How to Retrieve My EIN Number: A Quick Guide for Business Owners

- Read & Associates

- Jan 7

- 11 min read

Misplacing your Employer Identification Number (EIN) can feel like a major setback, stopping critical business activities like opening a bank account or filing taxes. As experts who guide U.S. and international founders daily, we've seen the panic this small problem can cause.

But before you resign yourself to a long, frustrating ordeal with the IRS, take a deep breath. The answer to "how can I retrieve my EIN number" is often hidden in documents you already possess. A few minutes of strategic searching can save you hours of waiting on hold.

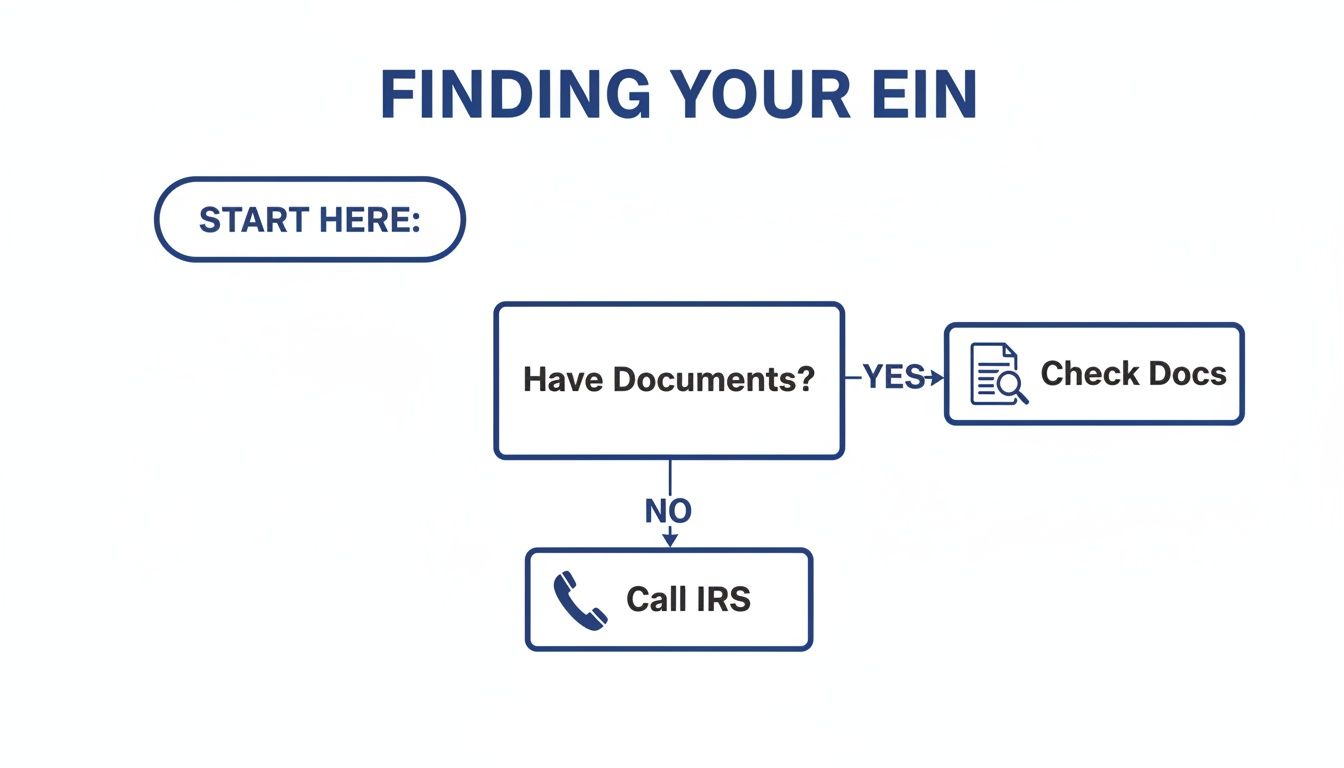

This quick decision tree lays out the most efficient path to follow.

As you can see, the game plan is simple: check your own records first. It’s the path of least resistance and, more often than not, the one that gets you back to business the fastest.

Where Your EIN Is Hiding in Plain Sight

Think of this as a targeted search mission. Instead of tearing your office apart, let's look at the most likely places your EIN is recorded. For many of our international clients, these documents are digital, making the hunt even quicker and more efficient.

