How Do I Calculate Employer Payroll Taxes? A Clear Guide for U.S. Business Owners

- Read & Associates

- Jan 20

- 16 min read

Navigating U.S. employer payroll taxes can feel like a complex puzzle, especially for founders new to the American business landscape. However, the process is manageable once you understand the core components. It boils down to a clear, repeatable process: determining an employee's gross pay, calculating your share of federal taxes like FICA and FUTA, and then factoring in state-level obligations, primarily SUTA.

Think of this as your roadmap to building a compliant and financially sound U.S. operation from your very first hire.

Your Guide to U.S. Employer Payroll Tax Calculations

For any business owner, especially those establishing a U.S. entity, mastering your payroll tax duties is absolutely critical. This isn’t just about staying compliant and avoiding hefty IRS penalties; it’s about understanding the true cost of your workforce to ensure accurate financial planning and sustainable growth.

Many entrepreneurs mistakenly believe payroll tax only involves the money withheld from an employee's check. That's only half the story. As an employer, you have a separate set of taxes to calculate and pay, which are a direct, and often significant, cost to your business.

These liabilities must be integrated into your budget from day one. The main federal taxes you are responsible for are:

FICA Taxes (Employer's Share): This is your matching contribution for Social Security and Medicare taxes. For every dollar your employee contributes, you contribute a dollar.

FUTA Tax: The Federal Unemployment Tax Act, a tax paid entirely by you, the employer, to fund federal unemployment programs.

SUTA Tax: The State Unemployment Tax Act. Like FUTA, this is an employer-paid tax, but the rates and rules vary dramatically from one state to another.

The Core Federal Tax Rates

To calculate payroll accurately, you need the current rates and wage limits, which are periodically adjusted by the government. Here are the key federal figures for 2026.

The Social Security tax rate is 6.2% for both you and your employee. However, this tax only applies to the first $184,500 an employee earns in a year.

The Medicare tax is 1.45% for both you and your employee, with no wage limit. You will pay this on every dollar of an employee's earnings.

Finally, the Federal Unemployment (FUTA) tax has a gross rate of 6%, but it only applies to the first $7,000 of an employee's wages. Fortunately, most employers receive a credit for their state unemployment tax payments, which brings the effective FUTA rate down to a more manageable 0.6%.

To help you keep track, here is a quick summary of the key federal employer taxes.

Key Federal Employer Payroll Taxes At A Glance

Tax Component | Employer Rate | Applicable Wage Base | Key Takeaway |

|---|---|---|---|

Social Security | 6.2% | First $184,500 of earnings per employee (for 2026) | You match the employee's 6.2% contribution. |

Medicare | 1.45% | All employee wages (no limit) | You match the employee's 1.45% contribution. |

FUTA | 0.6% (effective rate) | First $7,000 of earnings per employee | This is an employer-only tax; the rate assumes you get the full state tax credit. |

This table covers the federal side of the equation. Remember that you will also have state-level unemployment taxes (SUTA) to manage, which have their own distinct rates and rules.

Navigating these calculations is a foundational step for any U.S. business. Getting it right from your first hire ensures a smooth operational runway and prevents unexpected compliance issues down the road.

This overview provides the essential figures you'll be working with. In the next sections, we'll dive into detailed examples, showing you exactly how to apply these rates in real-world payroll scenarios, tackle state-specific rules, and meet all your filing deadlines. For founders new to the U.S. system, mastering this is a critical milestone, and we're here to make it clear.

Calculating Federal Payroll Taxes: FICA and FUTA

When you hire your first U.S. employee, a firm grasp of federal payroll taxes is non-negotiable. These aren't suggestions—they're required calculations that must be precise to keep your business compliant. Your main federal duties boil down to two acronyms: FICA and FUTA.

Think of FICA, the Federal Insurance Contributions Act, as a team effort between you and your employee to fund the nation's Social Security and Medicare programs. Your responsibility is to calculate the employee's share, withhold it from their paycheck, and then match it, dollar for dollar, from the company's funds.

This employer match is a direct business expense. We have seen too many new business owners overlook this in their initial budgets, only to face a cash flow crunch down the road.

