Difference between inc and corp: A UK Founders Guide to Entity Choices

- Read & Associates

- 5 days ago

- 13 min read

Let’s get one of the most common questions out of the way right up front: when it comes to the difference between Inc. and Corp., there really isn’t one.

Legally speaking, Incorporated (Inc.) and Corporation (Corp.) are just different labels for the same thing. They’re corporate suffixes that tell the world your business is a distinct legal entity, totally separate from you, its owner. The choice between them? It comes down to branding and personal preference, not the law.

The Difference Between Inc and Corp Is Branding Not Law

When you’re setting up a company in the United States, it's easy to get bogged down in details that feel huge at the moment. Deciding whether to put "Inc." or "Corp." after your company name is a classic example of this. It feels like a big deal, but it has absolutely no impact on your company’s legal standing, how it’s taxed, or the liability protection it offers.

Both suffixes do the exact same job: they signal that your business is officially a corporation.

For UK founders, this means the real, substantive decisions are found elsewhere. Don't waste time debating suffixes. Your energy is much better spent on the truly critical choice: deciding between forming a Corporation (which would use Inc. or Corp.) and a Limited Liability Company (LLC).

And if you do go the corporation route, you've got another crucial layer to understand—the tax designation. This is where the whole C Corporation versus S Corporation discussion comes in, and it's a game-changer.

For UK founders and other non-US residents, this distinction is paramount. S Corporation status is restricted to U.S. citizens and residents, making the C Corporation the standard and often only viable option for international entrepreneurs seeking to incorporate in the US.

Getting these structural decisions right is the key to setting up your U.S. venture for success. It impacts everything from tax efficiency and liability protection to your ability to attract American investment.

To put it plainly, the Inc. vs. Corp. debate is a tiny detail. The choice of entity type, however, has massive consequences. Let’s break it down.

Inc vs Corp A Quick Comparison

The table below really drives home the point. While the suffixes are interchangeable, the underlying business structure you choose is what truly matters.

Feature | Inc. (Incorporated) | Corp. (Corporation) | Key Takeaway for UK Founders |

|---|---|---|---|

Legal Status | Designates a corporation | Designates a corporation | Identical; both create a separate legal entity. |

Liability Protection | Provides limited liability | Provides limited liability | Identical; both protect personal assets. |

Tax Implications | Taxed as a C Corp or S Corp | Taxed as a C Corp or S Corp | Identical; tax is based on C/S Corp election, not the suffix. |

Branding/Perception | Often seen as more traditional | Can feel more modern or global | The choice is purely cosmetic and should reflect your brand identity. |

So, as you can see, the suffixes themselves don't change a thing about how your company operates legally or financially. The heavy lifting is done by the corporate structure itself, and for most UK founders, that will be a C Corporation.

Understanding Your US Business Entity Options as a UK Entrepreneur

We’ve already cleared up that the difference between "Inc." and "Corp." is just a matter of taste. Now, let’s get into the choice that actually shapes your US business: setting up a Corporation versus a Limited Liability Company (LLC).

For a founder based in the UK, these aren't just interchangeable terms. They are fundamentally different legal and tax structures. Getting to grips with how each one works is the first real step to building a solid, compliant business in the States.

The Corporation (Inc. or Corp.)

A corporation, regardless of which suffix you tack on the end, is a formal business entity owned by its shareholders. It stands as a completely separate legal person from its owners, which is where the strong liability protection—often called the "corporate veil"—comes from.

This structure is pretty rigid and traditional. You have a board of directors making the big-picture decisions and officers who handle the day-to-day grind. It's exactly this formality, however, that makes corporations the go-to for companies planning to raise venture capital. Investors know the game: stock-based ownership and predictable governance make it easy for them to cut a check.

The Limited Liability Company (LLC)

The LLC, on the other hand, is a much more modern and flexible beast. Think of it as a hybrid, mixing the personal liability protection you get from a corporation with the simpler tax structure and operational ease of a partnership. Typically, an LLC’s profits are "passed through" directly to its owners (called members), so you avoid the double taxation that can sometimes hit corporations.

