What is a C Corporation? A Definitive Guide for Business Owners

- Read & Associates

- Jan 14

- 18 min read

At its most fundamental level, a C corporation is a business structure that is legally a separate "person" from its owners. It’s a distinct entity in the eyes of the law, a crucial concept for any business owner looking to operate in the U.S.

Imagine building a fortress for your business. Everything the company does—making money, signing contracts, owning property, even facing lawsuits—happens within the fortress walls. This setup keeps your personal assets, like your home and savings, safely outside and protected. This powerful separation is a huge advantage for entrepreneurs, especially for non-resident founders looking to build a secure U.S. company. Understanding this structure is the first step toward making an informed decision for your venture.

Understanding the C Corporation Framework

The C corp is the most common corporate structure for businesses that plan to grow big, raise money from investors, or eventually sell shares to the public. Ownership is held by shareholders, strategic oversight comes from a board of directors, and daily operations are handled by officers (like a CEO or President). This formal hierarchy creates a clear and predictable governance model that investors and partners around the world understand and trust.

The biggest draw here is that legal independence. The corporation itself is responsible for its debts and legal troubles, not the owners. This "corporate veil" is what shields your personal wealth, giving you a critical layer of security as you grow.

Who Should Consider a C Corporation?

Any business can form a C corp, but it really shines for founders with specific, ambitious goals. It's the go-to choice when you're planning for serious expansion and know you'll need outside funding to get there.

You should seriously consider a C corporation if you are:

Seeking venture capital: VCs and angel investors almost always require a C corp structure because it makes issuing different classes of stock simple and scalable.

A non-resident founder: Unlike other structures like the S corp, C corps have no restrictions on foreign ownership. This makes them the standard, and often only, choice for international entrepreneurs entering the U.S. market.

Planning to go public: If your dream is an Initial Public Offering (IPO), the C corp's ability to issue unlimited shares of stock is a non-negotiable requirement.

The C corporation is the bedrock of American enterprise, providing a globally recognized model for liability protection and capital investment. For international founders, it’s not just an option—it’s often the most strategic entry point into the U.S. market.

To help you quickly grasp the key points, here is a summary table.

C Corporation Key Features for International Founders

Feature | Description for Non-Resident Owners |

|---|---|

Ownership | No restrictions on who can own shares—U.S. citizens, non-residents, and even other companies can be shareholders. |

Liability | Provides strong personal liability protection. The owner's personal assets are separate from business debts. |

Taxation | The corporation is taxed on its profits at the corporate level. Dividends paid to owners are then taxed again at the personal level ("double taxation"). |

Investment | The preferred structure for venture capital and angel investors. It's built for raising capital. |

This table provides a high-level overview, showing why the C corp is often the default choice for global entrepreneurs.

A Popular Choice for Businesses of All Sizes

It’s easy to associate C corps with massive public companies, but they are surprisingly common among smaller businesses. In fact, 84.9% of all C corporations have fewer than 20 employees, which proves it's not just a tool for the big players.

While the total number of C corps has fluctuated since peaking in 1987, their fundamental value for growth-oriented companies remains as strong as ever.

To operate legally, every U.S. corporation needs a federal tax ID number from the IRS. Our guide explains what an EIN number is and how to get one for your new company. This is a crucial first step you’ll need to open a bank account, hire a team, and file your taxes.

The Three Pillars of C Corp Governance

To really understand what is a C corporation, you have to look at its internal power structure. This isn’t just a casual group of people working together; it’s a formal system with very distinct roles and responsibilities. This design is all about clarity, accountability, and enabling growth—and it's exactly what makes the C corp structure so attractive to serious investors and partners.

At its heart, a C corp’s governance stands on three separate pillars: the shareholders, the board of directors, and the officers. Each group has a specific job, creating a natural system of checks and balances that keeps the company moving forward.

Think of it like a professional sports team. The shareholders are the team owners—they put up the money and have the ultimate goal of winning a championship. The board of directors is the general manager, setting the long-term strategy and approving big roster moves. And finally, the officers are the coaches and players who execute the game plan every single day.

The Shareholders: The Owners

Shareholders are, quite simply, the owners of the C corporation. By purchasing stock, they provide the company with capital, and in return, their ownership stake grants them fundamental rights.

But here’s the key distinction: shareholders don’t run the day-to-day operations. Their influence is wielded in two main ways:

Electing the Board of Directors: They vote to put people on the board who they trust to provide high-level strategy and oversight.

