Can an LLC Have Employees? A Founder's Guide to Hiring in the US

- Read & Associates

- Jan 21

- 13 min read

Let's get straight to the point: Yes, a Limited Liability Company (LLC) can absolutely hire employees. This isn't a legal gray area or a complicated workaround; it's a core feature of the LLC structure that makes it such a powerful vehicle for growth for business owners in the U.S.

Yes, an LLC Can Have Employees—and Millions Already Do

Think of your LLC as more than just a legal shield for your personal assets. It's a flexible blueprint designed to scale, ready to expand from a one-person show into a thriving business with a full team. This adaptability is precisely why it's a go-to choice for so many founders, including international entrepreneurs looking to build a presence in the U.S. market.

For many business owners, the question "can an LLC have employees?" comes from a natural concern about complexity and staying compliant. The good news is that hiring is a standard, achievable milestone in an LLC's journey. It’s a clear sign your business is growing and ready for the next level.

The Sheer Scale of LLC Employment in the US

The role LLCs play as employers is enormous. Small businesses—the vast majority of which are set up as LLCs—are the backbone of the American economy. As of 2025, small businesses employed 62.3 million Americans, which is an incredible 45.9% of the entire U.S. workforce.

These numbers don't lie. Hiring employees isn't an exception for an LLC; it's the norm. You can dig into more small business statistics to see the full picture of their economic impact. This should give you confidence that by forming an LLC, you're using a structure that millions of other business owners have successfully used to build their teams. The real key is understanding the rules of the road from the start.

Key Takeaway: An LLC is fundamentally designed for growth. Hiring employees is a built-in capability of this business structure, not a hurdle to overcome. It’s the primary way small businesses contribute to the economy.

With the right guidance, you can handle U.S. compliance correctly right from day one. Navigating payroll, taxes, and labor laws might seem intimidating, but it’s a manageable process once you have a clear roadmap. In the following sections, we’ll break down exactly what you need to know.

Understanding the Difference Between Members and Employees

Before you can hire your first employee, it's crucial to understand the distinction between an LLC member and an employee. These roles are not interchangeable, and misclassifying them is a fast track to serious penalties with the IRS and Department of Labor.

Think of it like this: members are the owners of the company. They hold equity, share in the profits, and have a say in the business's strategic direction. Employees are the skilled team you hire to perform specific day-to-day functions. Both are vital, but their legal and financial relationship to the business is fundamentally different.

A member is an owner of the LLC. Whether you're the sole owner or one of several partners, your compensation isn't a salary. It's a distribution of profits, often called an "owner's draw." You're taking your share of the company's earnings.

Because of this, the LLC doesn't withhold taxes from your draw. You are responsible for paying your own self-employment taxes (which cover Social Security and Medicare) on your share of the profits. This is a critical point for any business owner, especially international founders who need to navigate their U.S. tax obligations correctly from day one.

How Employees Differ in Role and Compensation

An employee, on the other hand, is someone you hire to perform a specific job for a wage or salary. They do not have an ownership stake and don't receive profit distributions unless you’ve set up a specific bonus or profit-sharing plan.

Here’s where the treatment really diverges:

Formal Payroll: Employees must be paid through a formal payroll system on a regular schedule—weekly, bi-weekly, or monthly.

Tax Withholding: This is the big one. As the employer, you are legally required to withhold federal and state income taxes, plus Social Security and Medicare (FICA) taxes, from every single paycheck.

W-2 Form: At the end of the tax year, you must provide each employee with a Form W-2, which summarizes their total earnings and all the taxes you withheld for them throughout the year.

Labor Law Protections: Unlike owners, employees are protected by a host of federal and state labor laws covering things like minimum wage, overtime, and workplace safety.

Misclassifying a worker is one of the most expensive mistakes a business owner can make. In a recent court case, a medical staffing agency found this out the hard way. They labeled their workers as independent contractors to avoid payroll taxes, but the court looked at the reality of the working relationship and handed them a $9.3 million judgment for misclassification.

