like an LLC) to choose or change their federal tax classification. |

Who Files? | Primarily LLCs and other eligible entities that want to be taxed differently from their default status. |

Key Choices | An LLC can elect to be taxed as either an S Corporation or a C Corporation. |

This table shows just how foundational the form is. It's the mechanism that unlocks different, and often more powerful, tax strategies for your U.S. venture.

Understanding Default Versus Elected Tax Statuses

To really grasp why Form 8832 is such a game-changer, you first have to understand what happens if you don't file it. When you set up a Limited Liability Company (LLC) in the U.S., the IRS doesn't just wait for you to tell them how to tax it. It immediately assigns your company a default tax status.

This "factory setting" is based purely on a simple question: how many owners (or "members") does your LLC have? Think of it like a new phone straight out of the box—it comes with pre-set apps and settings that work for the average person. But for an ambitious UK founder, these generic defaults are rarely the right fit.

The Two Default Settings for LLCs

The IRS has two standard-issue classifications for LLCs. Seeing them side-by-side makes it crystal clear why you'll likely want to make a change.

Single-Member LLCs Default to a "Disregarded Entity" If you're the sole owner of your U.S. LLC, the IRS automatically treats it as a disregarded entity. This is just a fancy way of saying they see no difference between you and the business for tax purposes. All profits and losses flow directly onto your personal tax return, just like a sole proprietorship.

Multi-Member LLCs Default to a "Partnership" If your LLC has two or more owners, its default status is a partnership. Here, the business itself doesn't pay federal income tax. Instead, the profits are "passed through" to the members, who then report their share of the income on their personal returns.

These pass-through setups might sound simple, but they can create major headaches for UK founders focused on growth and fundraising. Imagine trying to reinvest your profits back into the business, but first having to pay personal income tax on that money—even if you never took a penny out. You can get a deeper dive into these issues in our guide on what a single-member LLC means for UK founders at https://www.setupstateside.com/post/what-is-a-single-member-llc-for-uk-founders-in-the-us.

The Power of an Elected Status

This is exactly where Form 8832 comes in. It lets you override the default and hand-pick the tax status that actually supports your business goals. Instead of being stuck as a disregarded entity or a partnership, you can formally elect for your LLC to be treated as a corporation.

For UK founders, the most powerful and common choice is to have their LLC taxed as a C Corporation. This election completely transforms your LLC, turning it from a simple pass-through entity into a separate taxpayer in the eyes of the IRS. It opens up a whole new world of strategic advantages.

Filing Form 8832 is your official notice to the IRS that you’re opting out of their one-size-fits-all system. It puts you in the driver's seat, letting you structure your U.S. company for investor appeal and tax-smart growth right from the start.

This flexibility is a bedrock of the U.S. business environment. Its importance was underscored back in 1998 when the IRS tried to limit its use by foreign entities, only to quickly retreat after an outcry from the business community. This event cemented the very flexibility that today's 33 million U.S. small businesses—including many launched by UK entrepreneurs—rely on. It's what allows a UK holding company to elect corporate status for its U.S. subsidiary, tapping into a market where foreign direct investment hit $296 billion in 2023.

By choosing to be taxed as a C Corporation, you create a structure that is:

Investor-Friendly: U.S. venture capitalists and angel investors almost exclusively invest in C Corporations.

Built for Reinvestment: Profits are taxed at the corporate level, so you can reinvest post-tax earnings back into growth without triggering an immediate personal tax bill.

Legally Distinct: This election reinforces the liability shield between your personal assets and the company's debts.

Ultimately, seeing the stark contrast between the default and elected statuses is the first step. It helps you see Form 8832 not as another piece of paperwork, but as a powerful strategic tool for your U.S. launch.

Strategic Scenarios for UK Founders in the US

Knowing the rules is one thing, but knowing how to play the game is what truly matters. Filing Form 8832 isn't just about ticking a box for the IRS; it's a strategic move that can fundamentally change your company's growth potential in the United States.

Let's put the theory aside and look at three real-world situations we see all the time with UK founders. These examples show how a simple "check-the-box" election can transform a standard US LLC into a powerhouse for growth, investment, and tax efficiency.

The E-commerce Entrepreneur Reinvesting for Growth

Picture a UK e-commerce brand that's hit a goldmine in the US market. Sales are through the roof, but to keep up, the founder needs to funnel every spare dollar back into the business—for more inventory, better warehousing, and a serious marketing blitz.

