LLC vs Business License: The Ultimate Guide for Founders

- Read & Associates

- Jan 15

- 16 min read

It’s one of the most common points of confusion for new entrepreneurs: "Do I need an LLC or a business license?" The simple truth is, it’s almost never an "either/or" question. An LLC and a business license are two completely different things, and for nearly every business operating legally in the US, you will need both.

Think of it this way: forming an LLC is like giving your business its own legal identity, while a business license is the permission slip that lets your business actually do things in a specific location. They work together, but they are not interchangeable. Navigating these requirements correctly is the first step toward building a successful U.S. company, and our expertise can guide you through every step.

Unpacking the Core Difference

When you're starting out, it's easy to get tangled up in the legal jargon. But the distinction between an LLC and a business license is crucial for staying compliant and protecting your personal assets. Let's break down what each one really does so you can build your business on a solid legal foundation.

Defining Your Business vs. Operating Your Business

Forming an LLC (Limited Liability Company) at the state level creates a formal business structure. This is the step that builds a legal wall between your personal life and your business life. If the business faces a lawsuit or racks up debt, this structure helps protect your personal assets—like your house or car. In short, the LLC defines who your business is as a legal entity.

A business license, on the other hand, is all about operations. It's a permit issued by a government body (city, county, state, or even federal) that gives you the green light to conduct business in that area. It’s the official permission slip that answers what your business can do and where it can do it.

For a clearer picture, here’s a quick side-by-side look.

Quick Comparison: LLC vs. Business License

This table gives a high-level overview of the core differences.

Attribute | LLC (Limited Liability Company) | Business License |

|---|---|---|

Purpose | Creates a legal business entity, separate from its owners. | Grants permission to operate a business in a specific location. |

Issuing Body | State government (usually the Secretary of State). | Can be federal, state, county, or city government. |

Main Function | Provides personal liability protection and defines the business structure. | Ensures regulatory compliance and often tied to local tax collection. |

Duration | Perpetual, as long as you file annual reports and pay fees. | Typically requires annual renewal to remain active. |

While an LLC provides a foundational legal shield, the business license is what keeps you in good standing with the local authorities where you actually generate revenue.

The critical takeaway for any founder is that an LLC gives your business a legal identity, while a license allows that identity to interact with the marketplace legally.

Grasping this fundamental difference is the first and most important step toward building a secure and compliant U.S. company. The complexities can be daunting, but with expert guidance, the process becomes straightforward.

What Is an LLC? A Look at Your Legal Foundation

We've touched on the high-level differences, but let's dive deeper into what an LLC truly is and why it's a cornerstone for savvy business owners. Think of a Limited Liability Company as more than just a piece of paper; it's the legal architecture that builds a wall between your business and your personal life. An LLC is a formal business entity you create at the state level, typically by filing documents with the Secretary of State.

The primary purpose of an LLC is to create a legal separation between you, the owner (or "member"), and the company itself. This separation is the source of its most powerful feature: limited liability protection. If your business runs into debt or faces a lawsuit, this legal firewall is designed to protect your personal assets—your house, your car, your savings account—from being seized.

The Power of Liability Protection

Let's make this concrete. Imagine you run an e-commerce store as a sole proprietor—no LLC. If a customer sues your business over a defective product and wins, they can legally come after your personal assets to collect on that judgment. Suddenly, your family's savings are at risk.

Now, rewind and imagine you had formed an LLC. In that scenario, the lawsuit is filed against the company, not you personally. Creditors can generally only pursue the business's assets, leaving your personal finances untouched.

This protective barrier is often called the "corporate veil," and it is the number one reason founders opt to form an LLC. It's a smart, proactive move to manage risk from the very beginning.

Tax Flexibility: A Key Advantage

Beyond protecting your assets, an LLC brings significant tax flexibility. By default, the IRS sees a single-member LLC as a "disregarded entity." This means the business income and expenses flow through to your personal tax return (on a Schedule C), a concept known as pass-through taxation.