The stakes are incredibly high. Nailing down whether someone is a member taking distributions or an employee on payroll is the foundational step before you hire anyone. Getting this right from the very beginning protects your business from crippling penalties and legal battles. It’s precisely why getting professional guidance to set up your payroll and define these roles correctly is one of the smartest investments a growing business can make.

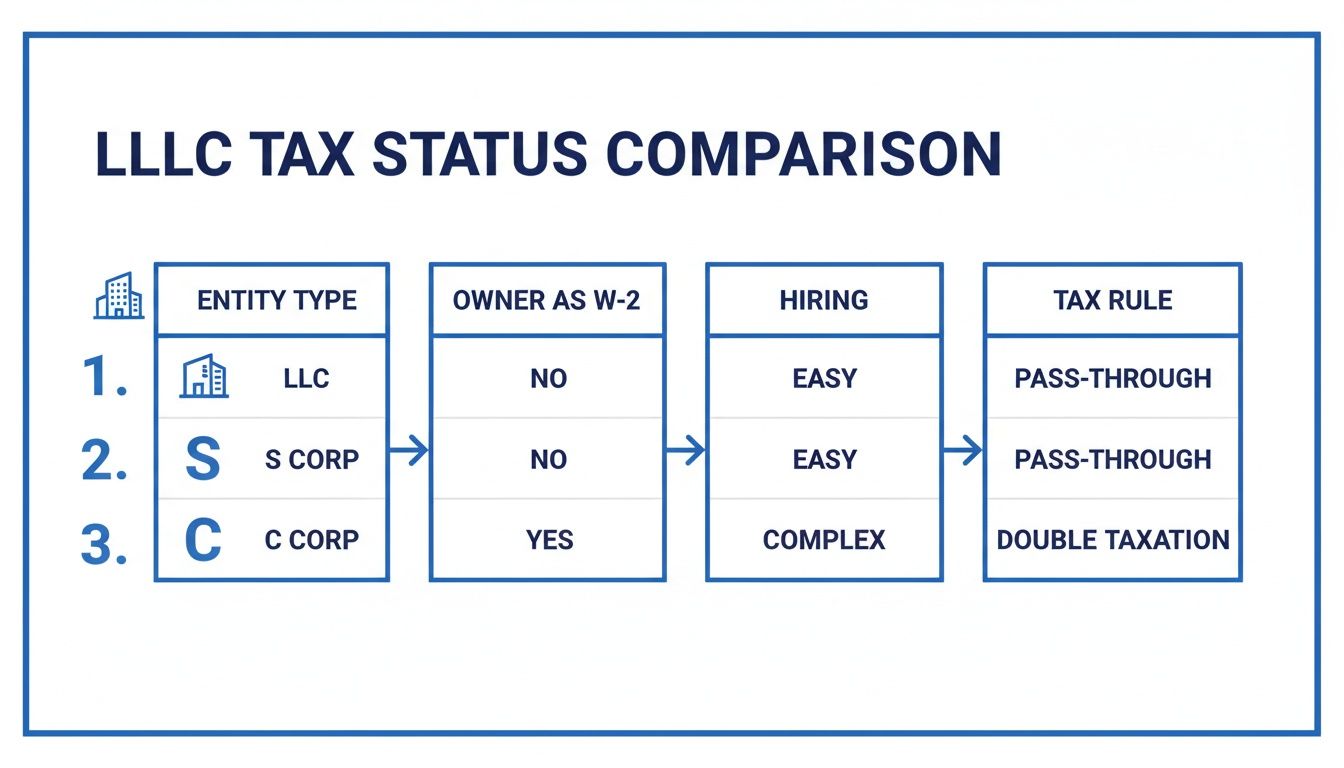

How Your LLC's Tax Status Changes the Hiring Game

How you’ve asked the IRS to tax your LLC is one of the most important factors in how you hire and, crucially, how you pay yourself and your team. It’s not just a box you check on a form; it dictates your entire payroll strategy and can have significant financial implications.

Let’s break down the ways the IRS can look at your LLC and what it means for bringing people on board.

