Your Expert Guide to Getting a Florida Resellers Permit

- Read & Associates

- Jan 22

- 15 min read

If your business buys inventory in Florida to sell to customers, you need what's officially called an Annual Resale Certificate—commonly known as a reseller's permit. As a business owner, this document is one of your most valuable tools, allowing you to purchase goods from suppliers without paying sales tax upfront.

The entire system is designed to prevent double taxation. You don't pay tax on the inventory you acquire because the responsibility for collecting that tax shifts to you when you make the final sale to your customer. For any business owner, especially one new to the U.S. market, mastering this process is fundamental to managing cash flow and establishing a compliant, successful operation.

Understanding the Florida Resellers Permit

Think of the reseller's permit as a state-issued pass. When you present it to your Florida-based supplier, they are legally authorized to sell you inventory tax-free. In exchange, you accept the duty of collecting the appropriate sales tax when you sell that product to the end consumer.

This system is administered by the Florida Department of Revenue and is the cornerstone of the state's retail and e-commerce ecosystem. Without a valid permit, you would be forced to pay sales tax on your inventory, only to charge your customers sales tax again. This double taxation erodes your margins and puts you at a significant competitive disadvantage.

To provide clear, actionable information for business owners, here is a summary of the most important details.

Florida Resellers Permit At a Glance

Concept | Key Detail | Importance for Your Business |

|---|---|---|

Official Name | Annual Resale Certificate | This is the official term used by the Florida Department of Revenue. Using it demonstrates professional understanding. |

Main Purpose | Buy inventory tax-free for resale. | Directly improves your cash flow by preserving working capital instead of tying it up in sales tax payments. |

Tax Responsibility | Shifts from you to the end customer. | You collect tax from your customer and remit it to the state, ensuring proper compliance. |

Validity | Expires on December 31st each year. | Requires annual renewal, which is typically automatic for compliant businesses, ensuring your records are current. |

Issuing Authority | Florida Department of Revenue | You must first register with them to collect sales tax to obtain the certificate. |

Jurisdiction | Florida-specific | Florida does not accept out-of-state resale certificates, making a Florida permit mandatory for tax-free purchases within the state. |

Mastering these fundamentals is the first step. Understanding how the permit applies to real-world business scenarios is where you can truly leverage its value.

Who Actually Needs a Resale Certificate?

Any business purchasing goods with the clear intention of reselling them needs a Florida Annual Resale Certificate. This requirement isn't limited to traditional brick-and-mortar stores; it applies universally across modern business models.

Here are a few common examples our clients encounter:

E-commerce Stores: An online boutique sourcing apparel from a Miami-based wholesaler requires a certificate to acquire that inventory tax-free.

Dropshippers: If you partner with a Florida supplier to ship products directly to your customers, you must provide them with your resale certificate. This is non-negotiable.

International Founders: We frequently guide non-resident entrepreneurs through this process. If your U.S. LLC buys electronics from a Tampa distributor to sell internationally, this permit is essential for avoiding U.S. sales tax on those bulk purchases.

Wholesalers & Manufacturers: Even if your business buys raw materials to create a finished product that you then sell to other businesses, the certificate is used for those initial component purchases.

At its core, the Florida Annual Resale Certificate is a tool for managing cash flow and ensuring tax compliance. It signals to the state and your suppliers that you are a legitimate reseller participating correctly in the sales tax system.

The Real Benefits and Key Features

The advantages of obtaining your Florida reseller's permit are immediate and directly impact your bottom line. It’s an indispensable step for any serious business owner operating in or sourcing from the Sunshine State.

Here’s a clear rundown of what this permit empowers your business to do:

Tax-Exempt Purchases: This is the primary benefit. You can purchase products for resale without paying sales tax upfront, which frees up a significant amount of working capital for growth.

Compliance and Legitimacy: Possessing a valid certificate proves your business is properly registered with the Florida Department of Revenue, a credential that suppliers require.

Annual Renewal: The certificate is issued annually and always expires on December 31st. This automated process helps ensure your registration details remain current with the state.

