What Is Sales Tax Nexus: A Guide for U.S. Business Owners

- Read & Associates

- Jan 18

- 12 min read

At its core, sales tax nexus is the connection between your business and a U.S. state that legally obligates you to collect and remit sales tax on your transactions there. For business owners, especially those new to the U.S. market, understanding this concept is not just important—it's foundational to operating legally and avoiding costly penalties.

What is Sales Tax Nexus Explained

Imagine a "tripwire" at every state border. When your business activities cross a certain threshold, you've tripped the wire, creating a tax obligation. From that point on, you are responsible for collecting that state's sales tax. This is a critical concept for anyone selling to U.S. customers, whether your business is based in Austin or Amsterdam.

Historically, that tripwire was purely physical. If you had an office, an employee, or a warehouse in a state, you had nexus. The rules were straightforward. But the explosion of e-commerce shattered that old model, forcing a complete rethinking of what "presence" really means for a modern business.

The Two Pillars of Nexus

Today, nexus generally stands on two main pillars. Each has its own set of rules, and as a business owner, you must understand both to maintain compliance and avoid unexpected financial liabilities.

Physical Nexus: This is the traditional standard, created by having a tangible footprint in a state. It covers obvious connections like a retail store or warehouse, but it also includes less obvious links, such as storing inventory in a third-party fulfillment center.

Economic Nexus: This is the modern standard, based entirely on your sales activity. Even with zero physical presence, you can establish nexus simply by selling enough. If your sales revenue or transaction volume in a state crosses a certain threshold within a year, you are required to collect sales tax.

The logic behind nexus is straightforward: if your business benefits from a state's economy and its residents, the state expects you to contribute to its public services—like roads, schools, and infrastructure—by collecting sales tax.

For remote sellers and international founders, economic nexus has completely changed the game. A successful marketing campaign driving orders from California, or a popular software tool taking off in New York, can create a tax obligation overnight—even if you've never set foot in the United States.

This guide will break down how to map your nexus footprint, get registered, and handle your ongoing tax duties, transforming a complex topic into a clear, manageable action plan for your business.

Understanding Physical vs Economic Nexus

Sales tax nexus isn’t a single, uniform rule. To properly manage your obligations, you must understand its two main forms: physical nexus and economic nexus. Each represents a different way your business can be connected to a state, and meeting either one can trigger the requirement to collect and remit sales tax.

For decades, physical nexus was the only standard. It’s the classic, most intuitive form of a business connection—it’s all about having a tangible, physical footprint within a state's borders. Think of it as the traditional definition of being "present."

This presence can be as clear-cut as owning a retail shop, leasing an office, or running a warehouse. What often catches business owners off guard, especially those with remote teams or complex supply chains, are the less obvious activities that also create a physical link.

The Scope of Physical Presence

A physical footprint is about more than just real estate. Many common business activities can establish physical nexus, often without the business owner realizing the tax implications.

Remote Employees or Contractors: A single employee working from their home in another state is often enough to create physical nexus. This isn't just for salespeople; it applies to customer support representatives, developers, or any other staff.

Storing Inventory: Using a third-party logistics (3PL) provider or a fulfillment service like Fulfillment by Amazon (FBA) means your products are stored in their warehouses. If that warehouse is in a state where you don't have an office, you now have physical nexus there.

Temporary Presence: Even short-term business activities can be enough. Attending a trade show where you make sales, sending a technician to perform on-site services, or having sales reps travel to meet clients can all trigger nexus.

Having a physical presence means your business benefits from a state's infrastructure—its roads for deliveries, its workforce, and its public services. In return, the state requires you to act as its agent in collecting sales tax.

This traditional standard worked when most commerce was local. But as e-commerce allowed businesses to sell across the country, it became clear a new standard was needed. That’s what led to the rise of economic nexus.

The Modern Standard of Economic Nexus

For any e-commerce store, SaaS company, or international business selling into the U.S., economic nexus is the new reality. It creates a connection based purely on your sales volume in a state, completely detached from your physical location.

This entire concept was solidified by a landmark Supreme Court case, which we'll explore next. It gives states the authority to require out-of-state sellers to collect sales tax once their sales revenue or transaction count in that state crosses a specific threshold within a 12-month period.

For instance, a state might set its threshold at $100,000 in sales or 200 separate transactions. If your business crosses either of those lines, you’ve established economic nexus. You now have a legal obligation to register and collect sales tax there, even without a single employee, piece of inventory, or office in that state.

A firm grasp on both physical and economic nexus is critical. It’s entirely possible for a business to have physical nexus in one state while triggering economic nexus in a dozen others, creating a complex web of tax duties that you must stay on top of to protect your business.

