Change Your Registered Agent: A Clear Guide for U.S. Business Owners

- Read & Associates

- Jan 10

- 13 min read

Switching your company's registered agent isn't just bureaucratic paperwork; it's a strategic move to keep your business legally sound and protected. While the process itself is typically a straightforward filing with your state of registration, executing it correctly is critical. A proper change ensures you never miss a crucial legal notice or tax document, keeping your company in good standing and mitigating unnecessary risks.

Why You Might Need a New Registered Agent

The decision to change your registered agent often signals a key milestone: your business is maturing. The friend, family member, or basic service you appointed at launch may no longer meet your growing needs. For business owners, especially those operating from outside the U.S., having a reliable, professional point of contact in the United States is non-negotiable.

Missed communications can have severe consequences. A founder might miss a critical IRS notice or a court summons simply because their agent was unavailable or slow to forward important mail. These aren't minor oversights. They can escalate into hefty fines, default judgments in lawsuits, and in worst-case scenarios, the state could administratively dissolve your company.

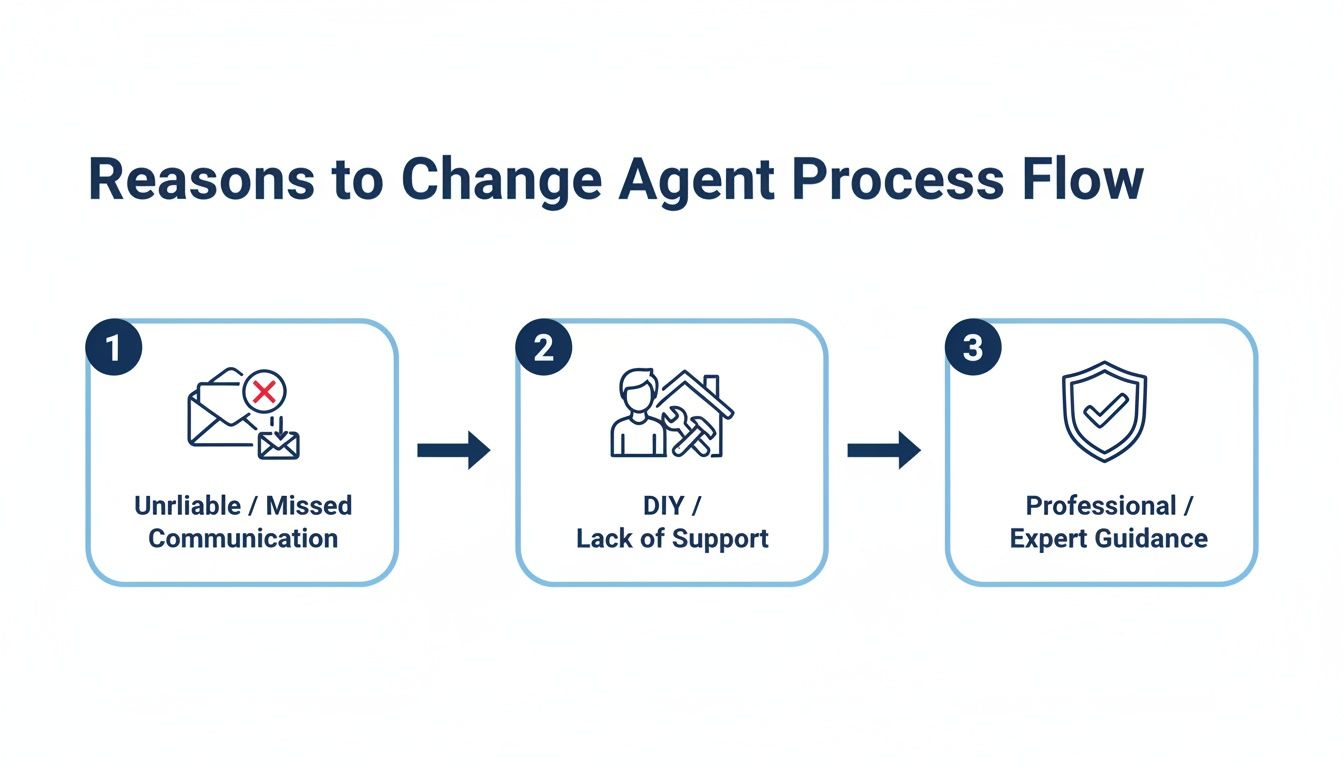

Common Reasons for Making the Switch

Several common scenarios prompt business owners to seek a new registered agent. If any of these resonate with your current situation, it’s likely time to make a change.

You're ready for professional support. Many startups begin by listing a founder or an acquaintance as their agent. While practical at first, this approach often becomes inefficient. A professional registered agent service offers the reliability, privacy, and availability required for official business matters, often bundled with compliance tools that simplify your administrative workload.