For LLCs with multiple members, the default tax treatment is as a partnership. Either way, the profits "pass through" to the members, who then pay taxes on their personal returns. This setup cleverly sidesteps the "double taxation" problem that corporations often face, where profits are taxed once at the corporate level and again when distributed to shareholders.

And if it makes strategic sense, an LLC can even elect to be taxed as an S-Corporation or a C-Corporation. This kind of adaptability is a powerful tool for optimizing your tax strategy as your business grows.

The LLC Formation Process

Putting this legal shield in place involves a few non-negotiable steps. While the exact details vary by state, the general roadmap is consistent:

File Articles of Organization: This is the foundational document you submit to the state to officially register your LLC. It contains the basics: your company's name, its address, and its members.

Draft an Operating Agreement: Even if your state doesn't mandate it, this internal document is absolutely essential. It lays out the rules of the road for your business—ownership percentages, member responsibilities, how decisions are made—and can prevent major headaches and disputes down the line.

Appoint a Registered Agent: Every LLC is required to have a registered agent on file. This is a person or company designated to receive official mail and legal notices (like a lawsuit) on your business's behalf. For international founders, using a professional service is a necessity for staying compliant.

Getting these foundational pieces right is a strategic decision to build a secure, scalable company that's ready for any challenge. Our team specializes in guiding business owners through this process to ensure it's done correctly from the start.

Your Permit to Operate: What Exactly Is a Business License?

If an LLC is your business's birth certificate, a business license is its driver's license—it's the official permission slip from the government to actually do business. Think of it as the key that lets you legally open your doors, whether they're physical or virtual, within a specific city, county, or state.

It’s crucial to understand that a business license provides absolutely no liability protection. Its purpose is purely regulatory. Government agencies use licenses to track businesses, ensure they’re following safety and zoning rules, and, of course, collect the right taxes. It doesn't create a legal shield; it simply authorizes your LLC or other entity to operate.