How the Wayfair Ruling Rewrote the Rules

To truly understand modern sales tax compliance, you need to know about one Supreme Court case that completely overturned decades of tax law. For years, the landscape was governed by a 1992 ruling, Quill Corp. v. North Dakota. The rule it established was simple: a business only had to collect sales tax in a state where it had a physical presence.

This meant an online retailer could ship products all over the country without collecting sales tax in most states. This gave booming e-commerce companies a significant advantage over local, main-street businesses that had to collect tax on every sale.

As online sales exploded, states watched billions in potential tax revenue disappear. They began to argue that the Quill rule was hopelessly outdated for an internet-driven economy, setting the stage for a legal battle that would redefine the meaning of sales tax nexus.

The Wayfair Earthquake

That landmark moment came on June 21, 2018, with the Supreme Court's decision in South Dakota v. Wayfair. In a 5-4 ruling, the court officially threw out the old physical presence rule from Quill. For any business selling remotely, this was an absolute earthquake. You can find more insights into the U.S. sales tax landscape on Kreston.com.

The ruling gave individual states the authority to create their own "economic nexus" laws. This was a game-changer. It meant states could now require remote sellers to collect sales tax based purely on their sales figures or number of transactions in that state—no physical footprint required. The response was immediate. By 2023, all 45 states with a statewide sales tax had implemented economic nexus rules.

This single decision changed everything. Suddenly, millions of remote sellers, SaaS companies, and international businesses became responsible for collecting sales tax in states they had never even set foot in.

What This New Reality Means for Your Business

The post-Wayfair world is, in a word, complex. A business based anywhere—from Florida to France—can now find itself responsible for sales tax in dozens of states at once, simply by selling to customers there. One successful product launch or a viral marketing campaign can trigger nexus practically overnight.

This new reality demands a proactive approach to tax compliance. You must meticulously track your sales on a state-by-state basis to know if you're approaching an economic threshold. The days of "out of sight, out of mind" for sales tax are long gone. For any modern business selling in the U.S., active nexus management has become a non-negotiable part of staying compliant and mitigating risk.

Navigating the Maze of State-by-State Thresholds

The Wayfair decision gave states the authority to create their own economic nexus laws, but it didn't create a single, nationwide rulebook. This is where the real challenge begins for business owners. Instead of one standard to follow, you are faced with a complex patchwork of unique rules for almost every state.

Keeping track of these differences isn't just an administrative task; it's fundamental to staying compliant and protecting your business. Your sales figures might be well under the threshold in one state but could easily push you over the nexus line in another. You cannot treat all states the same when it comes to sales tax.

Ignoring these nuances can lead to significant compliance issues, including back taxes and penalties you never anticipated. A one-size-fits-all approach is a recipe for trouble.

The Most Common Thresholds You'll See

While every state has its own rules, a common standard has emerged. By 2023, every state with a sales tax had an economic nexus law, but their triggers vary. The most common benchmark, adopted by roughly 30 states, is $100,000 in annual gross sales OR 200 separate transactions into the state. If you cross either of those lines in a 12-month period, you have nexus. For a deeper dive, you can explore detailed guides on state-by-state economic nexus laws from Wolters Kluwer.

A 2022 survey revealed that 68% of small businesses found nexus compliance significantly more complex after the Wayfair ruling. That statistic highlights just how challenging it is for entrepreneurs to keep up with these constantly shifting rules on their own.

Remember, it’s usually an "either/or" situation. You could make just 10 large sales that total $120,000 and trigger nexus on revenue alone. Conversely, you could sell 250 small items for a total of only $20,000 and still trigger it by crossing the transaction threshold.

Key State Exceptions to Watch Out For

The real complexity comes from states that have created their own unique rules. Several major markets have set different thresholds, and if you're selling nationwide, it is essential to know what they are.

Here are a few of the major exceptions that demonstrate how different the rules can be:

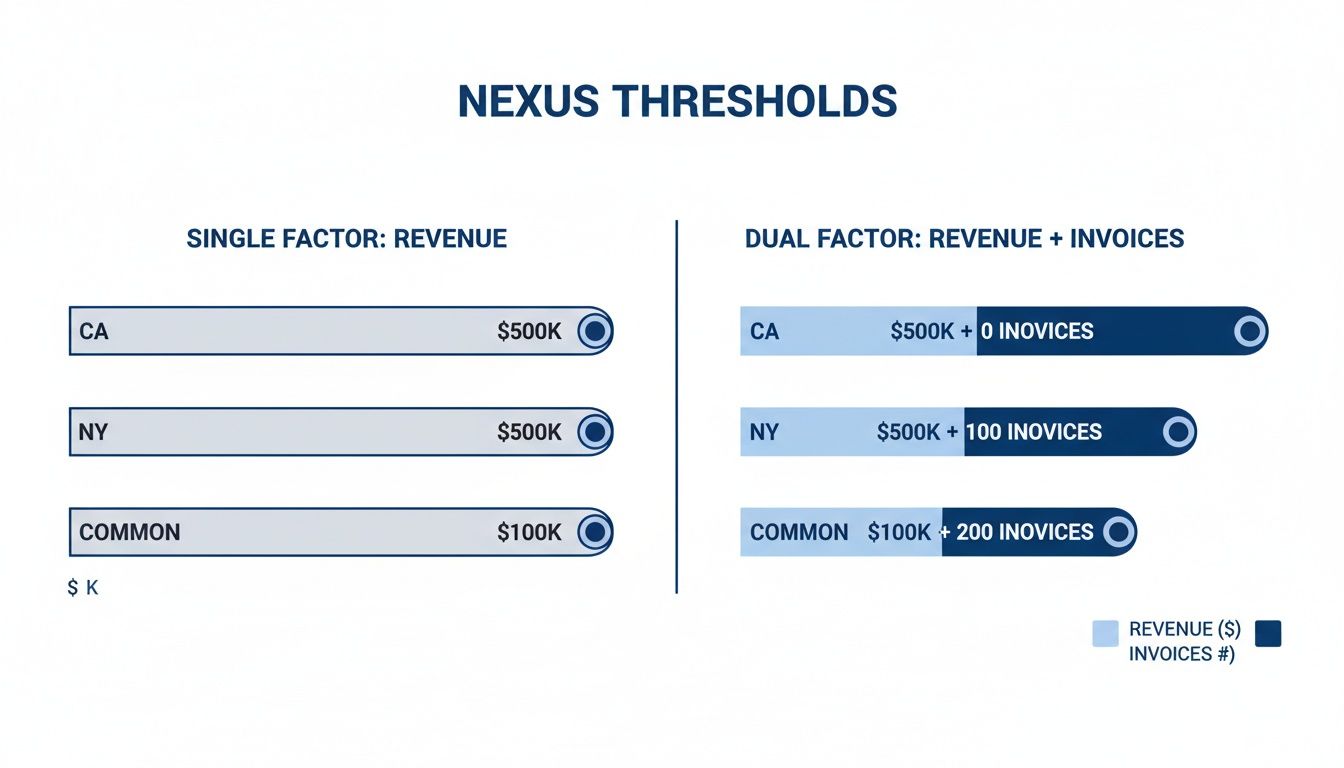

California & Texas: As two of the largest economies, these states offer sellers more room with a much higher, sales-only threshold of $500,000. They have eliminated the transaction count, so you only need to monitor your gross sales.

New York: New York is unique because it uses an "and" condition. You only create economic nexus if you meet both the sales and transaction thresholds: over $500,000 in gross sales and more than 100 separate transactions.

States Ditching the Transaction Count: A growing number of states are simplifying their rules. Places like Iowa, North Dakota, and Washington have recently dropped their 200-transaction rule, focusing solely on the $100,000 sales trigger.

This variety of rules makes it essential to view your nexus footprint as a dynamic aspect of your business, not a one-time calculation.

To give you a clearer picture of this patchwork, here’s a look at the different thresholds in a few key states.

Sample Economic Nexus Thresholds Across Key U.S. States

State | Sales Threshold | Transaction Threshold |

|---|---|---|

Florida | $100,000 | None |

Illinois | $100,000 | 200 Transactions |

California | $500,000 | None |

Texas | $500,000 | None |

New York | $500,000 and | 100 Transactions |

Pennsylvania | $100,000 | None |

As you can see, what triggers nexus in Illinois is completely different from what triggers it in California or New York. For any business selling across the U.S., particularly one based internationally, this complexity sends a clear message: obtaining expert guidance isn't a luxury—it's a necessity for growing safely in the American market.

Your Four-Step Nexus Compliance Action Plan

Understanding that you have a sales tax obligation is the first hurdle. But knowledge alone isn't enough—taking concrete action is what protects your business. Once you’ve determined you have a connection to a state, you need a clear, repeatable process to manage your responsibilities.

Think of this simple four-step framework as your compliance roadmap. It breaks down a daunting challenge into manageable stages, helping you turn uncertainty into a structured strategy.

Step 1: Map Your Nexus Footprint

Before you can do anything else, you must determine exactly where you have nexus. This isn't a one-time check; it's an ongoing process of monitoring both your physical presence and your economic activity across all 50 states.

Start by analyzing your sales data from the last 12 months. Identify every state where your sales have crossed the economic threshold, whether based on revenue or transaction count. Simultaneously, map out any physical ties you may have, including:

Locations of your remote employees

Inventory stored in warehouses (including third-party logistics, or 3PLs)

Consistent business travel for sales meetings or trade shows

Step 2: Register for Sales Tax Permits

Once you have your list of nexus states, the immediate next step is to register for a sales tax permit in each one. This is non-negotiable. You cannot legally collect sales tax from customers until you have an official permit from that state’s department of revenue.