If they're operating as a default single-member LLC, this gets messy, fast. The LLC is treated as a "disregarded entity," which is a fancy way of saying the IRS sees no difference between the business's profit and the founder's personal income. All profits are taxed as personal income in the US, even if the money never leaves the company's US bank account. This creates a massive tax drag on the very cash needed for reinvestment.

By filing Form 8832 and electing to be taxed as a C Corporation, the whole game changes.

Smart Reinvestment: Now, the US business pays its own corporate tax on its profits. The money left over can be plowed directly back into inventory and marketing without creating a personal tax bill for the founder back in the UK.

A Clean Break: This election draws a clear financial line between the US operations and the founder's personal finances, which makes bookkeeping and tax planning infinitely simpler.

You're in Control: The founder decides when profits are paid out as dividends, giving them control over their personal tax situation under the US-UK tax treaty.

For an e-commerce seller, the C Corp election is a masterstroke in capital efficiency. It's what lets you scale faster and more sustainably.

The Tech Startup Seeking US Venture Capital

Now imagine a UK tech startup with two co-founders who've built a brilliant SaaS product. They've set up a US LLC to break into the world's biggest tech market and are gearing up to raise a seed round from Silicon Valley investors.

They hit a wall almost immediately. US Venture Capital (VC) firms have a hard-and-fast rule: they invest in C Corporations. Period. VCs need a structure that supports preferred stock for them, stock option plans for key hires, and a clear runway to an IPO or acquisition. A default multi-member LLC, taxed as a partnership, just doesn't provide that.

For a startup chasing VC money, filing Form 8832 to elect C Corporation status isn't just a good idea—it's the ticket to the game. It tells investors you're "venture-ready" and structured for the explosive growth they're betting on.

This simple election makes the company investable overnight. It aligns your corporate DNA with the non-negotiable expectations of the US investment community. For a closer look at these structural choices, our guide to LLCs for non-US residents offers some great background.

The UK Consulting Agency Expanding Stateside

Finally, let's look at a successful UK consulting agency opening a US office. They've set up a multi-member LLC and now face a critical decision on how it should be taxed.

The right answer really depends on what they plan to do with the profits.

Scenario A: The Pass-Through Path. If the partners intend to take most of the profits out each year, sticking with the default partnership status might seem easy. But it's often a trap, exposing them to complex US self-employment taxes and messy personal tax filings.

Scenario B: The Corporate Play. If they plan to leave a good chunk of the profits in the US entity to cover salaries, office space, and expansion, electing C Corp status is usually the smarter move. Profits are taxed at a predictable corporate rate, and the partners can manage distributions in a way that makes sense for them.

To make this crystal clear, let's break down the key factors in a table.

Choosing Your US Tax Classification A Scenario-Based Comparison

This table helps illustrate the trade-offs a UK founder faces when deciding between the default LLC structure and electing to be a C Corporation for US tax purposes.

Factor | Default LLC (Partnership/Disregarded) | Elected C Corporation |

|---|---|---|

Profit Reinvestment | Inefficient; profits are taxed at personal rates for UK partners regardless of distribution. | Efficient; profits are taxed at the corporate level, allowing for tax-free reinvestment of post-tax earnings. |

Investor Appeal | Very low; unattractive to US VCs and most institutional investors. | High; the standard and expected structure for US venture capital and angel investment. |

Tax Simplicity | Complex for partners, who must file personal US tax returns and deal with "pass-through" income. | Simpler for founders; the corporation files its own return, and founders are only taxed on salaries or dividends. |

US-UK Tax Treaty | Can be complex to apply at the individual partner level for business profits. | Clearer application for dividends paid from a US corporation to a UK resident shareholder. |

For the consulting agency, and for most UK founders, thinking through these trade-offs is essential. Filing Form 8832 isn't a chore; it’s your chance to pick the corporate structure that perfectly matches your financial strategy for the US market.

When and How to File Form 8832

Okay, so you understand what Form 8832 is. Now for the equally important part: knowing exactly when and how to file it. Getting the timing right isn't just a minor detail—it's a core part of your tax strategy. Filing this form on schedule ensures your chosen tax status kicks in right when you need it, helping you sidestep expensive compliance mistakes down the road.