Not All Licenses Are Created Equal

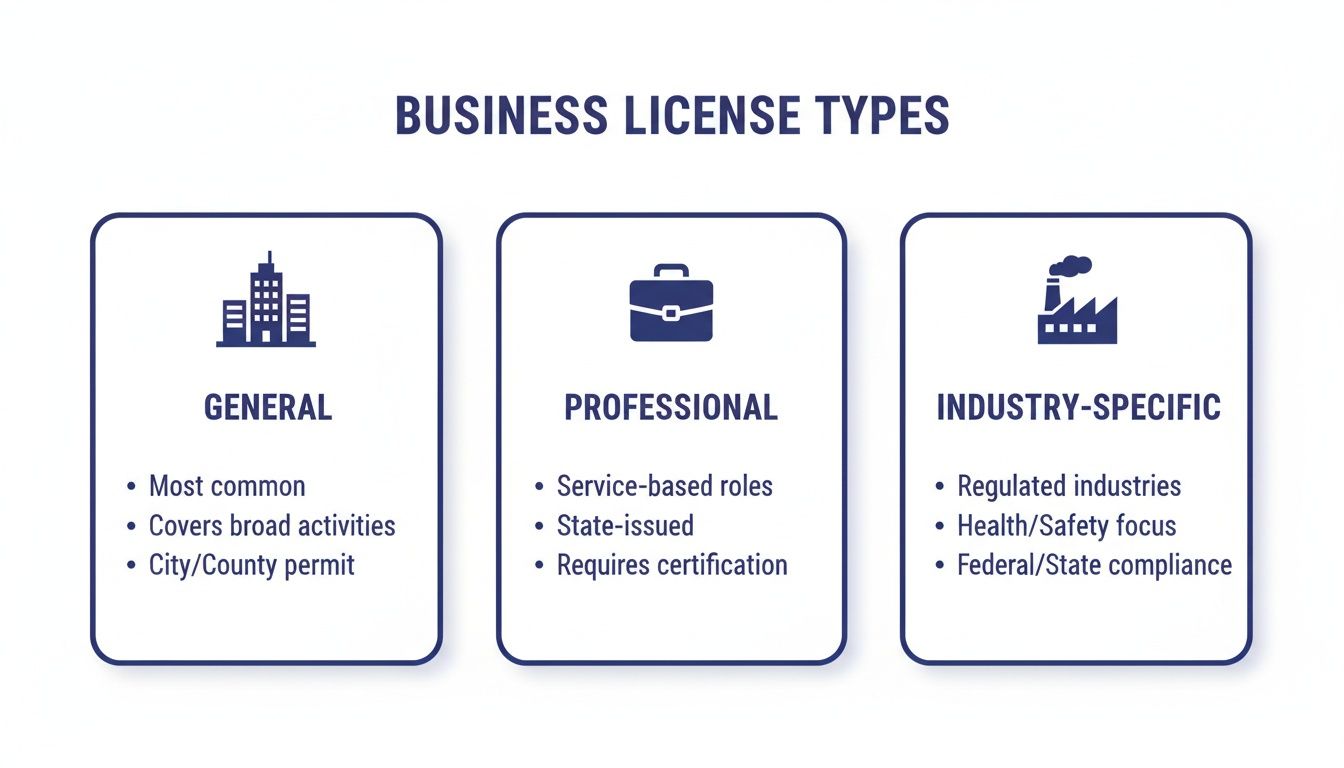

The world of business licensing can feel like a maze because there's no single, universal permit. The licenses you need are tied directly to what you do and where you do it. The rules can change dramatically from one town to the next.

Generally, you'll encounter a few common types:

General Operating Licenses: Most cities and counties require this basic license just for existing within their jurisdiction. It’s their way of keeping a census of all commercial activity in the area.

Professional Licenses: Are you an accountant, consultant, or lawyer? You'll likely need a professional license from a state board, which verifies you meet certain educational and ethical benchmarks for your field.

Industry-Specific Permits: This is where it gets highly specific. A restaurant needs a health permit. An e-commerce store needs a seller's permit to collect sales tax. A construction company needs contractor's licenses.

Here's the key takeaway: Licensing is hyper-local and industry-dependent. Forming an LLC in Wyoming doesn't give you a free pass to operate an office in Austin, Texas. You'll still need a local Austin business license and a Texas seller's permit if you're selling taxable goods.

The High Cost of Skipping the Paperwork

Trying to operate without the right licenses is a gamble you don't want to take. The consequences can be severe, ranging from hefty fines and back taxes to a court-ordered shutdown of your entire operation.

Imagine an online store that fails to get a seller's permit in a state where it has a strong customer base. That business could suddenly be on the hook for years of uncollected sales tax, plus steep penalties and interest—a financial blow that could easily sink the company. This isn't just about following rules; it's about protecting your bottom line.

Figuring out the tangled web of federal, state, and local requirements is a significant challenge, especially for founders based outside the U.S. The information is often buried deep in confusing government websites. This is one of the most common—and most expensive—mistakes new entrepreneurs make. Getting expert help here can save you a world of trouble and ensure you're set up to operate legally and confidently from day one.

A Detailed Comparison of LLCs and Business Licenses

While it’s useful to think of an LLC as your company’s legal identity and a license as its permission to operate, the real distinctions become clear in the day-to-day functions of your business. For founders, especially those based outside the U.S., grasping these differences is absolutely essential for budgeting, planning, and long-term compliance.

Let’s move past the basic definitions and dive into a side-by-side analysis of how each one impacts your business in the real world, from legal protection and taxes to the actual steps you'll take to get set up.

Legal Protection: The Corporate Veil vs. Regulatory Compliance

The single biggest difference between an LLC and a business license is liability protection. An LLC is specifically designed to create a legal wall—often called the "corporate veil"—between your company’s finances and your personal assets. If the business gets sued or racks up debt, this structure is what protects your personal savings, home, and car from being on the line.