Breaking Down FICA Taxes

FICA isn't a single tax; it comprises two distinct parts. Each has its own rate and rules, and mastering these details is the bedrock of every accurate payroll run.

Social Security Tax: The rate is a flat 6.2%, paid by both the employee and you, the employer. Crucially, it only applies to earnings up to a certain annual limit. For 2026, that limit is $184,500. Once an employee earns more than that in a year, you both stop paying Social Security tax on their income for the remainder of that year.

Medicare Tax: This one is simpler. The rate is 1.45% for both you and the employee. Unlike Social Security, there is no wage limit on Medicare. It applies to every single dollar an employee earns, regardless of how high their salary goes.

Let’s run the numbers with a practical example. Imagine you have an employee, Alex, who earns a gross salary of $5,000 this month. We will assume Alex is nowhere near the annual Social Security cap.

Here's how you'd calculate your FICA portion for that paycheck:

Social Security: $5,000 x 6.2% = $310

Medicare: $5,000 x 1.45% = $72.50

For this one paycheck, your direct FICA tax cost as the employer is $382.50. You'll pay this to the IRS, in addition to the identical $382.50 that you withheld from Alex's pay.

Your FICA contribution is an exact mirror of what you withhold from your employee's paycheck. This doubling effect is why understanding how to calculate employer payroll taxes is so important for accurate financial planning.

Understanding FUTA: The Federal Unemployment Tax

Next is the Federal Unemployment Tax Act, or FUTA. This tax is entirely your responsibility—it's an employer-only tax that you never withhold from an employee's wages. It represents the federal government’s portion of the unemployment insurance system.

The FUTA calculation can seem unusual at first. The official tax rate is 6.0%, but almost no one actually pays that rate.

The reason is that the IRS provides a significant credit—up to 5.4%—to employers who are current on their state unemployment tax payments. When you receive that full credit, your effective FUTA tax rate drops to a much more manageable 0.6%.

This small rate applies only to the first $7,000 of an employee's wages each year. After an employee earns more than that, you are done with FUTA for them for the rest of the calendar year.

For most full-time employees, you will reach this wage base early in the year. The maximum FUTA tax you will typically pay per employee is straightforward:

$7,000 (wage base) x 0.6% (effective rate) = $42 per year

That's it. Once you've paid that $42 for an employee, your federal unemployment obligation for them is fulfilled for the year. This is a perfect example of why staying on top of your state tax filings is so important—it directly saves you money on your federal taxes.

Getting these federal requirements right is the first major hurdle in running U.S. payroll. For international founders, in particular, having a crystal-clear process is essential. If you’re feeling unsure about these steps, a consultation can provide the clarity needed to manage your U.S. entity with confidence.

Navigating State Payroll Tax Obligations

Once you've mastered federal payroll taxes like FICA and FUTA, you encounter the next layer of complexity: state taxes. This is where a one-size-fits-all approach becomes impossible. Every state has its own rulebook, creating a complex patchwork of regulations that can easily challenge even seasoned business owners, especially those hiring across state lines.

Unlike the fairly uniform federal system, state payroll taxes vary widely. The rates, wage caps, and even the programs they fund differ significantly. For anyone new to the U.S. system, particularly international founders, getting this part right is crucial for accurate budgeting and maintaining compliance. Most of your focus will be on state unemployment, but an increasing number of states are also introducing their own paid leave and disability programs.

State Unemployment Tax Act (SUTA)

The most common state-level payroll tax you'll encounter is for the State Unemployment Tax Act (SUTA), often called State Unemployment Insurance (SUI). It serves the same purpose as FUTA—funding unemployment benefits for individuals who have lost their jobs through no fault of their own. It is an employer-paid tax.

However, that's where the similarities end. Each state government sets its own SUTA rates and wage base (the maximum amount of earnings on which you pay the tax), and the differences can be substantial.

SUTA Wage Base: This is the cap on an employee's annual earnings that is subject to SUTA tax. A lower wage base is advantageous for you, as you will reach the cap sooner and stop paying that tax for the employee for the rest of the year.