LLCs are also a lot less fuss to run. There’s no legal requirement for a board of directors or formal annual meetings, which makes them a fantastic option for smaller businesses or solo founders. This straightforward approach has made the LLC a huge hit with international entrepreneurs.

The rise of the LLC is one of the biggest stories in US business formation over the last few decades. Its blend of protection and simplicity offers a compelling alternative to the old-school corporate model, especially for e-commerce sellers and service-based companies.

The numbers don't lie. A deep dive into IRS data shows that over 30 years, LLC filings grew at a staggering average annual rate of 21%. That growth absolutely blows traditional corporations out of the water. This shift shows a clear vote of confidence from new business owners in the LLC's adaptable framework. You can dig deeper into this data on the structural shift over at Berkman Solutions.

So, what does this mean for you as a UK founder? It really boils down to your ambitions. If your roadmap includes raising money from US venture capitalists, the corporation is the standard and expected path. But if your priority is tax efficiency and operational simplicity for a service or e-commerce business, the LLC is almost always the smarter choice.

The C Corp vs S Corp Decision For Non-US Residents

We've established that the difference between 'Inc.' and 'Corp.' is just a matter of wording. The real, substantive choice you'll face is between forming a C Corporation or an S Corporation. This decision profoundly impacts how your business and its owners are taxed, and for UK founders, US law pretty much makes the decision for you.

A C Corporation is what most people picture when they think of a classic American company. It's a distinct legal entity that pays taxes on its own profits. Then, if those profits are paid out to shareholders as dividends, the shareholders pay personal income tax on that money. This is often called double taxation, which sounds like a raw deal but is part of a structure built for massive growth and investment.

An S Corporation, on the other hand, is a "pass-through" entity. It’s a neat setup where the business profits and losses are passed directly to the shareholders' personal tax returns. The corporation itself doesn't pay federal income tax; the owners do, at their individual rates.

The Deciding Factor for UK Founders

So, which one is for you? As a UK entrepreneur, the choice is actually quite simple: you don't have one. To qualify for S Corp status, every single shareholder must be a U.S. citizen or a resident alien.

This residency rule is ironclad. If you’re a non-US resident, you are completely ineligible to form or even be a shareholder in an S Corporation. This makes the C Corporation your default—and really, your only—option for a U.S. corporation.

This might feel restrictive, but it's actually a blessing in disguise for most UK founders. The C Corp structure aligns perfectly with the ambitions of startups looking for American investment. Venture capitalists and institutional investors in the U.S. overwhelmingly prefer to put their money into C Corporations. They love the straightforward stock structure and the solid, predictable legal framework, especially for companies formed in Delaware. It’s the undisputed gold standard for high-growth businesses.