A Florida-Only Requirement: This is a critical distinction for business owners to understand. Unlike some states, Florida does not recognize resale certificates from other jurisdictions. To obtain a Florida permit, you must be registered in Florida to collect and remit sales tax.

Navigating this process is the first real step toward building a compliant and profitable business in the U.S. For founders, especially those based internationally, getting a handle on these foundational requirements is crucial. If you're feeling a bit lost on how this applies to your specific business, our team at Read & Associates Inc. is here to provide the expert guidance you need.

What You Need Before You Start

Attempting the Florida reseller’s permit application without proper preparation is a common misstep that leads to delays and frustration. A strategic approach involves gathering all necessary documentation before you begin. This is particularly vital for international founders, for whom a few key documents form the entire foundation of their U.S. business.

First and foremost, you need a legally registered U.S. business entity. Before you can address sales tax, you must have an official business structure, such as an LLC or a C Corporation. The Florida Department of Revenue interacts with your company, not with you as an individual.

The All-Important EIN for International Founders

If you are not a U.S. resident, the single most critical document is your Employer Identification Number (EIN). This is a federal tax ID issued by the IRS. For business purposes, it serves the same function as a Social Security Number (SSN) does for a U.S. citizen.

For an international entrepreneur without an SSN, the EIN isn't optional—it's everything. It’s the key that unlocks your ability to register with state authorities like the Florida Department of Revenue. An application submitted without an EIN will be rejected.

Obtaining an EIN is a separate process from forming your company, and it must be completed before you begin the state registration for your reseller’s permit. It is what validates your business in the eyes of U.S. tax agencies.

Your Essential Application Checklist

With your business entity formed and your EIN secured, you are well-positioned to proceed. However, there are a few other details you’ll want to have organized before you start the application. This preparation prevents scrambling for information mid-process.

Here is a checklist of what to have ready:

Legal Business Name and Address: This must be the official name and U.S. business address associated with your LLC or corporation. For many online sellers, this is the address provided by your registered agent service.

Federal Employer Identification Number (EIN): As emphasized, this is essential for non-residents. We recommend having your official IRS confirmation letter (CP 575) accessible.

Business Start Date in Florida: You will be required to provide the date your business activities officially established a connection (nexus) with Florida.

Primary Business Activity (NAICS Code): You must classify your business using the North American Industry Classification System (NAICS) code. For example, the code for "Electronic Shopping" is 454110. You can look up your specific code on the official NAICS website.

Owner and Officer Information: Be prepared to provide the names, addresses, and official titles for all company owners or officers.

Organizing these five items before you access the Florida Department of Revenue’s portal is the most effective way to ensure a smooth registration. It is the difference between a quick, successful application and a protracted process involving requests for additional information. If you encounter challenges with any of these steps, particularly company formation or obtaining an EIN, seeking expert assistance can save you invaluable time and resources.

How Florida's Digital Sales Tax System Works

Florida has made significant strides in modernizing its sales tax system, which is a major advantage for remote and e-commerce business owners. The state’s digital framework is designed for efficiency, simplifying compliance obligations for obtaining and managing a Florida reseller's permit.

This technology-forward approach is particularly beneficial for our international clients. Managing state tax regulations without a physical U.S. office can be a daunting task, but Florida’s online tools transform a potentially complex process into a manageable one. It is a prime example of why the state is known for its business-friendly environment.