Think of the filing deadline as a strategic window. The IRS gives you specific timeframes to make your election, and missing them can be a real headache. Get it right, and your tax structure is solid from day one. Get it wrong, and you could be stuck with a default classification that works against your business goals for a full tax year.

This is definitely not something to put off. The deadlines are firm, and while there are ways to fix a late filing, it’s so much easier to just nail it the first time.

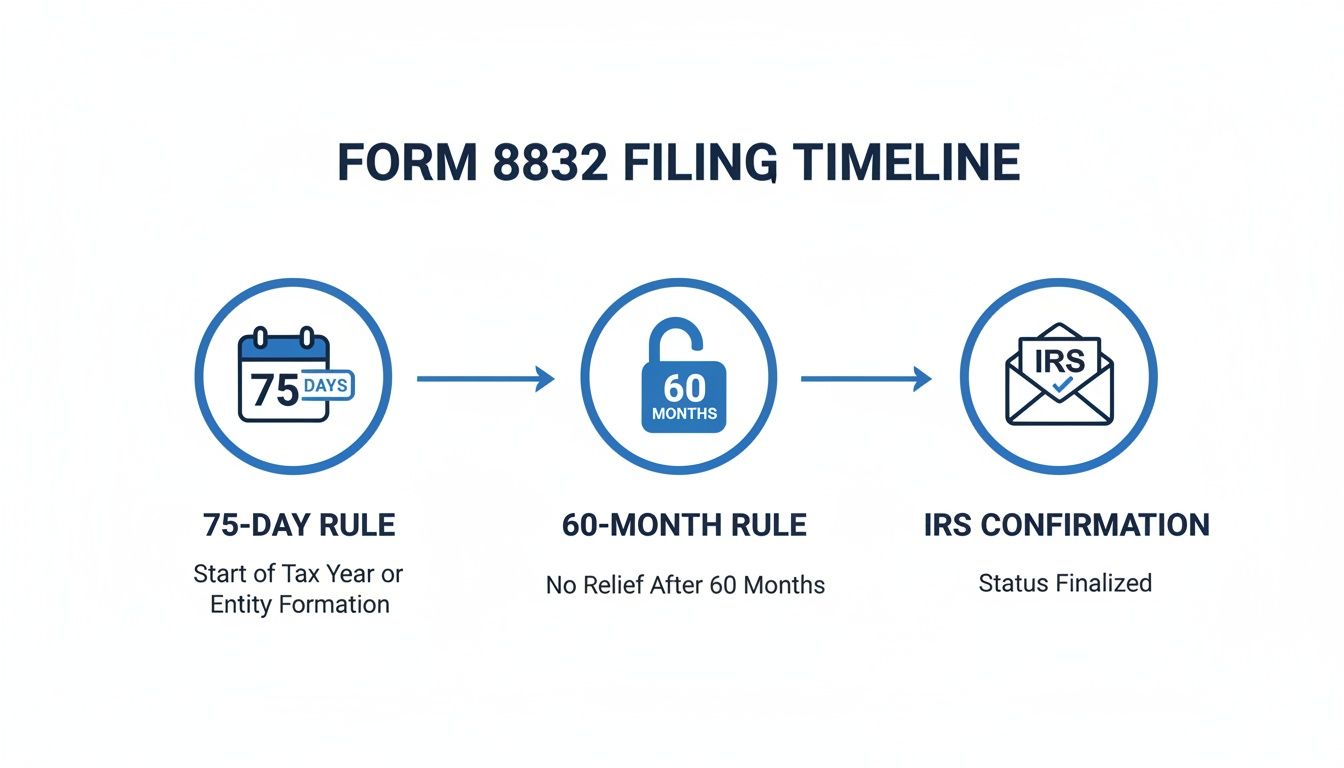

The All-Important 75-Day Rule

If there’s one deadline to circle on your calendar, it's the 75-day rule. This rule is your golden ticket to making a C Corporation election retroactive.

Here’s how it works: you can pick an effective date for your new tax status that is up to 75 days before the day you actually file Form 8832. For a new business, this is a game-changer. It means if you form your LLC on January 1st, you have until March 16th (roughly 75 days) to file the form and have your C Corp status apply from the very beginning.

This retroactive power is crucial. It ensures there's no awkward gap where your company is operating under an unwanted tax status. You can focus on getting everything else in order—like opening a bank account or getting your EIN—and still lock in the right classification from day one. Speaking of which, you'll need an Employer Identification Number before you can file, and you can learn all about that in our guide on what an EIN number is and how to get one.