SUTA Tax Rate: States assign a specific tax rate to every business. As a new company, you will typically be assigned a standard "new employer rate," which can range from less than 1% to over 3%, depending on the state and your industry.

Don't get too comfortable with that initial rate. Over time, it will adjust based on your company's "experience rating." In simple terms, if you maintain a stable workforce with few former employees filing for unemployment, the state may reward you with a lower SUTA rate. Conversely, a higher number of claims can increase your rate.

Comparing SUTA Across Different States

To appreciate how much this matters, consider a couple of examples. A state like Florida has a low SUTA wage base of $7,000, which matches the federal FUTA base. In contrast, a state like Washington has one of the highest wage bases in the country.

This is not a minor detail; it has a direct impact on your bottom line. In a low-wage-base state, your maximum SUTA cost per employee is relatively contained. But in a high-wage-base state, you continue paying that tax on a much larger portion of each employee's salary, which can dramatically increase your overall payroll costs.

The stark differences in state unemployment rules are a prime example of why multi-state payroll is its own specialized field. A strategy that works perfectly in one state could be inefficient or non-compliant in another, making expert guidance essential as you expand.

These rules are constantly changing, so you must stay current. This is especially critical for multi-state businesses, a common setup for global entrepreneurs. Looking ahead to 2026, the gap is widening: Washington's unemployment wage base is projected to hit $78,200, while Vermont's is just $15,400. With employer SUTA rates generally sitting between 0.5-6% (before credits), the potential cost difference is enormous. To see more on this, you can read the full guide on 2026 payroll tax adjustments.

Beyond SUTA: Paid Family Leave and Disability Insurance

Unemployment isn't the only state tax to monitor. A growing number of states have launched their own mandatory programs funded through payroll deductions. The most common ones are:

Paid Family and Medical Leave (PFML or PFL): This provides employees with paid time off for major life events, such as welcoming a new child or caring for a seriously ill family member. Funding mechanisms vary by state—some are employee-only, some are employer-only, and many split the cost.

State Disability Insurance (SDI): This program offers short-term pay to employees who cannot work due to a non-work-related injury or illness. Like PFL, funding can come from employees, employers, or both.

For instance, Washington's Family Leave Insurance premium is on the rise, with larger employers required to cover a portion. In New York, the state's Paid Family Leave program is funded entirely by employees through payroll deductions. Keeping track of which states have these programs and who is responsible for payment is a significant compliance challenge.

Juggling this complex web of state-specific rules is a heavy lift for any business owner. If you are focused on growth, particularly when just entering the U.S. market, these details can become a major distraction. This is precisely where our expertise becomes invaluable—we handle state-by-state compliance so you can focus on building your business with confidence.

A Practical Payroll Calculation Walkthrough

Seeing the numbers in action is where the theory of payroll taxes truly solidifies. Let's walk through a complete calculation for a new employee, from gross pay to your final tax liability for a single pay period.

This example brings together all the federal and state rules we've discussed into one clear, practical process. By following along, you’ll gain a solid understanding of how to perform these calculations—or, just as importantly, how to effectively oversee your payroll provider.

Meet Your New Employee

Let's set the scene. You've just hired a new marketing manager, Sarah, who works for you in Oregon.

Here are the key details for her first paycheck:

Gross Pay for the Month: $6,000

Pay Frequency: Monthly

Year-to-Date Earnings (before this check): $0 (it's her first one!)

Your Oregon SUTA Rate: 2.6% (the standard new employer rate)

Oregon SUTA Wage Base: $56,700 for the year

With this information, we can calculate exactly what you, the employer, owe in taxes for Sarah's first month.

Calculating Your FICA Match

First up is your half of FICA—the matching amount you pay for Social Security and Medicare. Since this is Sarah’s first paycheck of the year, her $6,000 in earnings is well below the $184,500 Social Security wage ceiling.

Social Security: You match the 6.2% withheld from her check. * $6,000 (Gross Pay) x 6.2% = $372.00

Medicare: This one has no wage limit, so you'll pay it on every dollar. * $6,000 (Gross Pay) x 1.45% = $87.00

Your total FICA liability for this paycheck is $459.00. Remember, this is a direct cost to your business, completely separate from the identical amount you will withhold from Sarah’s pay to remit to the IRS on her behalf.