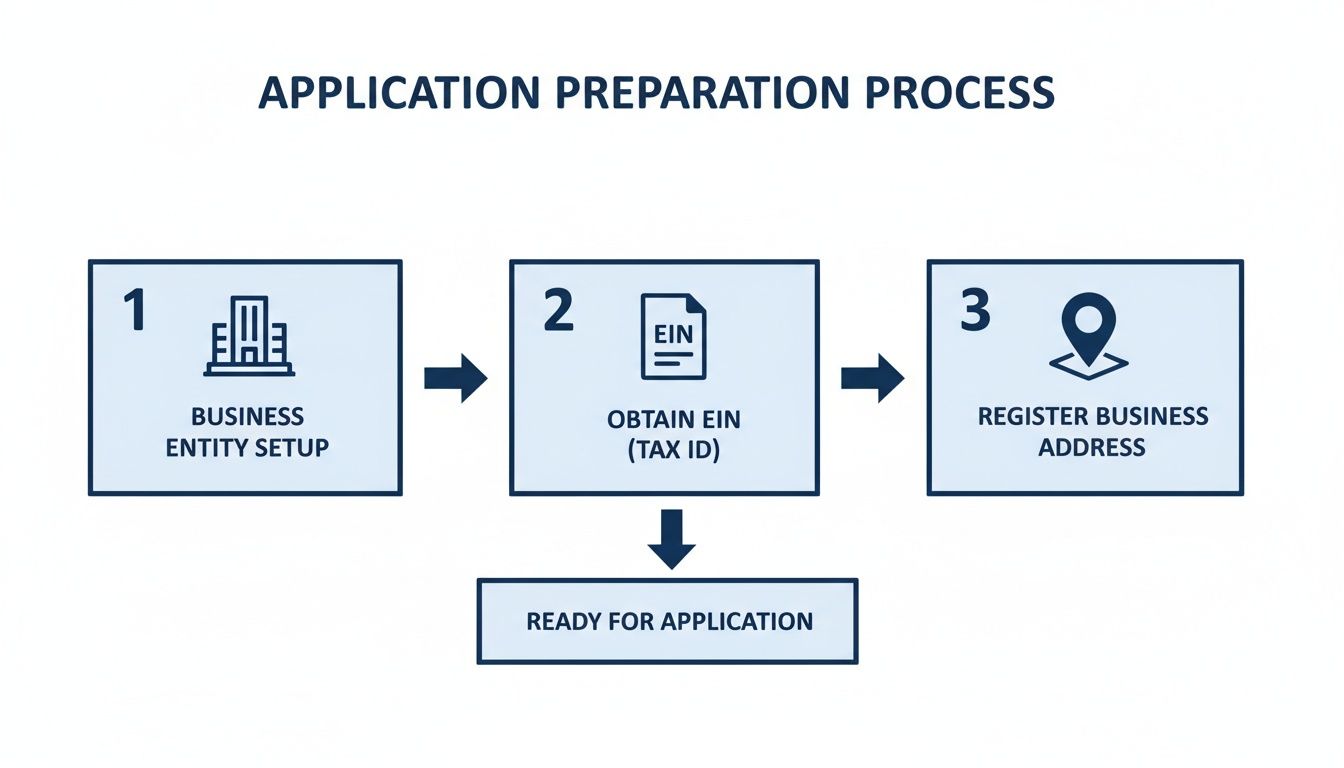

Before engaging with the state's system, a few foundational steps must be completed. This graphic outlines the necessary preparation.

As illustrated, establishing a legal business entity and obtaining an EIN are non-negotiable prerequisites. These must be in place before you can apply for the permit itself.

Your Three Options for Documenting Tax-Exempt Sales

Florida provides sellers with three distinct methods for documenting tax-exempt sales for resale. This flexibility allows you to choose the approach that best aligns with your business model—whether you handle a few large B2B orders or thousands of smaller wholesale transactions. Each of these methods is fully compliant and recognized by the Florida Department of Revenue.

A key update for business owners to note: as of 2025, Florida requires any business making tax-exempt purchases for resale to have an Annual Resale Certificate, which expires on December 31st each year. The state provides multiple ways for you, the seller, to document these sales, including convenient phone and online verification options. You can always explore the detailed state guidelines for in-depth information on Florida's tax regulations.

Let’s review the three primary methods available to your business.

Method 1: The Classic Paper Trail

This is the traditional, proven approach. When a customer with a Florida reseller's permit purchases from you tax-free, you obtain a copy of their Annual Resale Certificate. This can be a physical photocopy or a digital file, such as a PDF.

Your only responsibility is to maintain that certificate on file for at least three years. This method is well-suited for businesses with a limited number of repeat wholesale clients, where document collection and storage are not burdensome.