A business license, on the other hand, offers zero liability protection. Its job is purely regulatory. A license simply confirms you’ve met the specific rules set by a local, state, or federal agency to operate a certain type of business in their jurisdiction. It’s all about following the rules, not protecting your assets.

In short, an LLC defines who your business is legally—a distinct entity. A license defines what your business is allowed to do—operate, sell a product, or offer a service. They are completely different tools for entirely different jobs.

Tax Implications: Pass-Through vs. Tax Collection

When it comes to taxes, their roles couldn't be more different. An LLC provides incredible tax flexibility, most famously through pass-through taxation. By default, an LLC’s profits and losses "pass through" directly to the owners' personal tax returns, which helps you avoid the double taxation that corporations sometimes face. For more complex tax planning, you can even explore how an LLC can elect to be taxed as a C Corporation.

In contrast, business licenses are almost always tied to tax collection, not your company's tax structure. A perfect example is a seller's permit, which is a type of license. It doesn't change how your business is taxed; it just gives you the authority to collect sales tax from your customers on behalf of the state. It’s an administrative tool, not a tax strategy.

This infographic breaks down the common types of licenses you might need.

As you can see, beyond a general license from your city or county, your profession and industry will determine what other specific permits you'll have to secure.

Formation and Costs: State Filing vs. Multi-Agency Permits

The processes for getting an LLC and a business license are completely separate and involve different government agencies.

LLC Formation: This is a one-time event you handle at the state level, usually through the Secretary of State. You'll file your Articles of Organization, pay a one-time fee, and your legal entity is officially formed.

Business Licensing: This is often a multi-layered process. You might need to apply for separate licenses from city, county, state, and even federal agencies, each with its own application, fee, and waiting period.

The rise of the LLC is a testament to its value. According to IRS data, the number of LLCs in the United States exploded from just 200,000 in 1993 to over 2.4 million by 2018—that's a staggering 1,100% increase. This growth is driven by that powerful blend of liability protection and tax flexibility that founders love.

Ongoing Compliance: Annual Reports vs. Regular Renewals

Keeping your business in good standing also involves different tasks. An LLC typically requires you to file an annual report and pay a yearly fee to the state. This is usually a straightforward process to confirm your business information is current.

Business licenses, however, often need to be renewed every year or two. Missing a renewal deadline can lead to hefty fines or, even worse, an order to shut down your operations immediately. This makes keeping track of multiple renewal dates a critical administrative task.

To bring this all together, here's a table that lays out the key differences feature by feature.

LLC vs Business License Detailed Feature Breakdown

Feature | LLC | Business License |

|---|---|---|

Primary Purpose | Creates a separate legal entity and provides liability protection. | Grants official permission to operate a business in a specific jurisdiction. |

Liability | Shields personal assets from business debts and lawsuits. | Offers no liability protection whatsoever. |

Tax Treatment | Pass-through taxation by default; can elect corporate taxation. | Often related to tax collection (e.g., sales tax permit), not business tax structure. |

Issuing Authority | State government (usually the Secretary of State). | Varies widely: can be city, county, state, or federal agencies. |

Formation | A one-time state filing (Articles of Organization). | Often requires multiple applications to different government bodies. |

Ongoing Needs | Requires an annual report and fee to maintain good standing. | Must be renewed periodically (annually, biennially) to remain valid. |

Geographic Scope | Recognized as a legal entity across all states. | Only valid within the specific city, county, or state that issued it. |

This breakdown makes it clear that these two things, while both necessary, serve very different functions in your business's legal and operational life.

Scenario: A Delaware E-commerce Store

Let's look at a real-world example. Imagine you form a Delaware LLC to run an online store that sells handmade goods.

Your LLC: Forming the LLC in Delaware establishes your legal business entity. This is what protects your personal assets if something goes wrong with the business.

Your Licenses: You will still need a seller's permit (a license) in every state where you establish "economic nexus"—a term for meeting a certain sales or transaction threshold. If your sales to customers in California cross their threshold, you are legally required to get a California seller's permit and start collecting California sales tax.