Calculating Federal and State Unemployment Taxes

Next, we tackle the unemployment taxes: FUTA (federal) and SUTA (state). Both of these only apply to wages up to a certain annual cap. Since Sarah is brand new, her entire $6,000 monthly salary is taxable for unemployment purposes this time around.

FUTA Calculation: The net federal rate is 0.6% on the first $7,000 an employee earns in a year. * $6,000 (Taxable Wages) x 0.6% = $36.00

SUTA Calculation (Oregon): Your assigned rate is 2.6% on the first $56,700. * $6,000 (Taxable Wages) x 2.6% = $156.00

After this first check, you have now paid unemployment tax on $6,000 of Sarah's wages. This means you only have $1,000 left of FUTA-taxable wages for the rest of the year. You will reach the FUTA cap on her next paycheck.

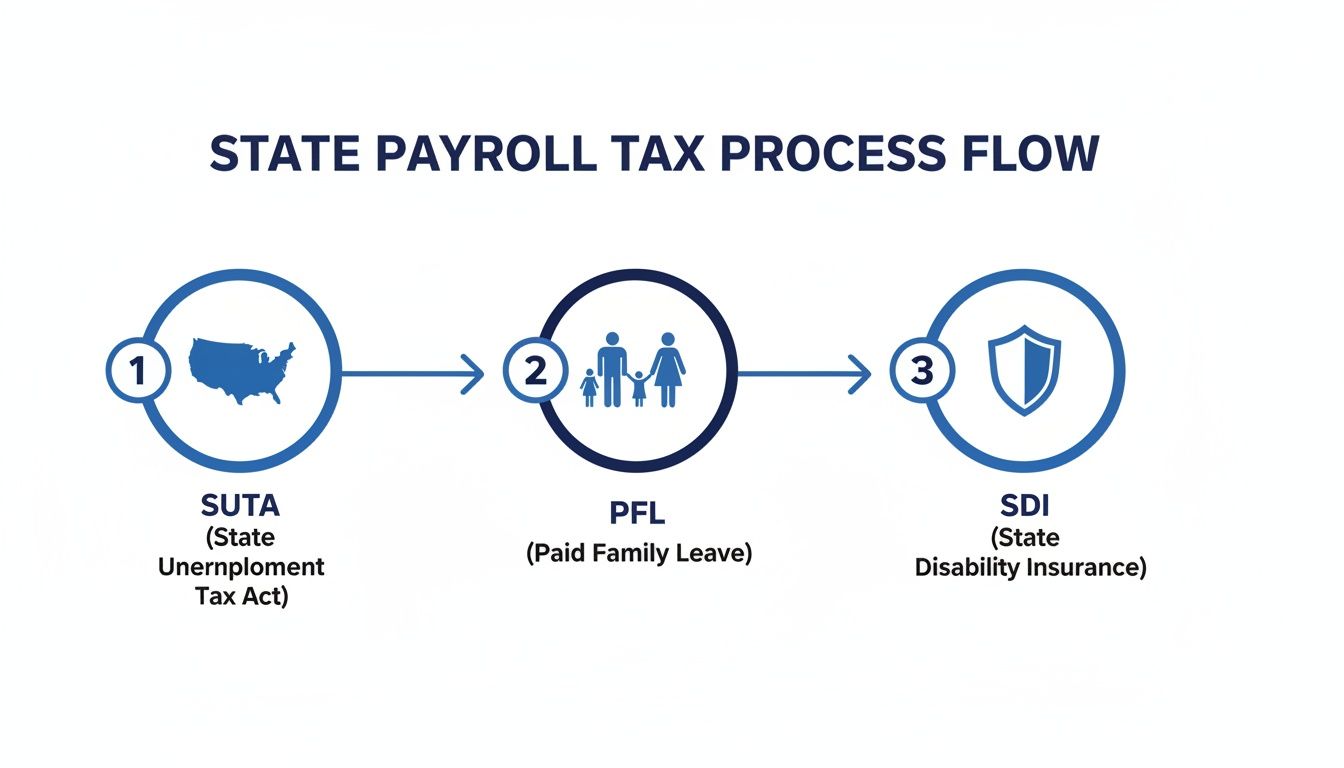

This flow chart provides a great overview of the typical steps for state-level taxes, which can often include programs beyond basic unemployment, like Paid Family Leave (PFL) or State Disability Insurance (SDI).