Method 2: Instant Digital Verification

For businesses prioritizing speed and efficiency—such as e-commerce stores or high-volume retail operations—Method 2 is an excellent choice. Instead of collecting and storing a certificate, you can verify the transaction directly with the Florida Department of Revenue in real-time.

You accomplish this by obtaining a transaction-specific authorization number at the point of sale via one of two channels:

Online Portal: Access the state's Seller Certificate Verification application, enter the buyer's certificate number, and receive immediate authorization.

Phone Verification: Call the toll-free number at 877-FL-RESALE (877-357-3725) to receive a verbal authorization number.

This instant verification method completely eliminates the need for document storage. It provides immediate confirmation of a buyer's tax-exempt status, which is ideal for integration into an online checkout process for a seamless customer experience.

Method 3: Batch Processing for High-Volume Sellers

This is the most powerful option for businesses with a large, consistent base of resale customers. Method 3 allows you to obtain a single annual vendor authorization number for each customer, valid for the entire calendar year.

Instead of verifying each purchase individually, you can submit a batch file of all your resale customers' certificate numbers to the Department of Revenue's online portal. The system processes the data and returns a corresponding list of annual vendor authorization numbers. For any business with significant wholesale operations, this approach is a major time-saver that dramatically reduces administrative workload.

Ultimately, the optimal method depends on your sales volume and customer base. Many of our clients utilize a hybrid approach—using Method 1 for infrequent buyers while relying on Methods 2 or 3 for regular clients. Taking the time to understand these options is key to making Florida’s system work for you. If you are unsure which strategy is best for your business, a consultation with an expert can provide clarity and ensure you are set up for success.

How to Use and Manage Your Florida Reseller Permit

Obtaining your Florida reseller permit is a significant achievement, but effective management is where the real work begins. Your day-to-day operational habits determine your long-term compliance. This is not merely about paperwork; it's about establishing robust, compliant processes from the start to avoid future penalties and audits.

The process is straightforward. When you purchase inventory from a supplier, you present them with your Annual Resale Certificate. They retain a copy as their legal justification for not charging you sales tax. This simple exchange is the core of how tax-exempt purchasing functions in Florida.

Staying on Top of Record-Keeping

The Florida Department of Revenue has stringent record-keeping requirements. You are legally obligated to maintain all records related to your tax-exempt purchases for a minimum of three years. This is a mandate, not a suggestion. In the event of an audit, you will be required to produce these documents to verify the legitimacy of your purchases.

The three-year period begins from the date the tax would have otherwise been due. To ensure full compliance, your files should include:

Copies of every resale certificate you have provided to a vendor.

The corresponding invoices from your suppliers, which should clearly indicate the purchase was tax-exempt.

Detailed records that trace the purchased inventory to its final sale to a customer.

Failure to produce these documents during an audit can lead the state to reclassify those purchases as taxable. This could result in a significant liability for back taxes, interest, and steep penalties.

Common Traps to Watch Out For

We have seen many business owners, particularly those new to the U.S. market, encounter a few common pitfalls with their Florida reseller permit. Avoiding these is critical to maintaining your business's good standing.

The most frequent mistake is using the permit for purchases of items that are not intended for resale.

Your Annual Resale Certificate is exclusively for inventory—items you plan to sell. Using it to buy business supplies or personal goods is illegal and constitutes a major compliance violation that can trigger an audit.

To be perfectly clear, do not use your permit for:

Office Supplies: Items like desks, computers, or office chairs are for business operations, not for resale. You must pay sales tax on them.

Personal Purchases: Using your business's resale certificate for personal shopping is a serious offense with severe consequences.

Marketing Materials: Business cards, promotional flyers, and website hosting are operational expenses. They are not inventory and are fully taxable.

Don't Forget the Annual Renewal

A crucial detail about the Florida permit is that it's an Annual Resale Certificate. This means it expires on December 31st of every year.

Fortunately, the renewal process is typically automatic. As long as your business remains active and you have been filing and remitting sales tax correctly, the Florida Department of Revenue will usually mail you a new certificate for the upcoming year without requiring a new application.