Key Takeaway: That 75-day window is your prime opportunity to sync your tax status with your business formation date. If you miss it, your election will most likely only take effect from the date you file, which can complicate your first year's taxes.

Looking Ahead: The 12-Month Prospective Window

What if you're a planner and want to get ahead of things? The IRS has you covered there, too. You can file Form 8832 and set an effective date up to 12 months in the future.

This is less common for brand-new startups, but it's a handy tool for existing businesses planning a future change. For instance, an LLC might decide it wants to become a C Corp starting January 1st of next year to keep its accounting and tax records clean and simple. Filing the form in advance locks in that change.

The flexibility of Form 8832 is one of its greatest assets. You have the 75-day lookback for new companies and the 12-month look-forward for planned changes. Just be aware that if you pick a date outside this range, the IRS will automatically adjust it for you. After you file, you should get a confirmation notice from the IRS in about 60 days. If you're a foreign-owned LLC, remember to attach a copy of this notice to your Form 1120-F.

The 60-Month Lock-In Period

Once you file Form 8832 and your election is accepted, that decision is pretty much set in stone for a while. The IRS enforces a 60-month rule, meaning you generally can't change your entity's classification again for five years.

This lock-in period really drives home how important it is to make the right choice from the start. You can’t just flip-flop between being a partnership and a corporation to chase short-term tax advantages. The IRS put this rule in place specifically to stop businesses from "gaming the system."

There are a few rare exceptions, like if your business has a more than 50% change in ownership. But for most founders, the decision you make is one you'll be living with for at least five years. That’s why it’s so critical to think about your long-term vision—especially around fundraising, profits, and growth—before you put that form in the mail.

A Step-by-Step Guide to Completing the Form

Let’s be honest, IRS paperwork can look intimidating. But when it comes to Form 8832, think of it less as a grueling tax return and more as a simple declaration of your company's identity. I'll walk you through the essential parts of the form for a UK founder, turning what seems like a bureaucratic headache into a straightforward task.

We're going to focus on the two most important sections: Part I, where you lay out your company’s basic information, and Part II, where the magic happens and you make your election. Getting these details right is non-negotiable. A simple typo in your Employer Identification Number (EIN) or a forgotten signature can get the whole thing rejected.

Part I: Your Entity Information

The first part of the form is all about the fundamentals. This is how you introduce your company to the IRS, so accuracy is everything. A mistake here can cause your form to be sent right back.

Before you even start filling it out, gather these key details:

Your LLC’s Legal Name and Address: This needs to be an exact match to what’s on your company formation documents and your EIN confirmation letter. No variations.

Your Employer Identification Number (EIN): It's worth checking this number two or three times. An incorrect digit is one of the most common—and easily avoidable—reasons the IRS rejects a filing.

You’ll also need to confirm who owns the company. If you're the sole owner, you'll tick the box for that. If you have partners in your LLC, you'll need to indicate whether all members are making the election or if it's being done by an authorized officer.

Part II: The Election Details

This is the real heart of Form 8832. It’s where you officially tell the IRS how you want them to tax your LLC, putting your strategic decisions into action.

Line 6: Choosing Your New Tax StatusThis is where you make your choice. For the vast majority of UK founders who plan to attract investors or reinvest profits back into the business, the go-to option here is "A corporation."

Line 8: The Effective DatePay close attention to this date—it's critical. As we've covered, you can backdate your election by up to 75 days or future-date it by up to 12 months. If your goal is to have C Corp status from day one, you should enter your company's formation date here, but only if you are filing within that 75-day window.

This timeline is crucial, so here’s a visual breakdown to make it crystal clear.

As the graphic shows, that initial 75-day period is your golden window. Remember, once your choice is made, you’re locked in for 60 months, so it's a decision with long-term consequences.

Finalizing and Filing the Form

The final hurdle is the signature. Every single member of the LLC must sign and date the form, and don't forget to include their titles. It's an easy step to overlook, but a missing signature is a guaranteed rejection.

Crucial Tip: Before you seal the envelope, make a full copy of the signed Form 8832 for your own records. I always recommend sending the original to the IRS service center using certified mail. This gives you a tracking number and proof of delivery—something you'll be very glad to have if the form ever goes missing.