Approving Major Corporate Actions: Massive decisions like merging with another company, selling the entire business, or dissolving the corporation almost always require a shareholder vote.

For an international SaaS company just starting out in the U.S., the initial shareholders are usually the founders. As the business grows and needs more cash, venture capital firms or angel investors might come in, becoming new shareholders by trading their investment for a piece of the company.

The Board of Directors: The Strategic Minds

The board of directors, elected by the shareholders, is the strategic brain of the company. Their job isn’t to get bogged down in daily management; they’re there to focus on the big picture. They also have a fiduciary duty, which is a legal obligation to act in the best interests of the corporation and its shareholders.

Their core responsibilities include:

Appointing and Overseeing Officers: The board is responsible for hiring, evaluating, and if needed, firing the top executives who run the company, like the CEO.

Setting Corporate Policy: They define the company's overarching vision, mission, and the major policies that will guide it.

Making Major Financial Decisions: This covers everything from approving the annual budget and declaring dividends to green-lighting significant investments.

Going back to our SaaS company example, the first board might just be the founders. But after a round of funding, you can bet that a lead investor will take a board seat to help steer the company’s growth and protect their investment.

The formal separation of roles—ownership by shareholders, oversight by directors, and management by officers—is the bedrock of C corp governance. This structure creates accountability and protects the entity’s most valuable asset: its legal independence.

The Officers: The Hands-On Leaders

The officers are the executives the board hires to manage the C corporation’s daily business. They are the boots-on-the-ground leaders tasked with turning the board's strategic vision into reality.

You’ll recognize these common titles:

Chief Executive Officer (CEO): The top executive, ultimately responsible for the company’s overall performance.

Chief Financial Officer (CFO): Manages all things financial, from accounting and reporting to budgeting and forecasting.

Secretary: Keeps the official corporate records in order, like meeting minutes and other vital documents.

These roles are what make the company tick. For our international SaaS startup, a founder would likely start as the CEO, making the critical calls on product development, marketing, and sales to hit the growth targets the board has set.

This clear, structured governance is directly tied to one of the C corp’s biggest advantages: its liability shield. Because the corporation is a separate legal person with its own management, its debts and legal troubles belong to the company, not to you. This is what creates the corporate veil, the legal barrier that protects your personal assets.

Understanding these three pillars isn’t just an academic exercise. This framework dictates how your business will run and builds the foundation of trust that investors need to see. If you're not sure how to structure your board or define officer roles, our team can help you build a governance model that's set up for success from day one.

Contact Read & Associates for a consultation to ensure your U.S. venture starts on solid ground.

Navigating C Corporation Taxes

Taxes are a huge part of any business decision, and when it comes to a C corporation, the model is unique. You’ve probably heard the term “double taxation,” which sounds a lot scarier than it actually is once you understand how to manage it.

All it really means is that a C corp’s profits get taxed twice: first when the company earns them, and a second time when those profits are paid out to the owners.

Think of it like this: the C corporation is its own legal “person.” Just like any individual who earns an income, the company has to pay taxes on its profits. This first step is pretty straightforward. The company calculates its net profit and pays corporate income tax directly to the federal government and, in most cases, the state government too.

That’s the first layer. Once the corporation has paid its tax bill, it can do one of two things with the money left over: reinvest it back into the business or distribute it to the owners (the shareholders) as dividends.

How Double Taxation Works in the Real World

This is where the second layer of tax comes in. When shareholders get those dividend payments, they have to report that money on their personal tax returns and pay tax on it. That’s how the same pot of corporate profit gets taxed again, this time at the shareholder's individual dividend tax rate.

Let's walk through a simple example. Imagine your new U.S. C corporation makes $100,000 in profit this year.

Corporate-Level Tax: The company first pays federal income tax on that profit. The current federal corporate tax rate is a flat 21%, so the tax bill is $21,000 ($100,000 x 0.21).

After-Tax Profits: After paying its taxes, the corporation has $79,000 left.

Dividend Distribution: The board of directors decides to distribute that entire $79,000 to you as the sole shareholder.

Shareholder-Level Tax: You now have $79,000 in dividend income. If you fall into the 15% qualified dividend tax bracket, you’d owe another $11,850 in personal income tax ($79,000 x 0.15).

When all is said and done, that original $100,000 profit resulted in a total tax bill of $32,850 ($21,000 from the corporation + $11,850 from you). This shows you exactly how “double taxation” plays out.