Here are the prime spots to check:

The Original IRS Confirmation Letter (CP 575): This is the definitive document. It's the official notice the IRS sent when they first assigned your EIN. If you have a "business formation" folder, either physical or digital, it should be in there.

Previous Federal Tax Returns: Your EIN is on every federal tax form you've ever filed. Pull up last year's Form 1120 (for corporations) or Form 1065 (for partnerships), and you'll find it right at the top.

Business Bank Account Statements: You cannot open a business bank account without an EIN. Log into your online banking portal or grab a recent statement; the number is often listed in your business profile or account details.

State or Local License & Permit Applications: Remember filling out those forms for your city business license or state permits? They almost certainly required your federal EIN for identification.

As experts in business formation, we see this scenario constantly: a founder receives their EIN confirmation by email or fax, saves it to a random folder, and forgets about it. Before you do anything else, try searching your email or cloud drive for "CP 575" or "IRS Form SS-4." You might be surprised what pops up.

This quick checklist prioritizes your search so you can be as efficient as possible.

Quick EIN Retrieval Checklist

Here's a breakdown of where to look first, from most to least likely to have what you need.

Document or Location | Where to Look | Success Likelihood |

|---|---|---|

IRS Confirmation (CP 575) | Your business's permanent records, digital or physical | Very High |

Prior-Year Tax Filings | Your accountant's files, tax software, or company records | Very High |

Business Bank Records | Online banking portal or printed monthly statements | High |

Business Licenses/Permits | Copies of state, county, or city applications | Moderate |

Old Loan Applications | Paperwork from any business loans or credit lines | Moderate |

Starting with these documents is about more than just finding a number; it’s about solving a problem that can bring your business to a grinding halt. A few minutes of focused searching now will save you from significant delays later.

If you’re just getting started and want to avoid this situation entirely, it helps to understand the process from the beginning. We recommend reviewing our complete founder's guide on how to apply for an EIN number. A little preparation can go a long way.

Calling the IRS Business and Specialty Tax Line

When your document search yields no results, the next logical step—and often the most direct one—is to go straight to the source. It’s time to call the IRS.

The specific number you need is the IRS Business & Specialty Tax Line at 800-829-4933. This is the most reliable way to get your EIN when you have no other records to fall back on.

Be prepared to wait. The line is open Monday through Friday, from 7:00 a.m. to 7:00 p.m. local time. In our experience, calling first thing in the morning or later in the afternoon, especially mid-week, can sometimes cut down your hold time significantly.

How to Prepare for Your Call

The IRS agent on the other end of the line has one primary goal: protecting your business's confidential information. They will not simply give an EIN to anyone who asks. You must prove you’re an authorized person, which means you need to be a corporate officer, partner, or sole proprietor tied to the original application.

To avoid a frustrating second call, gather all your information before you dial. Having everything ready makes the process smoother and demonstrates professionalism.

Here’s what you should have in front of you:

Your Full Legal Name: The one that matches your personal tax records.

Your Social Security Number (SSN) or ITIN: This is non-negotiable for verification.

Your Role in the Business: Be prepared to state your official title, like "President," "Managing Member," or "Owner."

The Business's Legal Name and Mailing Address: Ensure it's the exact name and address you used on the original Form SS-4 application.

Pro Tip: If you have a copy of your original Form SS-4 application, keep it handy during the call. The agent might ask you to confirm specific details from it, such as the business start date or entity type. Having it in front of you can save a lot of scrambling and expedite the call.

Navigating the Verification Process

Once you get through, an IRS representative will walk you through a series of security questions. While it might feel like an interrogation, they are simply following protocol to prevent fraud. Answer each question clearly. As long as your information matches their records, the agent will provide the EIN verbally over the phone.

Write it down immediately—and we mean immediately. Then, store it in several secure places so you don't have to go through this again.

For firms expanding into new states, this becomes even more crucial. The IRS Business Line at 800-829-4933 can also help clarify which EIN to use for different state filings. BLS data reveals that while only 0.4% of EINs are linked to businesses in 10 or more states, those entities manage an average of 52.8 establishments. This highlights why expert help is so valuable—at Read & Associates Inc., we handle tedious tasks like EIN retrieval alongside QuickBooks setup, tax projections, and nexus analysis, keeping you compliant without the headache. You can find more information on how the IRS supports businesses on their official site.