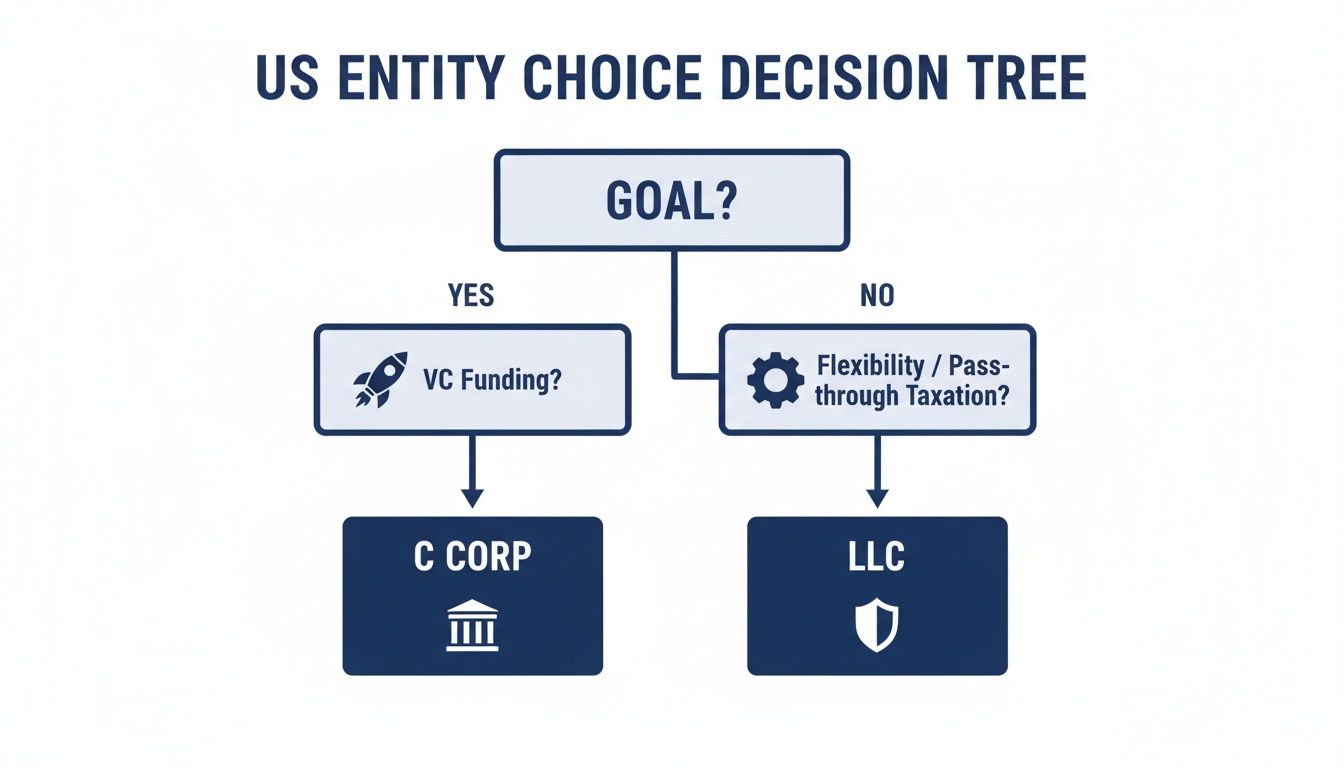

This decision tree gives you a quick visual of how founders typically choose their U.S. entity.

As you can see, if venture capital is your main goal, the C Corp is the obvious route. If you're after more operational flexibility, an LLC often makes more sense.

Tax Treatment and Long-Term Strategy

The tax conversation is central here. Interestingly, some research suggests that the historical trend of domestic US businesses moving away from C Corps to pass-through entities actually boosted total factor productivity growth by 0.37% annually. For a UK founder, however, that C Corp "double taxation" is a calculated trade-off. It’s the price of entry for a structure that’s built to attract investors and scale globally.

Ultimately, choosing the C Corporation isn't a compromise; it's a strategic move that plugs you directly into the U.S. investment ecosystem. It lays down a clear, well-travelled road for growth, proper governance, and a successful future exit.

For a much more detailed look, check out our definitive guide on what a C Corporation is.

Choosing Your US Company Name and Suffix

Alright, with the heavy lifting of your corporate structure sorted, let's talk about something a bit more fun: naming your US company. We've already established that from a legal standpoint, there’s no real difference between using "Inc." or "Corp." But that doesn't mean the choice is meaningless. This is all about branding and the first impression you want to make in the American market.

For a lot of founders, "Inc." feels classic and established. It has a certain gravitas, suggesting a company that’s built to last. If you're building a brand around trust, reliability, and a sense of permanence, "Inc." is a fantastic choice that reinforces those qualities.

On the flip side, "Corp." often comes across as a bit more modern and sleek. You see it a lot with tech firms and businesses with a global footprint. If your brand is all about innovation, efficiency, and a forward-thinking vibe, "Corp." might just fit your company’s personality better.

Honestly, don't lose sleep over this. It's largely a cosmetic choice. Pick the one that feels right for your brand's story and how you want to present yourself to US customers.