As the visual shows, handling state payroll is rarely a single task. You must identify and comply with several different programs, each with its own set of rules.

### Your Total Employer Tax BillLet's add it all up for Sarah's first monthly paycheck:* FICA Match: $459.00* FUTA Tax: $36.00* SUTA Tax: $156.00Total Employer Tax: $651.00

That $651 is the true, additional cost you absorb as an employer for this single pay period, on top of Sarah's gross salary. While it may seem like a lot, it’s worth noting that the U.S. system is relatively streamlined compared to many other countries. For instance, Swiss employers might face a total tax burden anywhere from 7.57% to 22.9%, whereas U.S. federal employer taxes are a fixed 7.65% plus your state unemployment rate. You can learn more by checking out a comparison of the lowest and highest payroll taxes by country on hireborderless.com.

This walkthrough shows that while the math isn't overly complex, it demands absolute precision and a sharp eye on wage bases. For a founder wearing multiple hats, especially one new to U.S. compliance, this is exactly the kind of task that can lead to costly errors. Outsourcing it can ensure you stay compliant and free you up to focus on what really matters—growing your business.

Filing and Depositing Your Payroll Taxes: Staying on the IRS's Good Side

Calculating your payroll tax liability is only half the battle. The other, equally crucial half is filing the correct forms and depositing that money on time. The IRS is uncompromising with these deadlines, and the penalties for late or inaccurate payments can become substantial very quickly.

For any business owner, especially those managing a U.S. operation from another country, this is where administrative diligence is paramount. Let's walk through exactly what you need to file and when you need to pay to maintain full compliance.

Your Quarterly Check-In: Form 941

Think of Form 941, the Employer's Quarterly Federal Tax Return, as your regular report to the IRS. Every three months, you use this form to declare how much you paid in wages, the amount of federal income tax you withheld, and the total FICA taxes (both your share and your employees') you've collected.

This form is essentially a reconciliation. It aligns the taxes you’ve calculated and withheld with the deposits you’ve made during that quarter. The deadlines are strict and fall at the end of the month following each quarter's close:

Q1 (Jan-Mar): Due April 30

Q2 (Apr-Jun): Due July 31

Q3 (Jul-Sep): Due October 31

Q4 (Oct-Dec): Due January 31

Filing Form 941 correctly and on time is a fundamental responsibility of running a business with U.S. employees. There are no exceptions.

The Annual Unemployment Report: Form 940

While you report FICA taxes quarterly, federal unemployment (FUTA) tax is reported annually using Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return. This is where you report your total FUTA tax liability for the entire calendar year.

However, a key detail is that even though you file the form once a year (due January 31), you typically must pay the tax much more frequently. You are required to make a FUTA deposit for any quarter where your accumulated liability exceeds $500. If your liability for a quarter is less than that, you simply carry it over to the next quarter until it hits the threshold.

Getting Your Federal Tax Deposit Schedule Right

This is where many new employers make mistakes. You cannot hold onto the tax money you've withheld and pay it when you file your forms. The IRS requires payment much sooner and will assign you a specific deposit schedule.

Your schedule depends on your total tax liability during a "lookback period"—a specific four-quarter timeframe. The IRS will notify you of your schedule, which will be one of two types:

Monthly Depositor: If you reported $50,000 or less in total taxes during the lookback period, this is your schedule. You must deposit the taxes collected for a given month by the 15th of the following month.

Semi-Weekly Depositor: If your tax liability exceeded $50,000, you are on a more frequent schedule. The rules are more complex: if you pay employees on a Wednesday, Thursday, or Friday, you have until the following Wednesday to deposit the taxes. For any other payday, your deposit is due by the following Friday.