Your current agent is unresponsive. If you find yourself consistently chasing your agent for information or experiencing delays in receiving important documents, they have become a liability. A dependable registered agent service ensures that time-sensitive mail and legal notices are forwarded to you promptly.

You want to consolidate services. As your company grows, you may need more than just a mail-forwarding address. Many founders switch to a firm that can handle registered agent duties alongside accounting, tax preparation, and compliance management. This integrated approach improves efficiency and ensures nothing falls through the cracks.

We once assisted a non-resident founder whose U.S. LLC nearly missed a major state tax deadline. Their previous agent—a well-meaning relative—had let the official notice sit on a desk for three weeks. That delay almost cost the company its good standing and exposed it to significant penalties. Professional services are designed specifically to prevent these kinds of costly errors.

This is a common business need. In a state like Florida, home to over 2.8 million business entities, tens of thousands of companies update their registered agent annually. A significant portion of these changes are initiated by founders seeking a more robust and dependable compliance framework.

If you need a refresher on the fundamentals, our detailed guide on what a registered agent is and why your U.S. business needs one is an excellent resource. Making this change isn’t just an administrative update; it’s an upgrade to your company’s compliance foundation.

Getting the Paperwork Right: How to Officially Change Your Agent

Deciding to switch your registered agent is the first step; navigating the state's official process is the next. While not overly complex, it requires meticulous attention to detail. A minor error on a form—such as a missed signature or an incorrect address—can lead to the rejection of your filing, causing delays and creating a potential gap in your company’s compliance status.

The first action is always to verify the specific rules in your state of formation. This is not a one-size-fits-all process. Delaware’s requirements differ from Wyoming’s, which are distinct from Florida’s. The most reliable source of information is your state's Secretary of State website (or its equivalent business division), where you can find the current forms and instructions.

First Things First: Hire Your New Agent and Get Their Signature

Before you begin filling out any state forms, you must formally engage your new registered agent. This is a non-negotiable prerequisite.

Your new agent must formally consent to assume the role. Most states require them to physically or digitally sign the change-of-agent form as proof of their agreement. Attempting to file the form without their explicit approval will result in an immediate rejection. This signature serves as the state's verification that a legitimate, consenting agent is prepared to receive critical legal notices on behalf of your company. To understand why this role is so vital, you can learn more about what a registered agent service does for your U.S. business.

This transition from an informal arrangement to a professional service is a common and prudent step for growing businesses seeking greater peace of mind.

Many businesses make this change when they recognize that the risks of missed mail or the need for professional compliance support are too significant to ignore.

Finding and Filing the Right Paperwork

With your new agent engaged and their consent secured, the next task is to locate the correct state form. The naming conventions vary by state, so some research may be necessary.

Look for documents with titles like:

Statement of Change of Registered Agent/Office: A common and straightforward form used by many states.

Articles of Amendment: Some states classify this change as a formal amendment to your original formation documents (e.g., Articles of Organization or Incorporation).

Annual Report: A few states, including Florida, allow you to update your registered agent when filing your annual report. This can be a simple and cost-effective option if the timing aligns.

Business owners sometimes get into trouble by downloading generic "Change of Agent" templates from the internet. These rarely meet state-specific requirements. States are highly particular, and using anything other than the official, current form from the Secretary of State’s website will result in a rejected filing.

Once the form is completed accurately, submit it with the required fee. Costs can range from $0 if included with an annual report filing to over $100 in some states. Online filings are generally faster, with processing times of a few business days, while mail-in filings can take weeks. Plan accordingly to avoid any period where your company is without an official agent on record.

How State Requirements for Changing an Agent Differ

When you decide to change your registered agent, you will encounter a fundamental reality of U.S. business: compliance is not uniform across states. Each state has its own rulebook, fee schedule, and specific forms. This patchwork system can be a challenge for business owners to navigate.

A process that works perfectly in Delaware may lead to a rejected filing in Florida.

This means you must confirm the exact procedure for your specific state of incorporation before taking any action. Skipping this step is like trying to use a map of New York City to navigate Los Angeles—you will waste time, and you may incur extra fees to correct the mistake.

A Look at Popular States for Founders

To provide a real-world perspective, let's compare the process in four states popular among business owners: Delaware, Wyoming, Florida, and Texas. The side-by-side comparison highlights why following a generic guide is not advisable. Some states offer a simple and inexpensive process, while others have more requirements.

For instance, Florida allows you to update your agent as part of your annual report filing, which is a cost-effective option if the timing works. However, this method is not available in Delaware or Wyoming, which require a dedicated form that can be filed at any time.