Let’s be honest, this whole process can feel like a major time sink. As a business owner, your energy is better spent on strategy and growth, not on hold with the IRS. Our team can step in and manage this entire interaction for you, freeing you to get back to what you do best.

What If You're a Non-Resident Business Owner?

For international entrepreneurs, finding a lost EIN comes with a unique set of challenges. Standard verification methods often rely on a Social Security Number (SSN), which you likely don't have. This single detail changes the entire process and can bring your progress to a screeching halt if you're not prepared.

Forget the main IRS Business Line. They are not equipped to handle these specific cases. Instead, you'll need to call the dedicated IRS international line at 267-941-1099. Just be mindful of the time difference—their hours are 6:00 a.m. to 11:00 p.m. Eastern Time, Monday through Friday.

How the International Verification Process Works

When you connect with an agent, they cannot use an SSN or ITIN to verify your identity. Their entire verification process hinges on the information you provided on your original Form SS-4 application. This is where accuracy is paramount.

You must have these details handy and exactly as they appeared on your application:

The full, official legal name of your U.S. business entity.

The U.S. principal mailing address you listed.

Your name as the "responsible party."

The exact date your business was legally formed or incorporated.

Even a minor mismatch—a slight misspelling or an old address—can cause the agent to deny your request. While this is a security measure, it often leaves international founders stuck in a frustrating loop of calling, getting rejected, and starting all over again.

This is a common hurdle we help clients overcome, especially global SaaS founders trying to set up U.S. banking. Industry data shows that nearly 30% of international business formations get stuck right at the banking stage, and EIN problems are a significant contributor. Getting the right expert help from the start can change that.

The Smartest Move: Using a Third-Party Designee

Instead of dedicating hours of your own time to navigating IRS phone trees and time zones, you have a much better option: authorizing a professional firm to be your third-party designee.

This isn't just about convenience; it's about expertise. When a professional represents you, they know exactly what the IRS needs to hear and how to present the information correctly. They can sidestep the common traps that snag most non-residents, making the process faster and far less stressful.

For global founders, working with a firm like Read & Associates Inc. means we can retrieve a lost EIN or manage the entire U.S. setup from day one. This includes navigating complex compliance issues, like sales tax nexus, which is crucial now that 45 states have economic nexus laws. By getting it right the first time, you avoid becoming part of the 15% reapplication rate caused by simple errors, allowing you to scale your business without a hitch. You can find more details on how business data is linked for compliance.

Common Mistakes to Avoid When Finding Your EIN

Trying to retrieve your EIN number should be a straightforward task, but a few common missteps can turn it into a significant compliance issue. Knowing what not to do is just as important as knowing what to do. A little foresight here can save you from major headaches down the road.

The single biggest mistake business owners make is applying for a new EIN because they can't find their old one. This is a massive error. The IRS issues one EIN per entity for its entire lifetime. Applying for a second one creates a duplicate record, which can tangle up your tax filings and lead to compliance issues that are incredibly difficult and costly to resolve.

Your business should only ever have one EIN. Think of it like a Social Security Number for your company; creating a second one introduces chaos into your financial and legal identity. The goal is always to find the original, never to replace it.

Another surefire way to hit a roadblock is sending an unauthorized person to do the job. If you have an assistant or a bookkeeper call the IRS on your behalf, they will be turned away immediately. This isn't just bureaucratic red tape; it's a strict security protocol to protect your business's sensitive information.

Keeping the Process on Track

So, how do you avoid these traps? It all comes down to being methodical and prepared. Before you pick up the phone to call the IRS, make sure you've covered your bases.

Here’s what you absolutely must get right:

Confirm Your Authority: Are you an authorized person? The IRS will only speak to a principal officer, general partner, grantor, owner, or trustor of the entity.

Have Your Details Ready: Don't start the call scrambling for paperwork. Have the exact legal name of the business, its official address, and your own identifying information on hand.

Focus on Recovery, Not Replacement: Remember, your mission is to find the EIN you already have. Never, ever re-apply.

While an EIN is effective immediately for most purposes, the game changes for complex, multi-state operations. Did you know that while 99.6% of EINs are linked to businesses in a single state, more complex companies can average activity across 52.8 states per EIN? This is a whole different level of complexity.