The Default: Sole Proprietorship and Partnership

If you’re a one-person LLC and haven’t told the IRS otherwise, you’re a disregarded entity taxed as a sole proprietorship. For multi-member LLCs, the default is a partnership. The rules for owners and employees are similar in both cases.

As the owner (or partner), you don’t get a traditional W-2 salary. Instead, you take money out of the business through what's called an "owner's draw." While it feels like paying yourself, there's no tax withholding on that transaction. You’re responsible for paying self-employment taxes (that’s Social Security and Medicare) on all the company’s net profits at the end of the year.

But what about actual employees? You can absolutely hire them. Once you have an EIN and a payroll system in place, you’ll pay them like any other business would—with a standard W-2, complete with all the necessary federal and state tax withholdings.

A documented and consistent payroll process is your best defense against worker misclassification issues, which can reduce the risk of fines by up to 85%.

The Strategic Choice: Electing S Corp Status

This is where things get interesting for LLC owners. By filing Form 2553 with the IRS, you can choose to have your LLC taxed as an S Corporation. This strategic move allows you, the owner, to become a W-2 employee of your own company.

Why would you do this? It's a smart tax play. You must pay yourself a "reasonable salary" for the work you do, which is subject to standard payroll taxes. But—and this is the key—any additional profit the company makes can be paid to you as a distribution, which is not subject to self-employment taxes.

For many profitable LLCs, this simple election can save thousands of dollars a year in taxes. It just requires a bit of diligence to set a reasonable salary and adhere to payroll rules.

Choosing the S Corp election can cut the self-employment tax rate on your distributions, potentially saving you 15.3% compared to taking all profits as a sole proprietor.

The Corporate Route: Electing C Corp Status

You can also elect for your LLC to be taxed as a C Corporation. This is less common for small businesses, but it essentially turns your LLC into a completely separate legal and tax entity.

In this setup, everyone who works for the company, including the owners, must be a W-2 employee. The company pays corporate income tax on its profits. Then, if those profits are distributed to owners as dividends, the owners pay personal income tax on them again. This is often called "double taxation," and it's the major trade-off for the liability protection and structure a C Corp offers.

LLC Tax Elections and Payroll Rules

It can be a lot to keep straight. This table simplifies how each tax election affects paying owners and employees.

Tax Classification | Can an Owner Be a W-2 Employee? | How Non-Owner Employees Are Paid | Key Tax Consideration |

|---|---|---|---|

Sole Proprietorship | No, owners take draws. | W-2 wages with full withholding. | All net profit is subject to self-employment tax for the owner. |

Partnership | No, partners take guaranteed payments/draws. | W-2 wages with full withholding. | Partners pay self-employment tax on their share of profits (via Schedule K-1). |

S Corporation | Yes, owners must take a "reasonable salary." | W-2 wages with full withholding. | Salary is taxed, but profits paid as distributions avoid self-employment taxes. |

C Corporation | Yes, owners are treated just like any other employee. | W-2 wages with full withholding. | The business faces "double taxation" on profits paid out as dividends. |

As you can see, the tax status you choose has real-world consequences for your payroll, your compliance, and your own take-home pay.

What’s Your Next Move?

Getting this right from the start is critical. Your tax election should match your business goals, especially when hiring is on the horizon. A mismatch can lead to overpaying on taxes, or worse, running into trouble with the IRS down the road.

This is exactly where expert guidance makes all the difference. We can help you look at your growth plans, map out your payroll costs, and make sure your LLC is structured for tax efficiency and compliance.

Let's connect and build your U.S. team the right way. Reach out to Read & Associates Inc. for a personalized review of your LLC’s tax structure and hiring strategy. We make it a priority to schedule consultations within 24 hours so you can get the clarity you need to move forward with confidence.

Your Step-By-Step Guide to Hiring Your First Employee

So, you're ready to grow your team. This is a monumental step for any business owner! But bringing on your first employee isn't as simple as just finding the right person. There's a set of legal and financial steps you must take to ensure full compliance. This guide will walk you through it, making sure your LLC starts its journey as an employer on the right foot.

Think of it like building a house. You wouldn't put up walls without first pouring a solid foundation. In the world of hiring, that foundation is built on federal and state compliance.