While "double taxation" can sound like a major drawback, it's often a reasonable trade-off for the powerful liability protection and investment flexibility a C corp provides. The key is simply smart tax planning.

It's also worth noting that corporate tax rates have changed dramatically over the decades. The current federal rate is less than half of what it was in the 1950s and 60s. Interestingly, despite these rates, U.S. corporate tax revenues only made up about 1.3% of GDP in 2022—a figure lower than most other advanced economies. You can find more data on this at the Peter G. Peterson Foundation's analysis of U.S. corporate tax revenues.

Smart Ways to Manage Your C Corp's Tax Bill

Savvy business owners don’t just accept double taxation as a fixed cost—they plan around it. A C corporation actually offers several great strategies for reducing the overall tax burden, making it a much more efficient structure than it first appears.

These aren't loopholes; they're intended features of the U.S. tax code. By understanding how to use them, you can make decisions that benefit both your company and yourself.

Here are two of the most popular and effective strategies:

Pay Yourself a Reasonable Salary: If you're an owner who also works in the business (as a CEO, manager, or developer, for instance), the corporation can pay you a salary. This salary is a business expense, so it gets deducted from the company's profits before corporate taxes are even calculated. You’ll pay personal income tax on your salary, of course, but the corporation gets a critical deduction, which completely eliminates that first layer of tax on that money.

Reinvest Earnings for Growth: A C corp doesn't have to distribute its profits. In fact, most successful startups and growing companies keep a large chunk of their earnings to pour back into the business. This money—called retained earnings—can be used to hire staff, build new products, or ramp up marketing. Since these retained earnings are only taxed at the corporate level, you can fuel your growth with funds that haven't been hit by that second layer of tax.

The right tax strategy really depends on your business goals. Our team specializes in helping international founders build a tax plan that fits their vision. Contact Read & Associates for a consultation, and we can explore how to set up your C corp for maximum tax efficiency.

C Corp vs. S Corp vs. LLC: Choosing Your Path

Picking the right business structure is easily one of the most critical decisions you'll make when bringing your company to the U.S. market. This isn't just about paperwork; it's a foundational choice that shapes everything from your personal liability and tax bill to your ability to land that first big investment.

The three main players are the C corporation, the S corporation, and the Limited Liability Company (LLC). Each has its own playbook, but for an international founder, one of them is almost always the go-to choice. Let’s walk through the differences that really matter.

Ownership Rules for International Founders

Right out of the gate, we hit a major roadblock for non-U.S. residents. U.S. law is very particular about who can own certain types of companies, and this is where the S corp gets disqualified immediately.

S Corporation: Plain and simple, this structure is off-limits if you're not a U.S. citizen or resident alien. That single rule makes it a non-starter for virtually every international founder.

C Corporation & LLC: Good news here. Both of these entities are wide open to foreign ownership. A C corporation places zero restrictions on the nationality or location of its shareholders. An LLC is just as flexible, allowing non-residents to be "members" (which is just LLC-speak for owners).

This one distinction makes the C corp and the LLC the only two realistic contenders for your new U.S. venture.

The Great Divide: How Your Business Is Taxed

Next up is the tax structure, and this is where you see a massive difference in how profits are handled. It all comes down to two key concepts: "double taxation" versus "pass-through taxation."

A C corporation follows the double taxation model we covered earlier. The corporation itself pays a federal corporate income tax on its profits. Then, if those profits are distributed to you and other shareholders as dividends, you pay personal income tax on that money.

S corps and LLCs, on the other hand, are typically pass-through entities. This means the business itself pays no federal income tax. Instead, the profits and losses "pass through" directly to the owners, who report them on their personal tax returns. This setup avoids the corporate-level tax altogether.

For a non-resident founder, the C corp's predictable, self-contained tax system is often simpler to manage from abroad than the pass-through complexities of an LLC, which can create U.S. personal tax filing requirements.

Attracting Investors and Raising Capital

If your game plan includes raising money from angel investors or venture capital (VC) funds, this decision gets a whole lot easier. American VCs almost exclusively invest in one type of company: the C corporation.

Why the strong preference? It boils down to a few practical reasons:

Stock Flexibility: C corps can create different classes of stock, like common and preferred. This is crucial because it allows investors to get special rights and protections for their money.

Scalability: You can have an unlimited number of shareholders in a C corp, which is perfect for a company that plans to go through multiple funding rounds and maybe even go public one day.