However, the responsibility remains with you to ensure you receive the new certificate and begin using it for all purchases made on or after January 1st.

How a Florida Permit Affects Your Multi-State Tax Obligations

As your business expands beyond Florida, your reseller's permit becomes one component of a much larger compliance strategy. While it is an essential tool within Florida, its authority ends at the state line. Understanding how your tax obligations evolve with your business's growth is critical to avoiding costly compliance issues.

The core concept you must understand is sales tax nexus. This legal term refers to a connection to a state that is significant enough to require you to register, collect, and remit sales tax there. Historically, nexus was tied to a physical presence, like an office or warehouse. Today, it is often triggered by economic activity alone.

Understanding Florida's Economic Nexus Threshold

Florida has a clear economic nexus threshold: $100,000 in retail sales shipped into the state during the previous calendar year. If your sales to Florida customers exceed this amount, you are required to collect their sales tax.

However, Florida law provides a significant advantage for resellers. It explicitly excludes wholesale and resale transactions from the $100,000 calculation. This is a game-changer for B2B businesses. It means you can source large volumes of inventory from Florida suppliers for resale without those purchases contributing to your nexus threshold.

This policy alone makes Florida an exceptionally attractive base for businesses centered on a wholesale or resale model, as it protects your sourcing activities from triggering a sales tax registration requirement.

The Challenge of Interstate Resale Certificates

While Florida’s rules are favorable, you cannot assume other states operate the same way. The regulations governing the acceptance of resale certificates vary dramatically across the U.S. Your Florida certificate, while valid in Florida, will not be accepted in states like California or Hawaii.

Approximately 12 states explicitly do not accept out-of-state resale certificates, which means you must register with their tax agencies directly to make tax-free purchases. You can find a detailed analysis of these complex state-by-state regulations on Commenda.io.

This patchwork of laws creates a compliance minefield for any business sourcing or selling goods nationwide.

The moment you start selling to customers in other states, you have to shift your focus. It's no longer just about Florida's rules; it's about the rules in every single state where you do business. What works in one state can get you into serious trouble in another.

Let's examine how Florida's rules compare to those of other major e-commerce states to illustrate the diverse compliance landscape.

Florida vs. Other Key States Resale Certificate Rules

The table below highlights why a one-size-fits-all approach to sales tax compliance is ineffective. A business sourcing from multiple states must often manage multiple registrations and rule sets.

State | Accepts Out-of-State Certificates? | Key Requirement |

|---|---|---|

Florida | No | You must register for a Florida sales tax permit to obtain an Annual Resale Certificate. |

California | No | Requires you to apply for a California seller's permit directly with their tax agency. |

Hawaii | No | You must register for a General Excise Tax (GET) license to make tax-exempt resale purchases. |

Texas | Yes | Generally accepts out-of-state resale certificates, simplifying the process for non-Texas businesses. |

As you can see, a business sourcing products from both Florida and California would need to be fully registered and compliant in both states, adhering to two completely different sets of procedures.

Why You Need a Proactive Strategy

For an expanding business, a reactive approach to tax obligations is a recipe for disaster. The penalties for failing to register and collect sales tax where you have nexus can be severe, including back taxes, steep interest, and fines that can cripple a growing company.

A proactive strategy is the only viable path forward. This includes:

Tracking Sales by State: Implement a robust system to monitor your sales volume in every state, allowing you to anticipate when you are approaching an economic nexus threshold.

Understanding Certificate Rules: Before sourcing from a supplier in a new state, you must confirm whether your existing certificates are valid or if a new registration is required.

Staying Current on Legislation: Sales tax laws are constantly evolving. A compliant practice today may be outdated tomorrow.

The sheer complexity of managing multi-state tax obligations is precisely why so many international founders and e-commerce entrepreneurs partner with compliance experts. Navigating this intricate landscape alone while trying to run your business is an unnecessary risk.