The Essential Hiring Checklist

Getting the order of operations right is everything. Each step builds on the last, creating the legal framework for your new employer-employee relationship. It's a logical process, but the details matter—especially if you're a founder who's new to the U.S. employment landscape.

Here are the absolute must-dos for every LLC hiring employees:

Get a Federal Employer Identification Number (EIN): If you don't have one yet, this is your first step. An EIN is essentially a Social Security Number for your business. The IRS requires it to track payroll taxes, and you simply cannot have employees on the books without one.

Register with State Labor Departments: Every state has its own rules. You'll need to register for state unemployment insurance (SUTA) and, in most cases, set up an account for withholding state income tax. This gets you on the right side of local labor laws from day one.

Get Workers' Compensation Insurance: Most states mandate this. It’s insurance that covers medical bills and lost wages if an employee gets hurt on the job. The specific rules—like how many employees you need before it's required—vary significantly by state, so you must check your local regulations.

Setting Up Payroll and Paperwork

Once you're registered and insured, it's time to get into the details of actually paying your new hire and handling their paperwork correctly.

Choose a Payroll System: You need a formal system to handle paychecks, withhold the right amount of taxes, and remit those funds to the IRS and state agencies on time. This isn't just about income tax; it includes FICA (Social Security and Medicare) and FUTA (federal unemployment) taxes, too.

Complete the New Hire Paperwork: Every person you hire must fill out two key forms. Form W-4 tells you how much federal income tax to withhold from their pay. Form I-9 is used to verify their identity and legal authorization to work in the U.S. As the employer, you are required to keep these forms on file.

The table below breaks down how your LLC's tax structure—which we covered earlier—impacts both your ability to hire and how you, as the owner, can be paid.

As you can see, while any LLC can hire people, the tax election you choose creates different rules for the owners. It's a key piece of the strategic puzzle that every business owner should consider.

An LLC's ability to hire is a powerful engine for economic growth. In 2025, small businesses, the majority of which are structured as LLCs, employed 62.3 million people in the U.S., accounting for 45.9% of the entire workforce. This shows that hiring is not just a possibility—it's what successful LLCs do. You can find more details in the U.S. employment landscape on consumershield.com.

Getting through these steps takes a sharp eye for detail. One missed form or a single payroll miscalculation can trigger penalties. That's why so many founders, particularly those based outside the U.S., choose to partner with an expert to ensure every box is checked correctly from the very beginning.

Navigating State Rules and Remote Work Compliance

Hiring talent across the United States can be a game-changer for your LLC, but it introduces new layers of complexity. The moment you hire an employee who lives outside your LLC's home state, you are officially operating in a multi-state arena where the rulebook can change completely from one border to the next.

This is a critical area for any business owner to get right, especially if you’re a non-resident founder managing a U.S. entity.

Once you hire an employee in a new state, you trigger something called "employment nexus." This legal term means your business now has a strong enough connection to that state to be subject to its laws and regulations. That connection creates a whole new set of obligations you must fulfill.

Think of it this way: if your Florida-based LLC hires a talented software developer who works from home in California, your business must now follow California's rules for that specific employee. It’s not a choice—it’s the law.

Understanding Your Multi-State Obligations

Establishing employment nexus means you must get formally registered in that new state. This usually involves filing paperwork with both the Secretary of State and the state’s tax agency, like the Department of Revenue. From there, the to-do list grows.

You’ll be responsible for:

Paying State Unemployment Taxes (SUTA): Similar to federal unemployment taxes (FUTA), each state has its own unemployment insurance program. You'll need to contribute to it for any employees working there.

Following Local Labor Laws: This is where things can get tricky. You have to abide by the new state’s specific rules on minimum wage, overtime calculations, paid sick leave, and even how often you issue paychecks.

Withholding State Income Tax: If the employee is in a state with an income tax, you're responsible for withholding the correct amount from their pay and remitting it to the state’s tax authority.