Familiarity: In the U.S. investment world, the C corp is the gold standard for high-growth startups. VCs know the rules, understand the structure, and are comfortable with it.

Trying to raise venture capital with an LLC or an S corp is an uphill battle. Their ownership rules and pass-through tax structures create huge headaches for investment funds, so they usually just say no.

C Corp vs. S Corp vs. LLC: A Comparison for Non-Resident Founders

To really see how these stack up, it helps to put them side-by-side. This table breaks down the key differences from the perspective of an international entrepreneur.

Attribute | C Corporation | S Corporation | LLC (Limited Liability Company) |

|---|---|---|---|

Foreign Ownership | Allowed. No restrictions on shareholder nationality or residency. | Not Allowed. Shareholders must be U.S. citizens or resident aliens. | Allowed. No restrictions on the nationality of members. |

Taxation Model | Double Taxation. The corporation pays tax on profits, and shareholders pay tax on dividends. | Pass-Through. Profits/losses are passed to shareholders' personal tax returns. | Flexible. Taxed as a pass-through entity by default, but can elect to be taxed as a C corp. |

Investor Appeal | Very High. Preferred by VCs and angel investors for its stock structure and scalability. | Very Low. Ownership restrictions make it unsuitable for institutional investment. | Low to Moderate. Complicated tax structure for investors; not preferred for VC funding. |

Number of Owners | Unlimited. Can have as many shareholders as needed. | Limited. Capped at a maximum of 100 shareholders. | Unlimited. Can have a single member or multiple members. |

In the end, your choice really comes down to your vision. If you're building a scalable company with ambitions of raising U.S. investment, the C corporation is the undisputed champion. If you're creating a smaller, self-funded business, an LLC can offer a bit more operational flexibility.

Navigating these options can feel overwhelming. Contact Read & Associates for a consultation, and our experts will help you choose the entity that sets your U.S. venture up for success from day one.

How to Form Your US C Corporation

Now that you understand the what and the why of C corporations, let's get into the how. Launching a C corp isn't a single event; it's a sequence of specific, deliberate steps. For founders living outside the U.S., this process can feel daunting at first glance. But when you break it down, it's a logical path from your big idea to a legally operating American company.

This section is your roadmap. We’ll walk through everything from picking the right state to opening a U.S. bank account, all while keeping the unique challenges of an international entrepreneur in mind. We want to empower you with the knowledge to build a solid company from day one.