The most critical takeaway is that assuming one state's process applies to another is a significant risk. A simple administrative task can quickly become a compliance headache if you don't get the local details right. Our team manages these variations for clients across all 50 states, ensuring a smooth and compliant process.

This table breaks down the key differences, giving you a quick, at-a-glance view of what to expect in these key jurisdictions.

State Comparison for Changing a Registered Agent

Here’s how the process, forms, and fees compare in four of the most common states for U.S. company formation. Notice how even the name of the form and the cost can vary significantly.

State | Official Form Name | Filing Fee | Typical Processing Time | Can be Filed with Annual Report? |

|---|---|---|---|---|

Delaware | Certificate of Change of Registered Agent | $50 | 3-5 business days | No, requires a separate filing. |

Wyoming | Statement of Change by Business Entity | $0 | 3-5 business days | No, a dedicated form must be filed. |

Florida | Varies (e.g., Statement of Change of Registered Agent) | $25-$35 | 5-7 business days | Yes, can be done on the Annual Report. |

Texas | Form 401 - Change of Registered Agent/Office | $15 | 3-5 business days | Yes, but a separate form is also an option. |

As you can see, the requirements are all over the map. Getting these details right is the difference between a smooth update and a rejected filing.

Why These Details Matter

Seemingly small details—like the form's exact name or a $15 fee versus a $50 one—are critical. Filing the wrong form or paying an incorrect amount are among the top reasons for rejection. Processing times also dictate when your new agent is officially on record, a crucial detail for ensuring there is no gap in coverage.

Navigating these state-by-state nuances is precisely where professional assistance becomes invaluable. Handling this process correctly from the start saves you from the administrative friction that diverts your attention from running your business. For companies operating in multiple states, keeping these rules straight becomes even more complex, which is why having a reliable compliance partner is so important. We handle these filings daily, ensuring your change of agent is seamless, no matter where your business is registered.

Common Mistakes to Avoid When You Switch Agents

Successfully changing your registered agent is not about navigating a complex legal maze; it is a relatively straightforward filing. The real challenge is avoiding a few common but costly mistakes.

Based on our experience assisting business owners, we've seen how simple oversights can lead to rejected forms, compliance issues, and unnecessary stress. Getting the details right upfront makes the entire process smooth.

One of the most common errors is filing the change of agent form without first obtaining your new agent’s official consent. States require proof—usually a signature on the form—that the new agent has formally agreed to accept legal documents on your behalf. Submitting the paperwork without it is an automatic rejection, with no exceptions.

Another classic mistake is mistiming the transition. Some business owners cancel their old registered agent service immediately after filing the change form with the state. However, state processing can take days or even weeks. This creates a dangerous compliance gap where your company legally has no agent, leaving it exposed.

Our expert advice is simple: Always wait for official confirmation from the state that your new agent is on record before you terminate your old service. This guarantees continuous coverage and ensures your company remains in good standing.

The Job Isn't Done After the State Says "Approved"

Once the state gives you the green light, it’s tempting to consider the task complete. This is a significant misunderstanding. The state filing is just the beginning. The next step is to update this change across your entire business ecosystem.

Forgetting this can lead to problems later. Imagine the IRS sends a tax notice to your old agent’s address and it never reaches you. Or your bank mails a critical fraud alert that disappears. These are not minor mix-ups; they carry real financial and legal consequences.

Here’s a quick checklist of where you must update your information:

Internal Records: Your LLC Operating Agreement or Corporate Bylaws should be amended to reflect the new agent. These are your company's foundational documents and must remain accurate.

The IRS: While your EIN is permanent, your "address of record" with the IRS may need updating, especially if you were using your old agent's address for tax correspondence. This is done by filing Form 8822-B.

Your Business Bank: Banks require your current information on file to send statements and important alerts. Keeping this updated is non-negotiable.

Licenses and Permits: Any state or federal business licenses you hold will also need to be updated with the new agent's details.

Think of it this way: the state is just one of many stakeholders who needs to know your official point of contact. Neglecting to inform the others is like moving to a new house but not updating your address with the post office, your credit card companies, or your family. Eventually, something important will get lost.

What to Do After Your Registered Agent Change Is Approved

You've received the confirmation notice from the Secretary of State. While it may feel like you’ve crossed the finish line, a few important tasks remain. Think of the state filing as the first, most crucial step. Now, it's time to communicate that change throughout the rest of your business operations.

This is a step many business owners overlook. The state knows about your new agent, but what about everyone else? Your bank, the IRS, and your own internal company documents may still point to the old address. This can quickly lead to a tangled mess of missed communications and potential compliance headaches.

Your Post-Approval Checklist

Completing this next phase is about thorough administrative cleanup. It ensures that all relevant parties—from tax authorities to your bank—have the correct contact information for your company. Taking care of this now will save you significant trouble later.