State Naming Requirements to Follow

Now, while the suffix is about branding, the rest of your company name has to follow some strict legal rules set by your state of incorporation. These aren't suggestions—get them wrong, and your formation paperwork will get bounced right back to you.

Here’s the checklist you absolutely need to follow:

You Must Use a Corporate Designator: The legal name of your company must end with a word that signals it's a corporation. The standard options are "Incorporated" (Inc.), "Corporation" (Corp.), or sometimes "Company" (Co.).

Your Name Has to Be Unique: Your chosen name can't be identical or "deceptively similar" to any other business name already on the books in that state. This is why running a name availability search is one of the very first things you have to do.

Some Words Are Off-Limits: You can't just throw words like "Bank," "Trust," or "Insurance" into your name. Using them requires special state approval and licensing because they imply a regulated purpose.

Getting these details right from the start saves you a ton of headaches. It ensures your name is not only a great fit for your brand but also legally sound, preventing any frustrating delays in getting your US entity off the ground.

Choosing The Right US Entity For Your Business

Now that we’ve sorted out the jargon around suffixes and tax codes, we can get to the real question: which entity is the right one for your business? This isn't a theoretical exercise—it's a strategic decision. Getting this right from the beginning saves you from expensive and complicated restructuring later and sets your company on the right track from day one.

So, let's move past the Inc. vs. Corp. debate and dive into the practical situations UK founders run into when they make the leap into the US. Each scenario demands a different playbook, depending on what you're trying to achieve, whether it's raising capital, optimizing taxes, or keeping things simple.

The UK Tech Startup Seeking US Venture Capital

If you're a UK tech founder with your sights set on American venture capital, there’s really only one choice: you need a Delaware C Corporation. This isn't just a suggestion; it's pretty much a requirement in the US startup world.

Why the insistence? US VCs live and breathe this structure. They know its stock classes, its predictable governance, and the solid, investor-friendly corporate law that Delaware is famous for. Showing up with an LLC or a corporation from a different state just creates friction. It’s an unfamiliar setup, and investors don't have the time or patience to deal with that kind of uncertainty.

The UK E-commerce Business Selling to US Customers

Let’s say you run an e-commerce store from the UK and are tapping into the huge American market. Your goals are completely different. You’re probably focused on simple tax filing, operational ease, and staying compliant without a lot of administrative headaches. For this kind of business, an LLC is almost always the better fit.

An LLC gives you pass-through taxation right out of the box. For a non-resident owner, this is far simpler than navigating the C Corp’s double-taxation system. LLCs also have fewer rigid rules about board meetings and minute-taking, freeing you up to focus on what really matters—making sales and growing your brand.

Key Insight: Your business model should be your guide. If you're on a high-growth, venture-backed path, the road leads straight to a C Corporation. But if you're a founder-funded business focused on operations, the flexibility of an LLC is a huge advantage.

The UK Consulting Firm Establishing a US Subsidiary

For a well-established UK consulting firm or another service business looking to plant a flag in the US, a C Corporation usually provides the right foundation. The clear, formal structure with a board of directors and officers gives you an immediate air of credibility in the American market.

That kind of formality really matters when you're trying to land big corporate clients, hire American employees, and set up solid banking relationships. A C Corp signals that you're stable, professional, and here to stay, which is exactly what you need to build trust and scale a services business in the States. It also creates a solid legal shield for the UK parent company.

These scenarios show that the classic corporate structures, typically C-Corps, are truly built for scale and attracting investment. This isn't just a startup trend; it's a pattern seen across the entire economy. Since the 1930s, the top 1% of firms have grown their control of the economy's assets from 70% to a staggering 90% by 2018. This massive consolidation was fueled by the C-Corp's unique ability to attract and pool capital.

You can dive deeper into this in the full analysis of rising corporate concentration from Chicago Booth Review. For a UK founder, the takeaway is clear: the C-Corp is the time-tested vehicle for bringing in serious investment and achieving massive scale in the US.