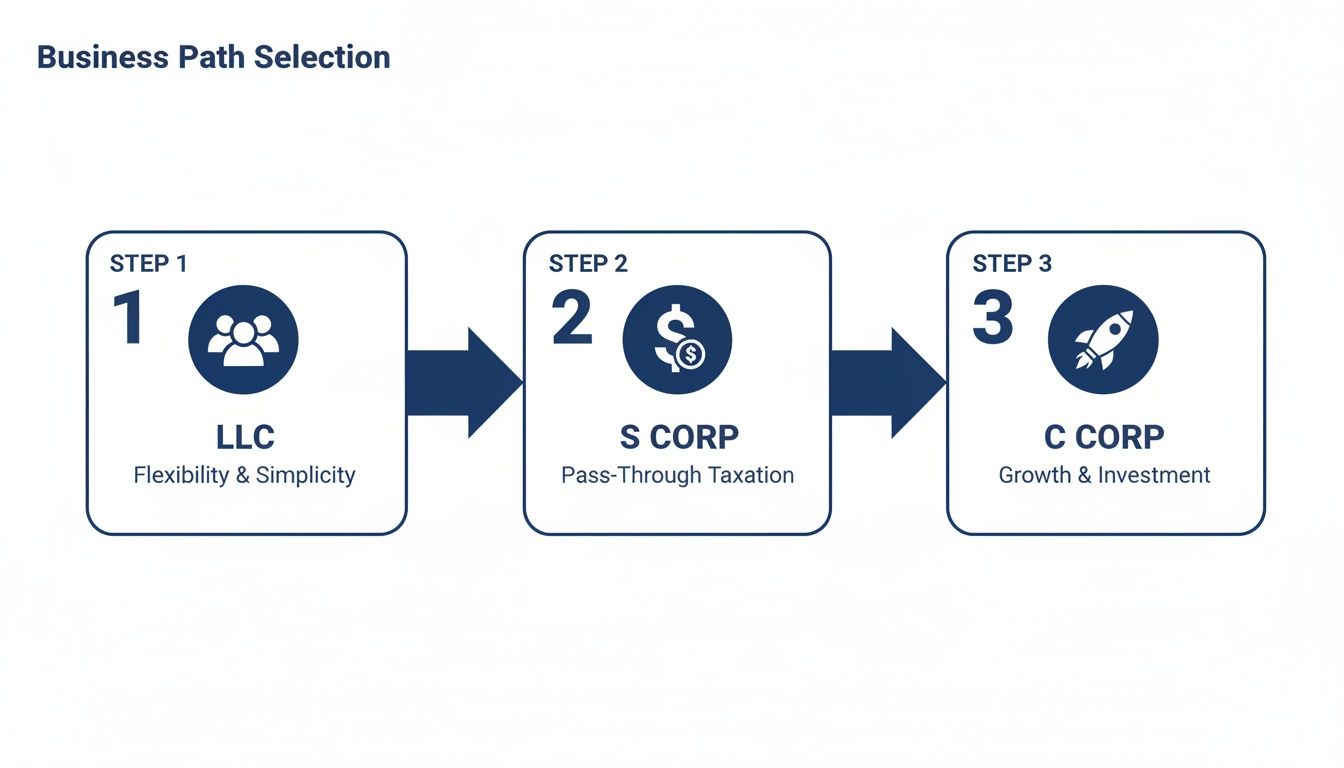

This visual gives you a good sense of the typical journey founders take, often landing on the C corp when growth and investment become the primary goals.

As you can see, each structure has its place. The C corp is the go-to vehicle when you're building a scalable, investor-ready venture.

Choose the Right State for Incorporation

Your first big decision is where to form your company. You can incorporate in any of the 50 states, and you don't have to choose the state where you have a physical office. For this reason, most non-residents gravitate toward states known for their business-friendly laws, predictable court systems, and founder privacy.

Delaware is the undisputed heavyweight champion, especially for startups planning to raise venture capital. A staggering 68% of Fortune 500 companies call it home. Its specialized Court of Chancery deals only with corporate law, which gives investors and founders a ton of confidence. Wyoming and Nevada are also excellent alternatives, particularly for their strong privacy protections and zero state corporate income tax.

Appoint a Registered Agent

Every single corporation in the U.S. is required by law to have a Registered Agent. This is a person or a company that agrees to be the official point of contact for receiving legal documents and government mail on your company's behalf. Crucially, they must have a physical street address (no P.O. boxes) in your state of incorporation and be available during normal business hours.

For any founder who isn't physically in the state, hiring a commercial registered agent service isn't just a good idea—it's a necessity. They handle this legal requirement for you, making sure you never miss a critical tax notice or legal summons. It’s a foundational piece of your compliance puzzle. If you want to dive deeper, you can explore more about what a registered agent service is in our essential guide for new U.S. businesses.

File Articles of Incorporation

This is the moment your company officially comes to life. The Articles of Incorporation (sometimes called a Certificate of Incorporation) is the legal document you file with the Secretary of State in your chosen state.

This document is usually pretty straightforward and includes:

Your official company name.

The name and address of your Registered Agent.

The total number of shares the corporation is authorized to issue.

The name and address of the person filing the document (the incorporator).

Once the state approves this filing, your C corporation legally exists.

Think of the Articles of Incorporation as your company's birth certificate. It’s the formal document that establishes your C corporation as a distinct legal entity, separate from its owners.

Get Your Employer Identification Number (EIN)

With your company officially formed, the next step is getting an Employer Identification Number (EIN) from the IRS. This nine-digit number is essentially a Social Security Number for your business. You absolutely need it to open a bank account, hire employees, and file your federal taxes.

For non-residents without a U.S. Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), the process is a bit different. You must file Form SS-4, typically by fax or mail. This is a common bottleneck for international founders, and getting it wrong can cause major delays. Having an expert guide you here is invaluable.

Open a US Business Bank Account

You've got your formation documents and your EIN. Now you can finally open a U.S. business bank account. This step is non-negotiable. It keeps your business finances completely separate from your personal money, which is vital for protecting that corporate liability shield we talked about.

While many traditional banks still require you to show up in person, a new wave of fintech platforms and startup-friendly banks are making remote account opening a reality for international founders. A dedicated U.S. bank account makes it a breeze to accept payments from American customers, track expenses, and manage your cash flow.

It’s a detailed process, but getting these steps right from the beginning is the bedrock of your U.S. expansion and saves you from a world of headaches down the road.