At Read & Associates Inc., we specialize in developing clear, scalable compliance strategies for businesses operating across the U.S. If you are ready to grow your business without the constant threat of unforeseen tax liabilities, schedule a consultation with our team. We will help you build the right foundation for long-term success.

Don't Let Florida Sales Tax Compliance Slow You Down

Obtaining your Florida reseller's permit is a critical first step for your business. But as a business owner, you know it's just the beginning. The true challenge lies in maintaining compliance with all the rules, especially as your business grows—a task made more complex if you're managing it from outside the U.S.

It's easy to become overwhelmed by the details. A single misstep with your record-keeping or a missed sales tax filing in another state where you have nexus can lead to serious consequences, including audits, fines, and unnecessary stress.

Instead of trying to become a sales tax expert overnight, you can focus on what you do best: growing your business. That's where our expertise provides value.

Let the team at Read & Associates Inc. manage the compliance complexities for you.

Your All-in-One Compliance Team

We are experts in U.S. business compliance, with a specialized focus on guiding international founders through the setup and operational phases. Think of us as your dedicated compliance department, ensuring every detail is handled correctly so you can focus on your business with confidence.

Our services include:

Company Formation: We will help you structure your LLC or corporation correctly from day one.

EIN Registration: Obtaining your Employer Identification Number is a crucial step, particularly for non-residents, and we manage the process efficiently.

Tax Management: From initial sales tax registration to ensuring your annual filings are accurate and timely, we have you covered.

Our mission is simple: to remove the burden of paperwork and bureaucracy from your shoulders. We manage the entire U.S. setup and compliance process so you can dedicate your energy to growth, not red tape.

Ready to build your U.S. business on a rock-solid foundation? Schedule a consultation with our expert team today and let's discuss how we can help you succeed.

Frequently Asked Questions About the Florida Resellers Permit

Even with the clearest instructions, navigating state tax rules always seems to bring up a few more questions. Let's tackle some of the most common ones we get from business owners about Florida's reseller permit.

Do I Still Need a Permit if I Only Sell Online?

Yes, absolutely. If your business has a physical or economic connection—what the state calls "nexus"—in Florida, you are responsible for collecting and remitting Florida sales tax. Your reseller's permit is the essential tool that allows you to purchase inventory for those online sales without paying sales tax to your suppliers.

It is a critical component for any e-commerce business based in Florida or with a significant sales presence in the state.

Since July 1, 2021, Florida’s economic nexus laws require even out-of-state sellers to register once they reach $100,000 in sales to Florida customers in a calendar year. The good news for resellers is that Florida does not count wholesale transactions toward that threshold. This is a significant advantage, but you must have valid resale certificates on file to substantiate that those sales were for resale. For a deeper dive, you can explore these insights on Florida's state tax compliance rules.

How Long Does It Usually Take to Get a Permit?

The timeline can vary. After you have formed your U.S. company and obtained your EIN, the next step is applying with the Florida Department of Revenue. If all your information is accurate and complete, the process can be quite fast.

In our experience, delays are almost always caused by missing details or inconsistencies in the application. This is why meticulous preparation is so important—it saves significant time and prevents future complications.

What Happens If I Forget to Renew My Certificate?

This is a critical point for business owners. Your Florida Annual Resale Certificate expires on December 31st of each year. If you fail to ensure it is renewed, it becomes invalid.

Making tax-exempt purchases with an expired certificate is a major compliance violation. In the event of an audit, those purchases will likely be reclassified as taxable, meaning you could be held liable for back taxes, interest, and substantial penalties.

A Word of Caution: Your reseller permit is only for buying inventory you plan to sell. Never use it for business supplies like a new laptop, office chairs, or marketing flyers. It’s not a get-out-of-tax-free card for your company's operational expenses, and misusing it can lead to serious trouble.

Keeping up with the nuances of state tax law can be overwhelming for any business owner. Instead of getting bogged down in compliance, let the team at Read & Associates Inc. handle it for you. We are experts in setting up and managing U.S. businesses for founders from all over the world. Schedule a consultation with us today and let's get your U.S. operations running smoothly.

Comments