How To Form Your US Company From The UK

When it comes down to it, the whole ‘Inc. vs. Corp.’ debate is really just a footnote in your company's story—it’s a simple branding choice. The decision that truly matters for UK founders is picking the right business entity. Will it be a C Corporation or an LLC?

This single choice has huge ripple effects, influencing everything from your tax obligations and compliance burdens to how easily you can bring US investors on board. Getting this right from the start requires a bit of planning and some solid advice.

This is where a formation partner like Set Up Stateside comes in. We take the guesswork and the risk of expensive mistakes off your plate. We specialize in handling the entire process for non-US residents, making sure your launch into the American market is smooth and legally buttoned up.

Our Comprehensive US Formation Services

We’ve designed our services specifically for UK entrepreneurs like you. Here’s what we take care of:

Entity Selection: We'll walk you through the pros and cons to help you decide on the best structure (C Corp or LLC) for your specific business.

State Registration: We handle all the paperwork to get your company officially registered in the right state for your ambitions, whether that's Delaware, Wyoming, or elsewhere.

EIN Application: No US Social Security Number? No problem. We’ll secure your essential Employer Identification Number directly from the IRS for you.

Compliance Setup: We sort out the necessities, like a US Registered Agent, a virtual business address, and clear guidance on keeping up with state requirements.

Think of it this way: by letting us manage the complex admin, you can skip the red tape and stay focused on what you do best—building your business. This approach sets you up for success right from the start.

With the right support, forming your US company from the UK is surprisingly straightforward. If you're still weighing the C Corp vs. LLC decision, our in-depth guide to LLCs for non-US residents is a great place to dig deeper.

Frequently Asked Questions

When you're a UK founder looking to break into the U.S. market, a lot of questions pop up. Here are some of the most common ones we get, with straightforward answers to help you get started.

Can I Use The Suffix Ltd For My US Company?

It’s a common question, and the short answer is no, not really. While 'Ltd' is the standard back home in the UK, it’s rarely used or even permitted for corporations in the United States.

Each state has its own rules, but they all require a clear indicator of the company's legal structure. Suffixes like 'Inc.', 'Corp.', or 'LLC' are the norm because they tell everyone exactly what kind of entity they're dealing with. Trying to use 'Ltd' just causes confusion and could even get you into legal trouble. It's always best to adopt standard U.S. suffixes to keep things clear and compliant.

Which State Is Best To Incorporate In?

This is the big one, and the answer really depends on your long-term goals. For most tech startups and companies planning to seek venture capital, Delaware is the hands-down winner. Its corporate law is sophisticated, predictable, and frankly, it’s what U.S. investors expect to see.

But if you're forming an LLC and privacy is a bigger concern, states like Wyoming or Nevada often get the nod for their stronger protections and friendlier fee structures. The "best" state isn't a one-size-fits-all answer; it's a strategic decision based on your business model, where you might have a physical presence (nexus), and your fundraising roadmap.

A professional consultation is vital to make the right choice for your business. Factors like state income tax, franchise tax, and annual reporting requirements can have a significant long-term financial impact. Making an informed decision upfront prevents costly restructuring down the line.

Do I Need A US Bank Account For My Corporation?

Absolutely, yes. A U.S. business bank account is non-negotiable for a few key reasons. First and foremost, it’s crucial for maintaining the "corporate veil"—the legal separation that shields your personal assets from any business debts or lawsuits.

On a practical level, it also makes life so much easier. You’ll need it to cleanly handle payments from American customers and to pay any U.S.-based staff or contractors.

Getting a U.S. bank account as a non-resident used to be a huge headache, but it’s a necessary step. After your company is formed, you’ll need an Employer Identification Number (EIN) from the IRS. Think of it as a tax ID for your business. You can learn more about how to get an EIN number for your new company in our detailed guide. A good formation service can help you get both your EIN and your bank account sorted, often without you ever having to fly over.

Expanding into the U.S. market from the UK involves navigating a new set of legal and financial rules. Set Up Stateside specializes in making this process seamless for non-resident founders, handling everything from formation and compliance to accounting and tax. Start your U.S. company today.

Comments