Be prepared for a detailed process, as every state has its own unique registration forms and required information. You will need to provide details like your business entity type, EIN, and a summary of your sales activities. Do not delay this step—collecting tax without a permit is illegal, and failing to register on time can lead to significant penalties.

The infographic below illustrates how different state thresholds can be, which is why a state-by-state analysis is so critical.

As you can see, there’s a big difference between a high-threshold state like California and the much more common $100,000 or 200 transaction rule that many others follow.

Step 3: Set Up Correct Tax Collection

With your permits secured, it’s time to begin collecting tax. This means configuring your e-commerce platform, marketplace accounts, or invoicing software to apply the correct sales tax rates at the point of sale.

This is rarely as simple as plugging in a single statewide rate. You must account for thousands of local jurisdictions—cities, counties, and special districts—that often have their own tax rates. If this is done incorrectly, you could be under-collecting and find yourself liable for the difference.

This is where automated tax software becomes an invaluable tool. These systems calculate the precise rate based on the customer's exact address, ensuring you collect the right amount on every transaction.

Step 4: File Returns and Remit Taxes on Time

The final step is the ongoing responsibility of filing sales tax returns and remitting the money you've collected to the appropriate states. Each state will assign you a filing frequency—usually monthly, quarterly, or annually—based on your sales volume.

Missing these deadlines is a costly error. States are quick to apply significant penalties and interest charges for late filings, and these costs can accumulate quickly. This four-step plan empowers you to manage your compliance, but the significant administrative burden is exactly why so many business owners turn to an expert firm to ensure it's done right from the start.

Got Questions About Sales Tax Nexus? We've Got Answers.

When business owners start digging into sales tax nexus, the same practical questions always seem to pop up. Let's tackle some of the most common ones we hear from entrepreneurs, especially those venturing into the U.S. market for the first time.

Do I really need to worry about this for digital products or SaaS?

Yes, absolutely. This is a common point of confusion for many global software founders.

The days when sales tax only applied to physical goods are long gone. States have updated their laws, and the vast majority now consider digital products, software-as-a-service (SaaS), and streaming content to be taxable. If your sales from these digital offerings cross a state's economic nexus threshold, you have an obligation to register and collect tax, just like a retailer selling physical goods.

What’s the worst that can happen if I just ignore it?

Ignoring your nexus obligations is a significant business risk. Sooner or later, states will identify non-compliance, often through an audit. When they do, the consequences are severe.

You will be held liable for all the sales tax you should have collected in previous years. On top of that, they will add penalties—which can easily be 25% or more of the tax you owe—plus daily compounding interest.

What begins as a small oversight can quickly snowball into a massive back-tax liability that puts your entire business at risk. It’s a financial hole that is very difficult to climb out of.

How often do I need to check for nexus?

Treat nexus as a dynamic part of your business operations, not a one-time checklist item. Your business is always evolving, and so is your nexus footprint.

At a minimum, you should conduct a comprehensive nexus review annually. However, a re-evaluation is necessary whenever a major operational change occurs.

For instance, you should immediately review your status if you:

Hire your first employee or a key contractor in a new state.

Notice your sales data shows you've crossed a new state's revenue threshold.

Begin using a new warehouse or fulfillment partner like Amazon FBA.

Proactive monitoring is the only way to stay compliant and avoid costly surprise assessments from a state tax agency.

Let the Experts Handle Your U.S. Tax Headaches

Let’s be honest: trying to untangle sales tax nexus on your own is a huge distraction. It pulls you away from what you should be focused on—growing your business. The rules are constantly shifting, and the sheer administrative burden of tracking thresholds and filing in dozens of states can be overwhelming, especially for an international founder entering the U.S. market.

This is where seeking professional help isn't just a good idea; it's a strategic decision.

The stakes are high. Mismanaging nexus can lead to serious financial consequences, from crippling back-tax bills to penalties that could jeopardize your company's future. When your U.S. success is on the line, "winging it" is not a viable strategy. Don't let the maze of sales tax rules stall your momentum.

Navigating U.S. tax law requires more than just software. It demands a strategic partner who has experience in the trenches and understands the unique hurdles that business owners, particularly non-residents, face.

At Read & Associates Inc., we live and breathe this so you don’t have to. Think of us as your dedicated U.S. tax and compliance team. We will handle the detailed nexus analysis, get you registered in the correct states, and manage your ongoing bookkeeping and tax filing to ensure you remain fully compliant.

We take the complexity off your plate, giving you the peace of mind to build your business with confidence. Let us manage the tax details so you can focus on your vision.

Ready to operate in the U.S. without the tax headaches? Contact Read & Associates Inc. for a consultation and start building your business on a solid foundation.

Comments