Here's what you need to address:

Update Your Company's Internal Documents: This is non-negotiable. Your LLC Operating Agreement or Corporate Bylaws should be amended to reflect the new registered agent's name and address. It's a simple change that keeps your foundational documents accurate.

Notify the IRS of the Change: If you used your old agent's address for IRS correspondence, you need to update it immediately. This is done by filing Form 8822-B, Change of Address or Responsible Party. Missing this could mean you never receive important tax notices, a problem you definitely want to avoid.

Inform Your Bank: Your bank requires your current address on file for everything from statements to fraud alerts. A quick call or an update through an online portal is usually all it takes, but it’s a critical step.

Notify Licensing Agencies: If your business holds any federal, state, or local licenses or permits, they also need to be updated. Each agency has its own procedure, so you will need to check with them directly to determine what is required.

Expert Tip: While you're updating the address, take a moment to double-check all the contact information on these accounts, including phone numbers and email addresses. This provides multiple ways for important notices to reach you, which is always a sound business practice.

Why This Is So Important

This is about more than just being organized; it's about protecting your business. Your registered agent is the official recipient for critical legal and state mail, including tax delinquency notices or a service of process if your company is ever sued.

If other agencies have outdated information, these documents could be sent to the wrong place or, worse, be lost completely.

By methodically updating every record, you create a solid, reliable communication chain and maintain your company's good standing. It’s the final piece of the puzzle that makes your registered agent change a complete success and provides the peace of mind that your U.S. business is compliant and well-managed. If you need assistance with these administrative tasks, our team is here to help you manage these details.

Should You Hire a Professional to Handle the Change?

You can certainly file the paperwork to change your registered agent yourself. For a business owner, however, the more important question is not "Can I do this?" but rather, "Is this the best use of my time?"

Your energy is best invested in growth, product development, and customer relationships—not navigating state bureaucracy.

When to Bring in an Expert

Hiring a professional service is a logical choice in several common situations.

For instance, if you operate in multiple states, the complexity increases significantly. Each state has its own specific form, a different filing fee, and unique deadlines. Keeping everything straight can be a full-time job, and a single mistake can put your company out of compliance.

What if you're on a tight deadline? Perhaps you are trying to secure a loan or enter into a partnership, and your company needs to be in perfect standing. A professional ensures the filing is done correctly the first time, avoiding the costly delays that can result from a rejection due to a simple error.

If you are an international founder, you are already managing numerous complexities. Outsourcing this task removes the guesswork from U.S. compliance and frees you from hours of frustrating research.

Using a professional service is about more than just filing one form. It's about gaining peace of mind, expert oversight, and a reliable partner who understands the intricacies of U.S. compliance.

For most founders focused on scaling their business, this is simply the most efficient path forward. You offload the administrative burden and ensure your company's good standing is protected.

If you are weighing your options and want to see how we can make this process completely seamless, you can discuss your specific situation with our team.

Common Questions About Changing Your Registered Agent

When you're ready to switch your registered agent, a few practical questions often arise. Here are clear, concise answers to the questions we hear most frequently, especially from business owners undertaking this process for the first time.

How Long Does This Actually Take?

The time required depends entirely on the state.

Some states offer efficient online systems and can process the change in just 1-2 business days. Others still rely on mail-in forms, which can take several weeks to be officially processed.

Always check the current processing times on the Secretary of State's website before you begin. Also, factor in the time needed to find and hire your new agent, as you need their signed consent before you can file the paperwork.

Can I Use an Agent in a Different State?

This is a common point of confusion, and the answer is a firm no. Your registered agent must have a physical street address in the same state where your company is formed.

So, if you have a Delaware LLC, your registered agent must have a Delaware address. There are no exceptions.

If your company is registered to do business in multiple states (a process known as "foreign qualification"), you will need a separate registered agent in each of those states. You cannot use one agent in Wyoming for your LLCs registered in both Wyoming and Florida.

The core principle is that each state requires a local point of contact for legal notices. Think of it as a legal requirement for a physical presence in every state where you're officially registered to do business.

Do I Need to Tell My Old Agent I'm Leaving?

Legally, you are not required to notify your old agent before filing the change with the state. However, as a matter of professional courtesy, it is good business practice. A brief email is usually sufficient.

More importantly, review the service agreement you signed with them. Check for any specific cancellation procedures or notice periods required to avoid unexpected fees. Once the state officially approves your new registered agent, your former agent's legal responsibility for your company concludes.

Juggling state rules and ensuring a smooth transition can be a headache, especially when you're managing a business. Read & Associates Inc. can handle the entire process for you—from filing the correct forms to updating your internal records. We ensure your company remains compliant, allowing you to focus on growth. Schedule a consultation with our experts today.

Comments