After you've sent it off, you can expect a confirmation letter from the IRS in about 60 days. When that letter arrives, file it away somewhere safe. It's your official proof that the election was accepted. By following these steps carefully, you can navigate Form 8832 with confidence and establish the right tax foundation for your US business.

Common Mistakes and How to Fix Them

Let's be honest, IRS paperwork can be a minefield. Even the sharpest founders can trip up on the details, and with Form 8832, a simple slip-up can lock your company into the wrong tax status for a whole year. Knowing the common pitfalls is half the battle.

By far the most common mistake is just missing the 75-day filing deadline. It’s easy to get swept up in the whirlwind of launching a business, and this crucial deadline can fly right by. When that happens, you lose the chance to have your C Corporation status active from day one.

Another frequent error? Getting the signatures wrong. For an LLC with multiple owners, it's not enough for just one person to sign. Every single member must sign Form 8832, or the IRS will reject it outright.

These aren't just minor administrative headaches. If you miss the deadline, your LLC is stuck with its default classification—either a disregarded entity or a partnership. This can throw a major wrench into your first year's tax strategy, especially if your whole plan was built around the C Corp structure.

What to Do If You've Missed the Deadline

So, you looked at the calendar and realized the 75-day window has slammed shut. Don't panic. The IRS has a process called late election relief that can be a real lifesaver. It’s a way to ask for forgiveness and get your election accepted after the fact, as long as you have a good reason.

The magic words here are "reasonable cause." You have to convince the IRS that you weren't just being careless. While there's no strict checklist, they're generally looking for situations where you acted in good faith but something went wrong.

Here are a few scenarios that often count as reasonable cause:

You Relied on Bad Advice: Your accountant or lawyer told you that you didn't need to file or gave you the wrong deadline.

Life Got in the Way: An unexpected event, like a serious illness or a natural disaster, made it impossible to file on time.

It Was an Honest Mistake: You genuinely didn't know you had to file the form, even though you were trying to do everything by the book.

To officially ask for this relief, you'll still file Form 8832, but you must write "FILED PURSUANT TO REV. PROC. 2009-41" right at the top. You also have to attach a separate statement explaining why you're late.

This statement is your chance to tell your story. Clearly explain what happened, state that you've acted reasonably and in good faith, and confirm that the U.S. government won't be harmed by granting your request. It's not a guaranteed fix, but a well-written, honest explanation gives you a solid shot at getting the tax status you wanted all along.

Common Questions About Form 8832

Even with a good grasp of the basics, U.S. tax forms can throw a few curveballs. Let's tackle some of the most common questions we hear from UK founders about Form 8832.

Can I Change My Mind After Filing?

Once the IRS accepts your Form 8832 election, that decision is generally set in stone for 60 months—that's five full years. This rule exists to stop companies from flip-flopping their tax status to get a temporary benefit.

There's an exception, but it's a big one: you can file again sooner only if there's been more than a 50% change in your company's ownership. Because you're locked in for the long haul, it’s absolutely critical to make the right choice from day one, aligning your tax status with your long-term goals for growth and funding.

What’s the Difference Between Form 8832 and Form 2553?

This is a classic point of confusion, but it’s actually quite straightforward.

Think of Form 8832 as choosing your company's fundamental tax identity. It’s the form that lets your LLC tell the IRS, "Hey, I want you to treat me as a corporation." Form 2553 is a second, separate step you’d take after being classified as a corporation to be treated as an S Corporation, a special tax status.

For the vast majority of UK founders, the S Corp election isn't an option due to strict rules about who can be a shareholder. That makes Form 8832 the key document for electing to be taxed as a standard C Corporation.

What Happens If I Never File Form 8832?

If you simply don't file, the IRS won't chase you down—they'll just apply their default rules. A single-member LLC defaults to a "disregarded entity" (taxed like a sole proprietorship), and a multi-member LLC defaults to a partnership.

While that sounds easy, these defaults can create massive headaches, leading to tax inefficiencies and, crucially, making it much harder to attract capital from U.S. investors. For any ambitious founder, being proactive and filing the form is a must.

Figuring this all out is precisely why Set Up Stateside is here. Our team lives and breathes U.S. tax for UK founders. We can help you make the right call on your entity classification and then handle the entire filing process for you. Let's make sure your U.S. business is built to succeed—find out how we can help at https://www.setupstateside.com.

Comments