This example proves it’s never a choice between an LLC or a business license. The LLC is your company’s legal foundation, and the licenses are the permits you need to build your sales operations on top of it. For any founder, understanding how to navigate these separate but equally vital requirements is the key to building a legally sound and sustainable U.S. business.

Why It's Almost Never a Choice: You Need Both

Thinking in terms of "LLC vs. business license" sets up a false choice. For almost any serious business operating in the US, it's not a matter of picking one over the other. You need both. They work together as a two-part system: one for legal protection, the other for operational permission.

Think of it this way: your LLC is your shield, and your licenses are the keys that unlock the market. One defines your company's legal existence, while the others grant it permission to do business. Skipping either one leaves you wide open to risks that can easily sink a new venture.

The Real-World Risks of Getting It Wrong

Let's look at what happens when founders only have one piece of the puzzle in place. Each component—the LLC and the license—tackles a completely different kind of risk. Understanding this difference is crucial, especially if you're running your business from outside the US.

Here are a couple of all-too-common scenarios:

The Exposed Consultant: An online business consultant gets a local business license to work from her home office but doesn't bother forming an LLC. When a disgruntled client sues for damages over alleged bad advice, there's no legal separation. Her personal assets—her house, car, and savings—are on the line to satisfy the lawsuit.

The Unlicensed Retailer: A founder sets up a Delaware LLC for his e-commerce brand, thinking the corporate structure is all he needs. He overlooks getting seller's permits in states where he has a lot of customers. Suddenly, he's hit with a massive bill for back taxes, crippling penalties, and a court order to stop selling in his most profitable markets.

For any business owner, this isn't optional. The LLC provides the solid legal structure you need to operate in the US, while proper licensing ensures you can navigate complex state and local rules without getting shut down.

Your LLC: The Legal Foundation

The main job of an LLC is to create a "corporate veil" by establishing your business as its own legal entity. This is the bedrock of your entire operation. It's what separates your business finances from your personal finances.

Without that separation, you are the business. Every business debt, every lawsuit, every liability is a direct threat to your personal financial well-being. Forming an LLC is the fundamental defensive move you make to protect yourself from day one.

Your Licenses: The Permission to Operate

Once your LLC is in place, business licenses are what give it the green light to actually sell products or services. They are your permits to operate in a specific city, state, or industry. A license won't shield you from a lawsuit, but it will prevent regulators from shutting your doors.

The exact licenses you'll need depend entirely on what you do and where you do it. This can include a mix of:

General business licenses from a city or county.

Professional licenses if you offer services like therapy, accounting, or legal advice.

Seller's permits (or sales tax permits) for collecting sales tax.

Industry-specific permits for regulated fields like food, childcare, or construction.

The costs and requirements for LLCs and licenses are worlds apart, which is why most new businesses lock in their LLC first. LLC formation fees can be as low as $70 in some states or over $300 in others. Then you have annual fees, which range from $0 in Texas to $800+ in California, even if you make no money. Business licenses, on the other hand, are operational costs, typically running $50-$500 per year, and are issued by local or state governments based on your business activity, not your legal structure. This duo is non-substitutable; you can dig into the broader economic impact of these regulations through World Bank research.

Ultimately, the only smart approach is an "LLC and business license" strategy. Your LLC is the shield that protects what you've built, and your licenses are the keys that let you legally earn revenue. It can feel like a lot to manage, but getting the right guidance from the start helps you cover all your bases without making expensive mistakes down the road.

Your Next Steps for US Business Formation

Alright, let's turn all this information into action. Now that you understand the crucial difference between an LLC and a business license, you're ready to build a legally sound US company. This final section is your practical, step-by-step roadmap to get from idea to a fully operational US entity.

Think of this as your launch checklist. Each step builds on the one before it, creating a solid foundation for your company's growth. For international founders and domestic entrepreneurs alike, getting this sequence right from day one is absolutely critical.

Your Five-Step Launch Plan

Following this plan ensures you've covered all your bases—from a legal and financial standpoint—so you can operate with confidence in the US market.