A quick tip for new businesses: Since you don't have a lookback period, you will start as a monthly depositor. But be careful! The "next-day deposit rule" applies if you ever accumulate a tax liability of $100,000 or more on any single day. In that event, you must deposit the money by the next business day.

No More Paper Checks: The EFTPS Mandate

The days of mailing a physical check to the IRS for payroll taxes are over. All federal tax deposits must be made electronically through the Electronic Federal Tax Payment System (EFTPS).

EFTPS is a free, secure service from the U.S. Department of the Treasury. Once enrolled, you can schedule your tax payments online or by phone, 24/7. It also provides a digital paper trail with confirmation numbers and a payment history, which is invaluable for your records.

Of course, when you use a professional payroll service or work with a firm like ours, we handle all EFTPS deposits for you. This ensures you never miss a deadline or make an error. Managing this compliance calendar requires a sharp eye for detail—something that can easily divert an entrepreneur's focus from growing their business. That's why so many founders outsource this function, gaining the peace of mind to concentrate on what they do best.

A Payroll Tax FAQ for Founders

If you're an international founder setting up a business in the U.S., payroll is likely one of your biggest operational challenges. It's a constant source of questions, and the American system can be a maze. Getting these details right from the very beginning is non-negotiable for building a compliant, solid company.

Let's address some of the most common—and often complex—questions we hear from our clients every day. Consider this expert insight from a team that has navigated these issues countless times.

"What Happens If I Mess Up a Payroll Tax Calculation?"

Discovering an error in your payroll tax calculations can be a stressful moment for any business owner. The key is to act quickly. The IRS and state tax agencies are generally understanding when you identify an honest mistake and correct it promptly; it's ignored errors that lead to significant trouble.

If you’ve underpaid, you must deposit the missing amount as soon as you find the error. You will likely also need to file an amended return, such as Form 941-X for federal taxes. Expect to pay some penalties and interest on the late payment, but the faster you correct it, the lower the cost will be.

If you've overpaid, you can typically claim a refund or apply the excess amount as a credit toward your next tax liability. This also requires filing an amended return. This is where professional help is invaluable—the correction process must be executed perfectly to avoid creating further complications.

"As The Owner, Do I Owe Employer Payroll Taxes on My Own Salary?"

This is one of the most frequent questions we receive. The answer depends entirely on your business's legal structure, as how you pay yourself dictates the tax rules.

S-Corps and C-Corps: If you are an owner who is also an employee (e.g., the CEO), you must take a "reasonable salary" on a W-2. The corporation is absolutely required to pay the standard employer payroll taxes (FICA match, FUTA, and SUTA) on that salary. This is non-negotiable.

LLCs (taxed as partnerships) & Sole Proprietorships: In these structures, owners typically take "owner's draws" instead of a formal salary. These draws are not subject to employer payroll taxes. Instead, you are responsible for paying self-employment tax on your share of the business profits, which covers both the employee and employer portions of FICA.

Getting this right is fundamental to your tax planning. Your choice of business entity has a massive, lasting impact on how you get paid and how much tax you owe.

"How Do I Handle Payroll For an Employee Working in Multiple States?"

Welcome to one of the most complex areas of U.S. payroll. When an employee works across different states, you cannot simply choose the most convenient one. You must determine where your business has "nexus"—a legal term for a connection significant enough to trigger a tax obligation.

Typically, you will need to register for payroll taxes in the state where your employee primarily lives or works. However, if they spend significant time working in another state, you may establish nexus there as well, which means another set of tax rules to follow. Every state defines nexus differently, creating a true compliance puzzle.

This multi-state scenario is a major hurdle for founders building remote or distributed teams. It demands a state-by-state analysis to ensure you are registered, withholding, and paying taxes correctly everywhere you are required to. Navigating this alone is a significant risk.

Managing U.S. payroll is all about precision, especially when you're running the business from another country. The questions we just covered are only the beginning. At Read & Associates Inc., our entire focus is on clearing up these complexities for international founders. We handle everything from setting up your U.S. company to running payroll and keeping you compliant, so you can focus on growth.

Ready to get your payroll right from day one? Schedule a consultation with our experts today.

Comments