Navigating all of this from another country can be tough. The team at Read & Associates handles every single step for our clients, from state selection to bank account guidance, to make sure your C corp is set up for success. Contact us today for a consultation and let's get you started.

Keeping Your C Corporation Running Smoothly After Launch

Getting your C corporation formed is a huge accomplishment, but it's really just the starting line. Think of it like buying a new car; the real work is in the regular maintenance that keeps it running perfectly. For a C corp, this "maintenance" involves a set of non-negotiable rules called corporate formalities, and they are essential for keeping your company in good standing.

These aren't just bureaucratic suggestions—they're legal requirements that prove your corporation is a real, separate entity, not just a personal piggy bank. Ignoring these steps is one of the quickest ways to lose the very liability protection you formed the company for in the first place. This ongoing compliance is what keeps the legal "fortress" around your personal assets strong.

The Nuts and Bolts of Corporate Formalities

To protect your company's legal status, you must treat it like a separate entity. That means documenting major decisions and holding regular meetings to show there's proper governance and oversight.

Here are the key things you can't skip:

Hold Annual Meetings: You need to hold formal meetings for both your board of directors and your shareholders at least once a year.

Keep Detailed Minutes: Every important decision made in those meetings has to be recorded in official documents known as corporate minutes. This creates a vital paper trail of your company's actions.

Maintain Corporate Bylaws: Your bylaws are the official rulebook for your company. You have to keep them current and, more importantly, actually follow them.

Taking these steps shows that your business is a properly managed organization, not just a casual extension of its owners.

The Danger of “Piercing the Corporate Veil”

So, what’s the worst-case scenario if you ignore these formalities? You could face a legal nightmare known as piercing the corporate veil. This is a legal concept that allows a court to completely disregard your corporation’s limited liability shield, making you personally responsible for its debts and lawsuits.

Imagine your corporation is a suit of armor protecting your personal finances. Failing to follow the rules creates chinks in that armor, leaving you vulnerable if the business gets into legal or financial trouble.

This can happen if you mix business and personal funds, don't keep good records, or just skip the required meetings. All of a sudden, that fortress you built is gone, and your personal savings, your house, and other assets are at risk.

Annual State Filing Requirements

On top of the internal rules, you also have annual duties to the state where you incorporated. These are non-negotiable tasks that keep your C corporation active and compliant.

The most common requirements include:

Filing an Annual Report: Most states make you file a report each year to update basic company information, like your business address and the names of your current directors and officers.

Paying Franchise Taxes: Some states, most notably Delaware, charge an annual franchise tax. This is basically a fee you pay for the privilege of keeping your company registered there.

Maintaining a Registered Agent: You are required to have a registered agent in your state of incorporation at all times. If you ever need to switch providers, you can learn how to change your registered agent in our guide for U.S. business owners.

Juggling these responsibilities can be a real challenge, especially when you're managing the business from another country. That’s where having a reliable partner makes all the difference. At Read & Associates, we take care of your ongoing compliance so your C corporation stays on solid legal ground, freeing you up to focus on growing your business. Contact us for a consultation to see how we can handle these details for you.

What's the Next Step for Your U.S. Venture?

Picking the right business entity isn't just a box to check—it's one of the first and most critical decisions you'll make. It sets the entire foundation for your company's future.

Throughout this guide, we've unpacked the C corporation, showing how it offers incredible liability protection and why it’s the go-to choice for founders who want to attract serious investors. The main trade-off, as we've seen, is the double-taxation structure. Ultimately, the best choice boils down to what you're trying to build.

Are you aiming for massive growth fueled by venture capital? The C corp is almost certainly the right move. Are you an international founder looking for a trusted, globally recognized way to plant your flag in the U.S. market? The C corp was practically built for that.

Choosing your entity isn't just a startup task; it's a long-term strategic decision. Getting it right from day one saves you a mountain of headaches and expensive restructuring down the road. It directly impacts your taxes, your ability to raise money, and how you grow.

Now, it’s time to shift from learning to doing. The single most important thing you can do right now is talk through your specific situation with someone who has navigated this process hundreds of times. A real expert can take all this information and help you build a clear, actionable plan that fits your business, not someone else's. This isn't a decision to leave to guesswork.

Let our team at Read & Associates Inc. help you get it right from the very beginning. We specialize in assisting business owners like you in forming and managing their U.S. entities, ensuring they are structured for long-term success. Reach out for a no-obligation consultation today.

Comments