Select a State and Form Your LLC First things first: choose a state that makes sense for your business goals. Wyoming and Delaware are often go-to options for non-residents, but the best choice depends on your specific situation. Once you've decided, you'll file your Articles of Organization with the Secretary of State. This is the moment your company officially becomes a legal entity, activating that all-important liability shield.

Appoint a Reliable Registered Agent Every single LLC in the US is required to have a registered agent. This is your official point of contact for legal notices and government mail. It's a non-negotiable step for staying in good standing, and it's especially vital if you're managing the business from outside the country.

Secure Your Employer Identification Number (EIN) The EIN is a unique nine-digit number the IRS gives you for tax administration. You can't do much without it—you'll need an EIN to open a bank account, hire employees, or file your federal taxes. For a complete walkthrough, check out our founder's guide on how to apply for an EIN number.

Open a US Business Bank Account Keeping your business and personal finances separate isn't just good practice; it's essential for maintaining your LLC's liability protection. A dedicated US bank account also makes your operations look more professional and seriously simplifies bookkeeping and tax time.

Research and Obtain All Necessary Licenses With your LLC formed and bank account ready, the final piece of the puzzle is licensing. This is where you need to do your homework. Carefully research and apply for every federal, state, and local business license required for your specific industry and the locations where you operate.

Trying to navigate this on your own can be a minefield of expensive mistakes and frustrating delays. Missing a single local permit or making a small error on your EIN application can stall your launch for months and rack up unexpected costs.

This is exactly where we come in. Our team of experts removes the guesswork and complexity from US business formation. We manage every detail, from the initial LLC registration to your ongoing tax compliance, so you can focus on what you actually love doing: growing your business. Your successful US launch starts with the right partner.

Frequently Asked Questions

Even with the best guides, real-world questions always pop up. Here are some of the most common ones we get from founders trying to sort out the LLC vs. business license puzzle.

Do I Get a Business License Before or After My LLC?

You’ll want to form your LLC first. Think of it this way: your LLC is the legal "person" that will be running the business. This entity needs to exist before it can ask for permission to operate.

When you go to apply for a business license, the city, county, or state agency will ask for your official LLC name and, in many cases, your Employer Identification Number (EIN). You can't provide that information until the LLC is officially registered.

Can an LLC Operate Without a Business License?

Absolutely not. An LLC is a fantastic tool for liability protection, but it doesn't grant you the automatic right to start selling or providing services. Operating without the right licenses and permits is a risky move.

You could face hefty fines, be required to pay back taxes with penalties, or even be legally forced to shut down your operations.

Key Takeaway: An LLC gives your business a legal identity, but a business license gives that identity permission to actually do business. You need both to operate legally and safely.

How Much Do Business Licenses Cost Compared to an LLC?

The costs are quite different in nature. Forming an LLC involves a one-time state filing fee, which can be anywhere from $50 to over $500, depending on the state. Some states also require you to file an annual report, which comes with its own fee.

Business license costs are typically lower for a single license—often between $50 to a few hundred dollars. However, you might need several different licenses (local, state, professional), and most of them must be renewed annually. This makes licensing an ongoing operational cost, whereas the LLC formation fee is mostly a one-off expense.

As a Non-US Resident, What Is Most Important to Know?

For international founders, the single most important thing to understand is this: you must have a U.S. legal entity, like an LLC, to properly operate in the U.S. market. It's your ticket into the ecosystem.

Once that LLC is formed, it has to play by the same rules as any domestic company. That means complying with every local, state, and federal licensing requirement. Getting this structure right from the beginning is crucial for accessing U.S. bank accounts, using payment processors like Stripe, and building trust with American customers.

Navigating LLC formation and the maze of U.S. business licensing can feel overwhelming, especially when you're doing it from another country. Read & Associates Inc. specializes in providing clear, end-to-end guidance for international founders, ensuring your U.S. venture is structured correctly and fully compliant from day one. Schedule a consultation with our experts today.

Comments