This is where expert help becomes invaluable. At Read & Associates Inc., we don't just help recover lost EINs. We assist with the bigger picture, like QuickBooks reconciliations and state tax planning—services that help prevent the 12% compliance failure rate we often see among unassisted international founders. You can find more data on business activity and EINs to understand the landscape better.

Let a Pro Handle It So You Can Get Back to Business

As a business owner, your time is your most valuable asset. Every minute you spend on hold with the IRS, digging through old files, or navigating bureaucratic phone menus is a minute you're not spending on revenue-generating activities like finding new customers, perfecting your product, or planning your company's next big move.

While the steps to find a misplaced EIN are manageable, the process is often a time-consuming administrative task. It’s one of those necessary evils that pulls you away from the work that actually grows your business.

This is where engaging a professional isn't just a convenience—it's a smart strategic decision. Instead of getting bogged down in the details, you can delegate the entire process to a team that communicates with the IRS every single day. We see ourselves as more than just accountants; we’re your operational partners, here to help you succeed in the U.S. market.

A Full-Service Solution for Global Founders

If you're an international entrepreneur, the challenge is rarely just about one lost number. It's about confidently managing an entire U.S. company from thousands of miles away. Our expertise goes far beyond simply tracking down an EIN.

We've built a complete, end-to-end solution specifically for non-resident founders like you:

U.S. Company Formation: We’ll walk you through the pros and cons and help you set up the right entity, whether that’s an LLC or a C Corporation.

A Solid U.S. Presence: We provide the essentials you need to operate legally, including registered agent services and a U.S. virtual address.

Worry-Free Compliance: From clean bookkeeping in QuickBooks and Xero to timely federal and state tax filings, we ensure your business stays in good standing.

Letting a professional handle your EIN retrieval and ongoing compliance isn't just another business expense. It's an investment in your own efficiency and peace of mind. It frees you to focus 100% on growth, knowing that the complex regulatory details are being managed correctly by experts.

Let us take the administrative headaches off your plate. Our team at Read & Associates Inc. knows how to navigate the complexities of U.S. regulations so you don’t have to.

If you’re ready to get your time back and focus on what you do best, schedule a consultation with us today. We'll handle the rest.

Frequently Asked Questions About EIN Retrieval

Even with the best game plan, a few questions always seem to pop up. Let's walk through some of the most common ones we hear from business owners who are trying to track down a lost EIN.

Can I Look Up My EIN Online?

This is the number one question we get, and the short answer is no. For critical security and privacy reasons, the IRS does not maintain a public, searchable database for EINs. The information is too sensitive to be publicly accessible.

You might find it on your state's business registration portal, but this is not guaranteed. The only truly reliable—and free—way to get it directly from the source is to call the IRS. This ensures the number is correct and you’re not dealing with a questionable third-party service that might have outdated or insecure data.

How Long Does The IRS Call Take?

We advise clients to block off at least 15 to 30 minutes for the call. The wait time is the biggest variable; it can fluctuate significantly depending on the day and time you call.

The good news is that once you get an agent on the line, the process is quick. As soon as they verify you're an authorized person for the business, they will provide the EIN right then and there.

The key is being prepared. The actual information retrieval is instant once you're verified. The part that takes time is waiting on hold, which is why having all your documents ready to go is so important to make the call efficient.

What If I Am Not An Authorized Officer?

The IRS is extremely strict about this. They will only release an EIN to an "authorized person" on record. This is typically a partner, a corporate officer (like the president or treasurer), or the sole proprietor themselves. If your name isn't listed on that original SS-4 application, the agent will not be able to help you.

However, there is a professional solution. A business can formally authorize a third party—like an accounting firm such as ours—to act on its behalf. This requires filing a Form 8821, Tax Information Authorization, with the IRS. It’s a formal process, but it’s the proper way to delegate this task to an expert who can handle it efficiently. Getting a firm grip on what an EIN number is and how you get one is the foundation for managing it correctly from the start.

Dealing with IRS procedures can be a major headache and pull you away from what you do best—running your business. The team at Read & Associates Inc. can handle these calls for you, making the retrieval process smooth and painless. Visit us at https://www.readandassociates.us to see how we can help.

Comments