The explosion of remote work has put multi-state compliance front and center for businesses. A recent study found that in 2025, 24% of professional job postings were for hybrid roles and 12% were for fully remote positions. That’s a huge number of companies building teams that span across state lines.

LLCs are an excellent fit for this modern, distributed workforce due to their flexibility. In fact, small businesses—the vast majority of which are LLCs—employ a staggering 62.3 million Americans. That's 45.9% of the entire U.S. workforce. It just goes to show that hiring, whether down the street or across the country, is a normal part of the journey for a successful LLC. You can find more great stats about the self-employed and small business landscape at Carry.com.

Keeping up with all these different state-by-state requirements is where many business owners get bogged down. The administrative work can feel endless, and the penalties for getting it wrong can be steep. This is precisely why partnering with an expert in multi-state tax and payroll is so important. It lets you scale your team without the logistical and legal headaches.

Build Your US Team With A Compliance Partner

An LLC offers a straightforward path to hiring in the US, but juggling tax codes, payroll rules, and state regulations can quickly become a full-time job. For non-resident founders and U.S. business owners alike, these details can feel like a maze—one that pulls focus from your core mission: growing the business.

Rather than wrestling with every regulation yourself, bring in a trusted compliance partner. An expert team can handle entity formation, secure your EIN, and manage ongoing payroll, bookkeeping, and annual tax filings—day in, day out.

A good partner will also take charge of classifying each worker correctly and navigating multi-state tax withholding, so you never miss a deadline or trigger a penalty.

Outsourcing compliance isn’t just about saving time—it’s a crucial risk management strategy. One slip in payroll or state registration can lead to significant fines, making professional oversight an investment in your company's future and your own peace of mind.

With these administrative hurdles off your plate, you can focus on leading your team, refining your product, and scaling confidently. The answer to “Can an LLC have employees?” becomes a simple, compliant plan for growth.

Ready to build, operate, and scale your US operations without the compliance headaches? Schedule a consultation with Read & Associates Inc. today. We’ll provide the expert guidance and support you need to hire and expand in America with confidence.

Your Top Hiring Questions Answered

Even with a solid grasp of the rules, there are always a few tricky questions that pop up when you're ready to bring on your first employee. Let's tackle some of the most common ones we hear from business owners.

Can a Single-Member LLC Have W-2 Employees?

Absolutely. This is a very common setup for entrepreneurs. While you, the owner of a single-member LLC, typically aren't a W-2 employee yourself (unless you've elected to be taxed as an S Corp or C Corp), you can certainly hire a full team of W-2 employees.

From a payroll perspective, the IRS sees your company as a legitimate employer, no different than any other.

Do I Need a New EIN to Start Hiring?

No. If you already have an Employer Identification Number (EIN) for your LLC, you're all set. Think of your EIN as your business's permanent Social Security Number—it stays with the company for life and is used for all federal tax matters, including payroll.

What's the Real Difference Between an Employee and a Contractor?

Getting this right is one of the most important things you'll do as an employer. The distinction boils down to one word: control.

An employee is someone for whom you have the right to control what work gets done and how it gets done. You'll withhold taxes from their paychecks and issue them a Form W-2 at year-end.

An independent contractor, on the other hand, is in business for themselves. You only control the result of the work, not the methods they use to achieve it. You pay them their full rate, and they receive a Form 1099-NEC. They are entirely responsible for their own taxes.

Be very careful here. Misclassifying an employee as a contractor, even accidentally, can trigger serious penalties from the IRS and state agencies.

Can My LLC Hire Non-US Citizens?

Yes, as long as they are legally authorized to work in the United States. Your responsibility as the employer is to verify this for every single person you hire, citizen or not.

This is done by completing and keeping a Form I-9, Employment Eligibility Verification, for each team member. It is a non-negotiable step in the hiring process that protects your business.

Answering these questions correctly is fundamental to building a compliant and successful business in the US. At Read & Associates Inc., we specialize in taking the guesswork out of U.S. entity formation, hiring, and payroll, so you can focus on what you do best: growing your company.

Ready to build with confidence? Visit us at https://www.readandassociates.us to schedule a consultation and see how we can help.

Comments